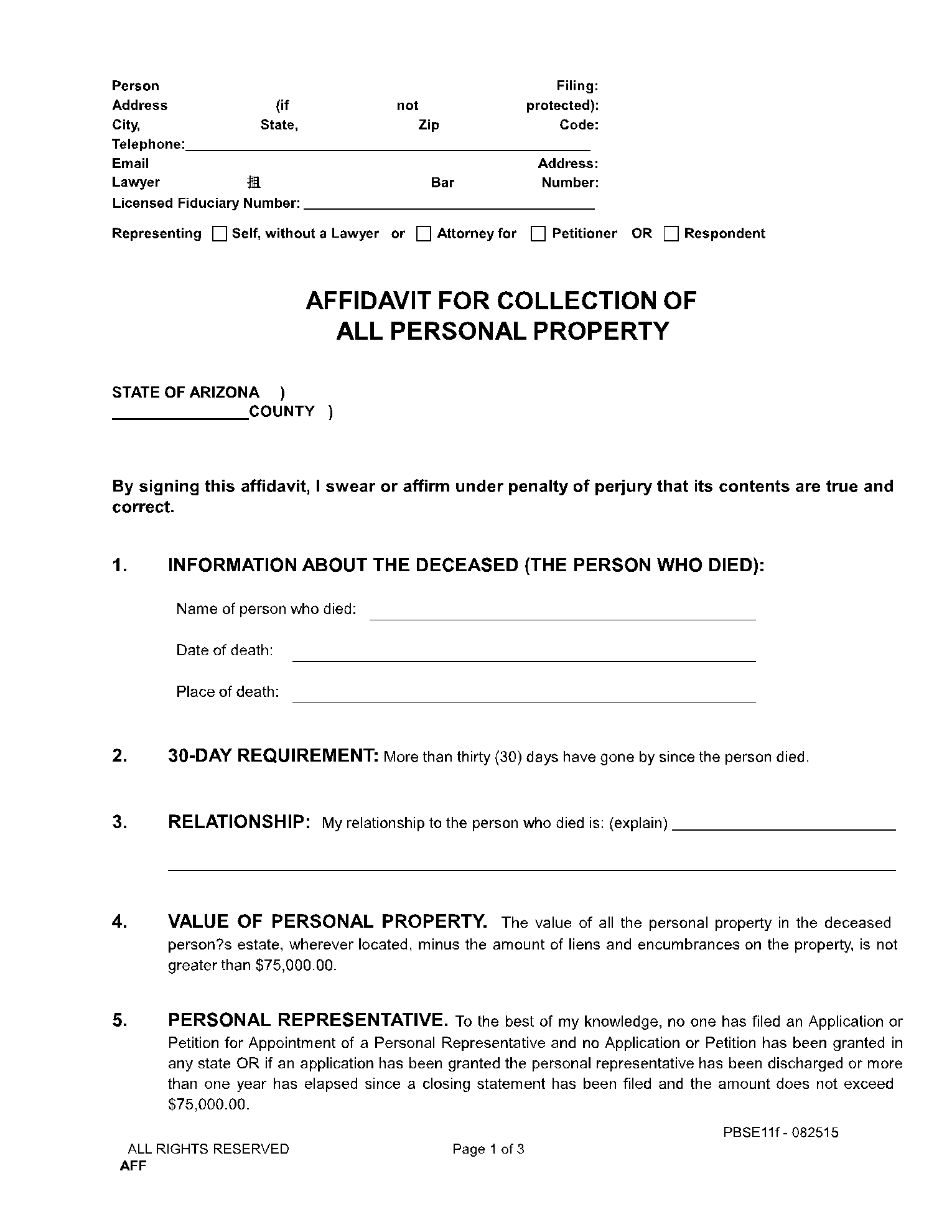

A small estate affidavit – also called the “Affidavit for Collection of Personal Property” – is used to speed up the settlement of a small estate upon someone’s passing. We cover the ins and outs of this affidavit below. If you wish to immediately start drafting the affidavit, you can use the free template above the page.

What Is a Small Estate Affidavit?

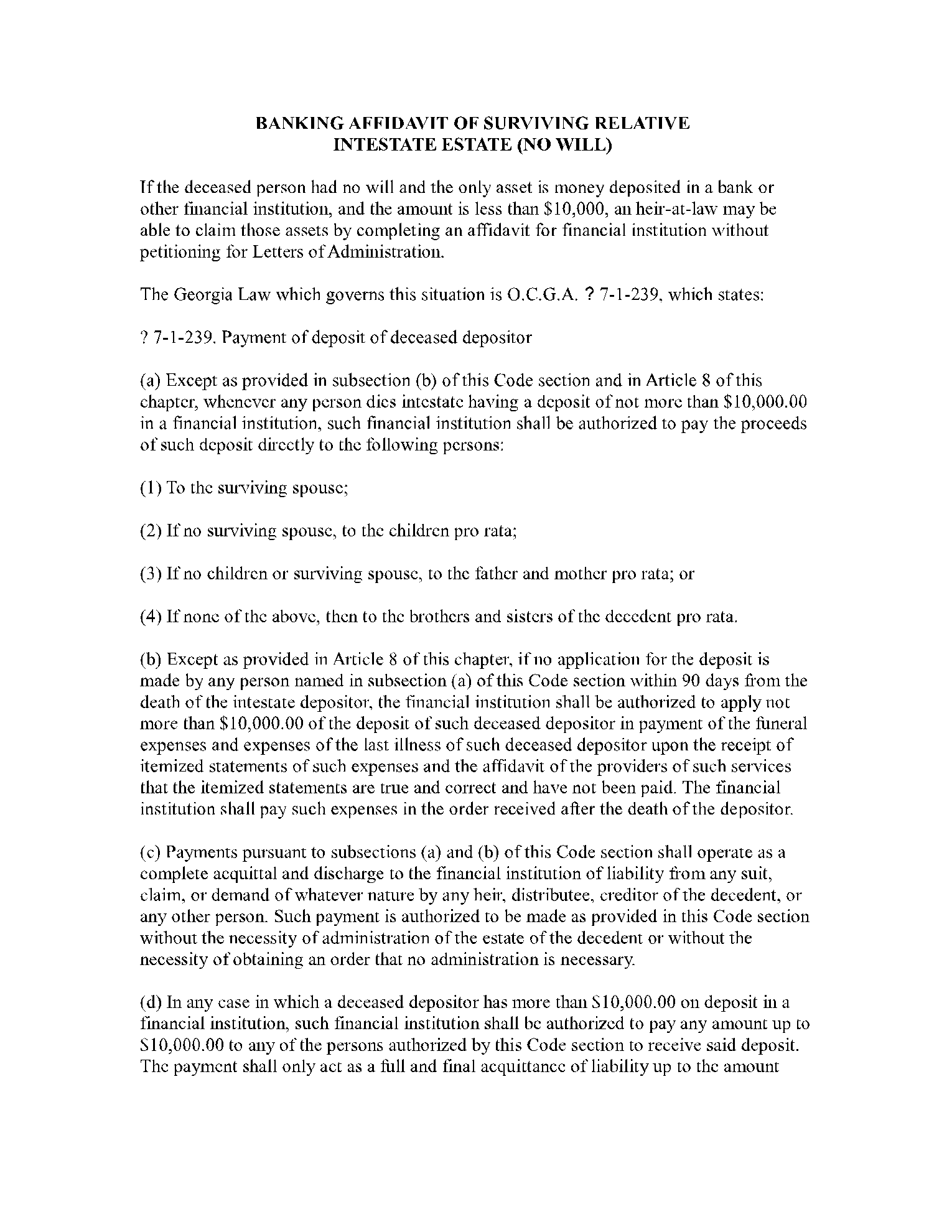

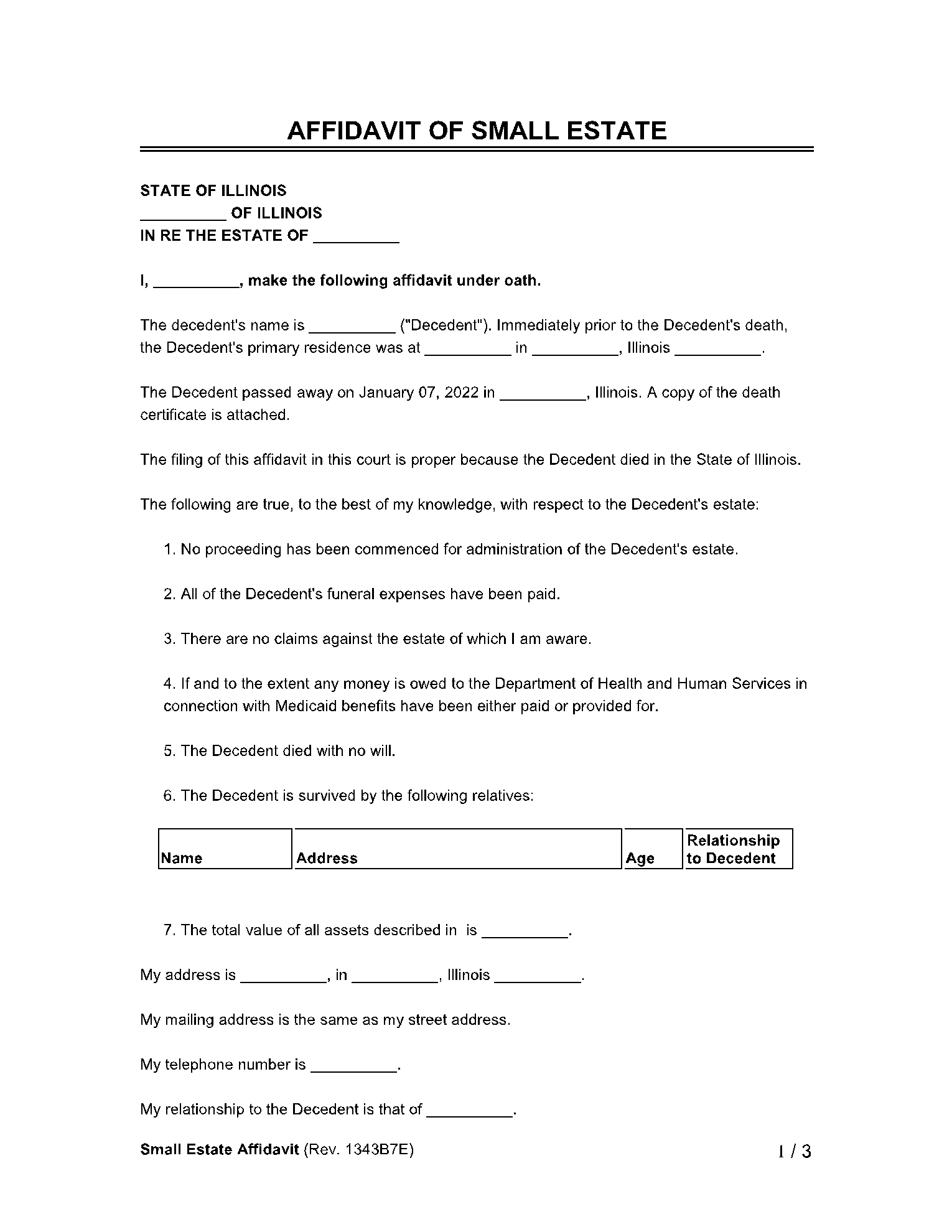

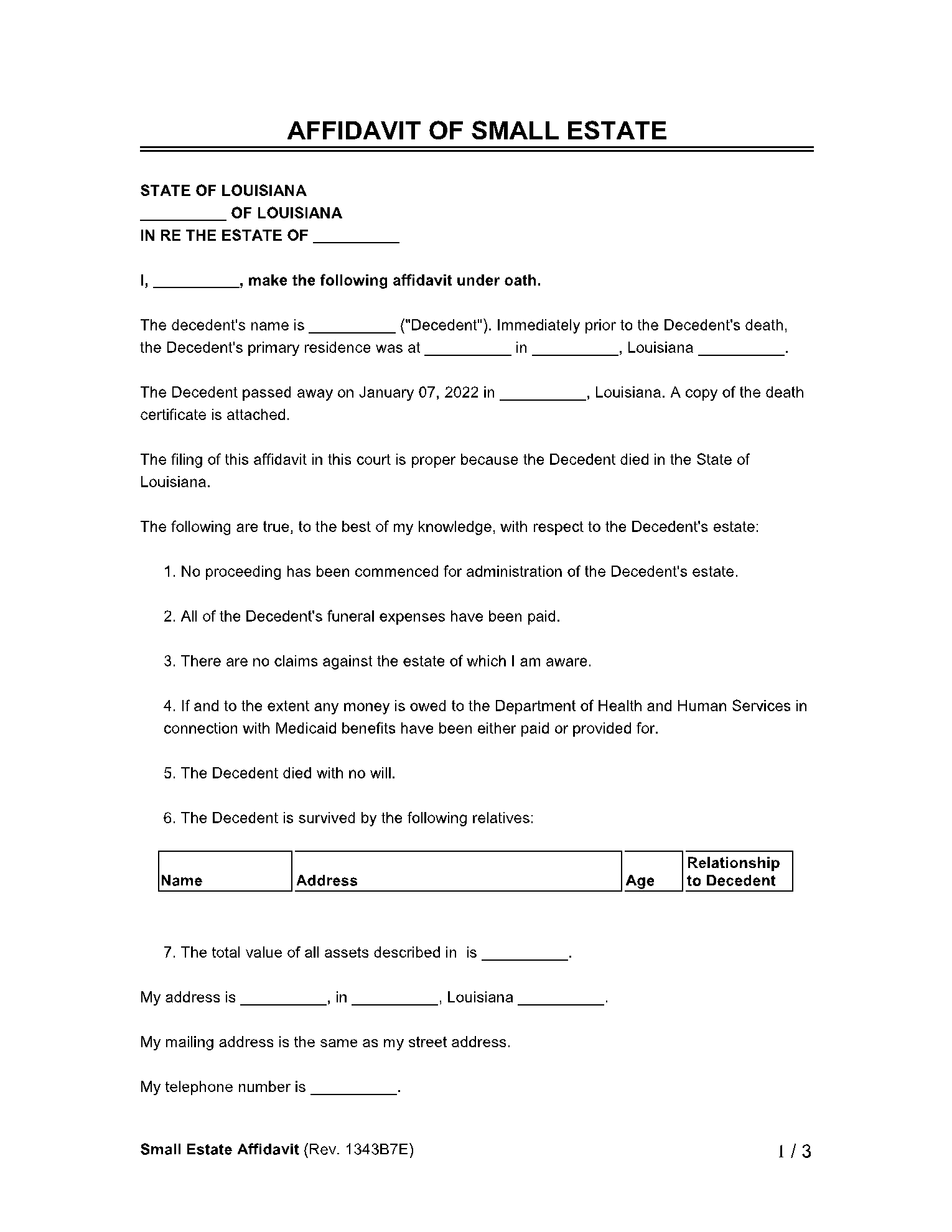

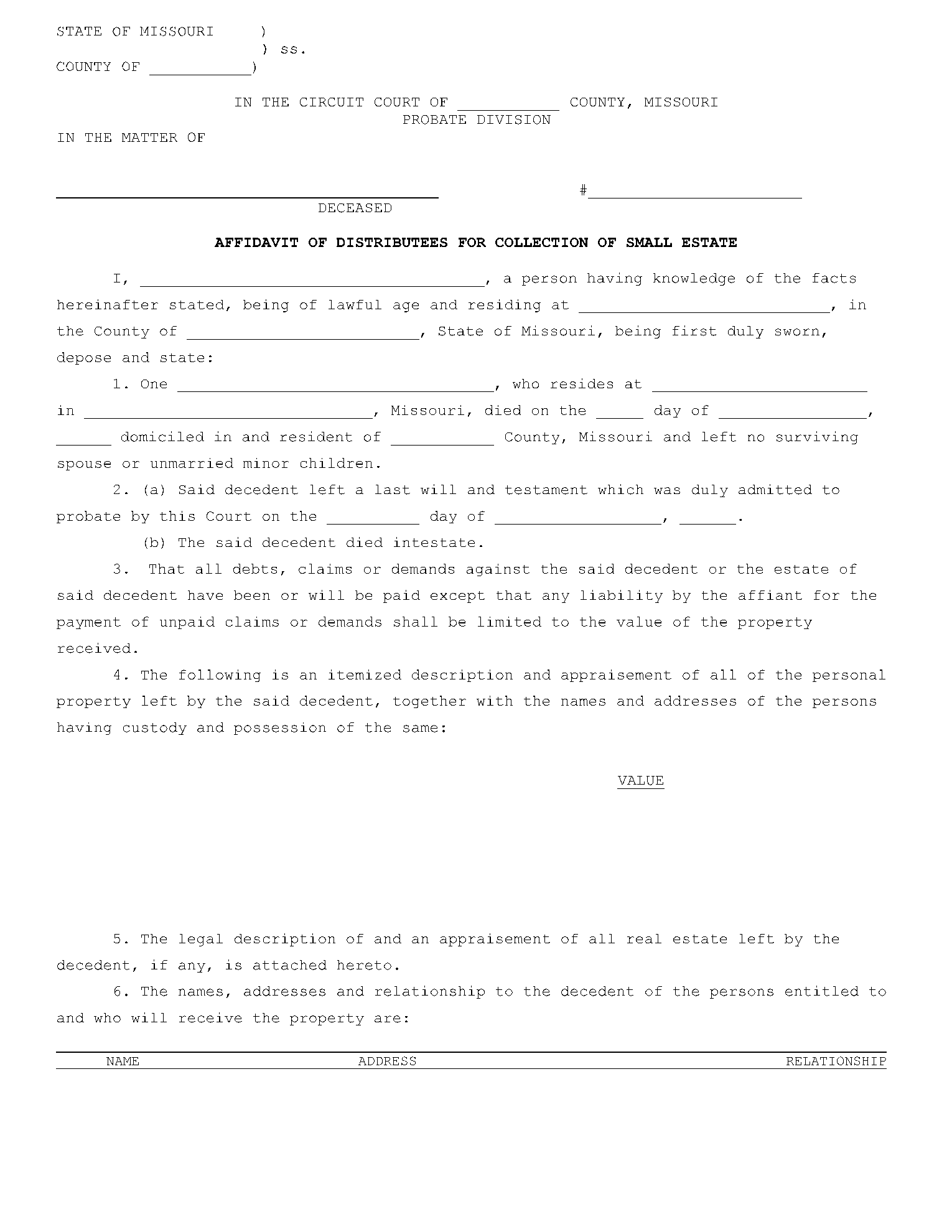

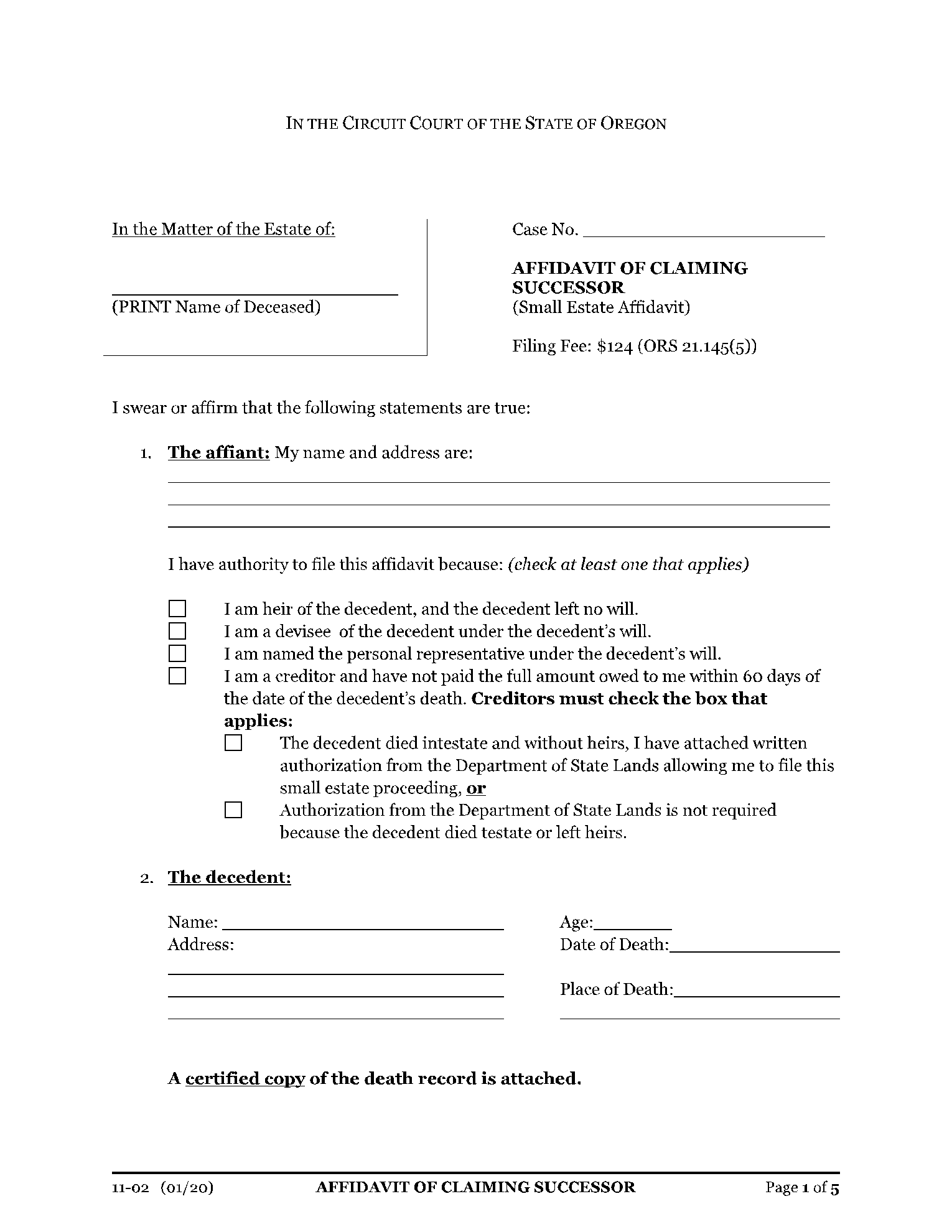

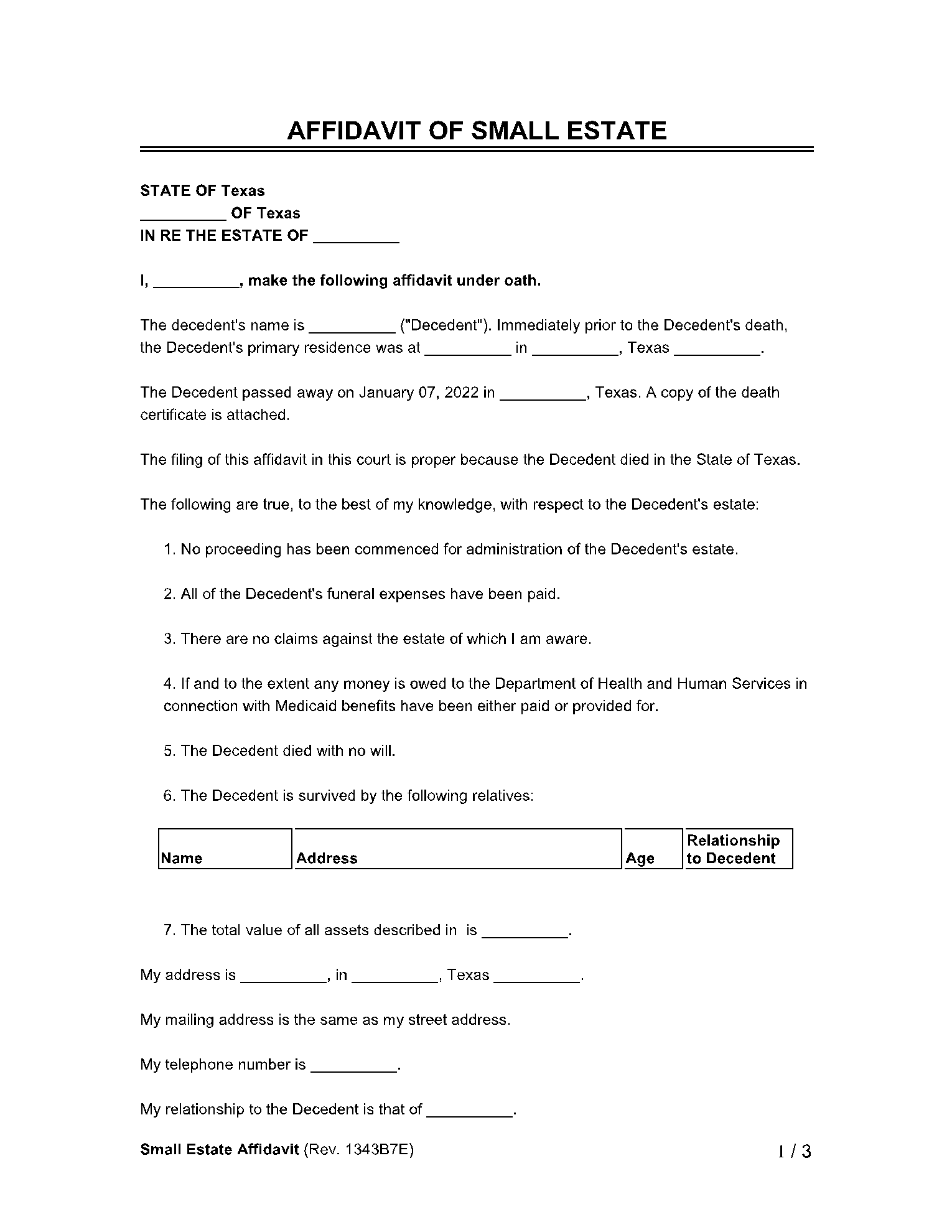

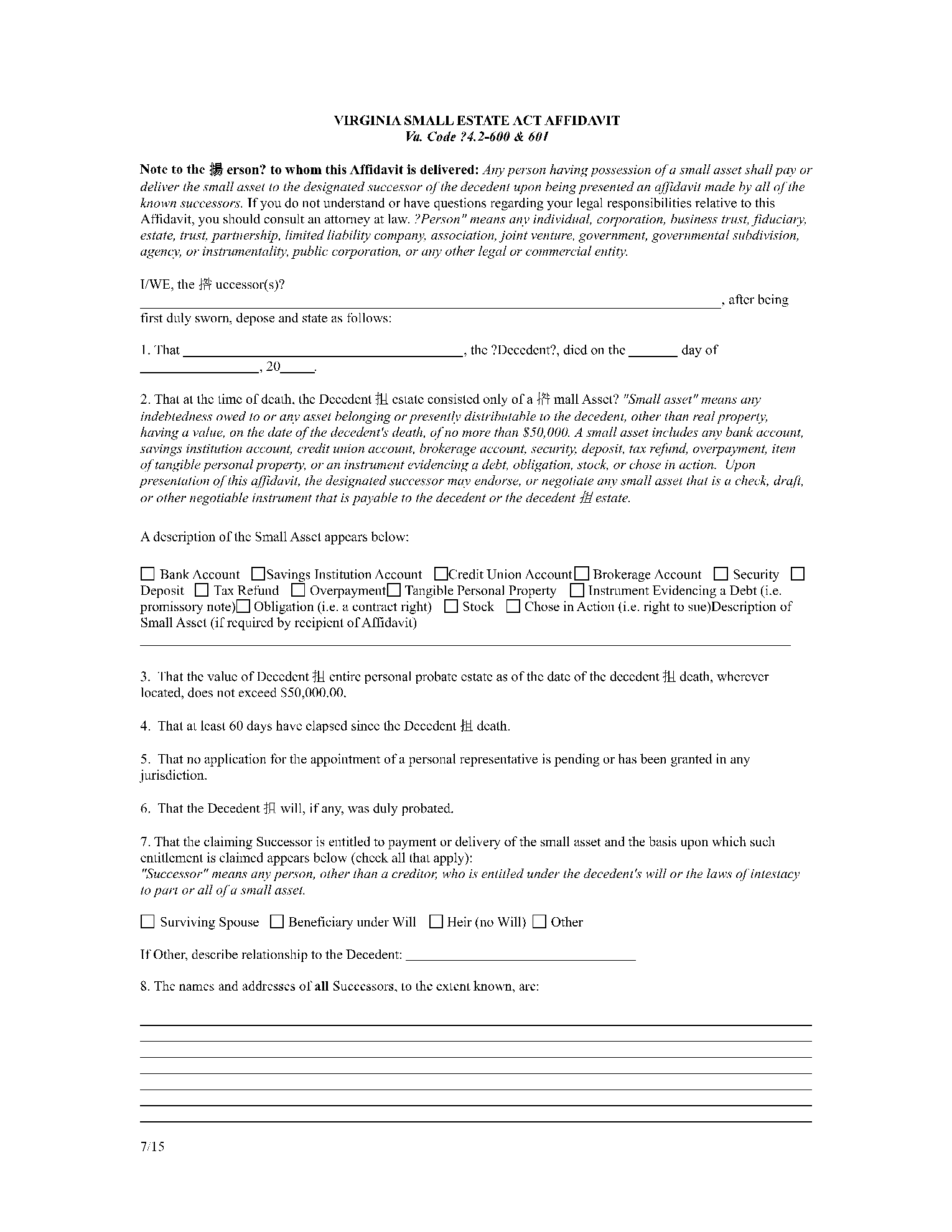

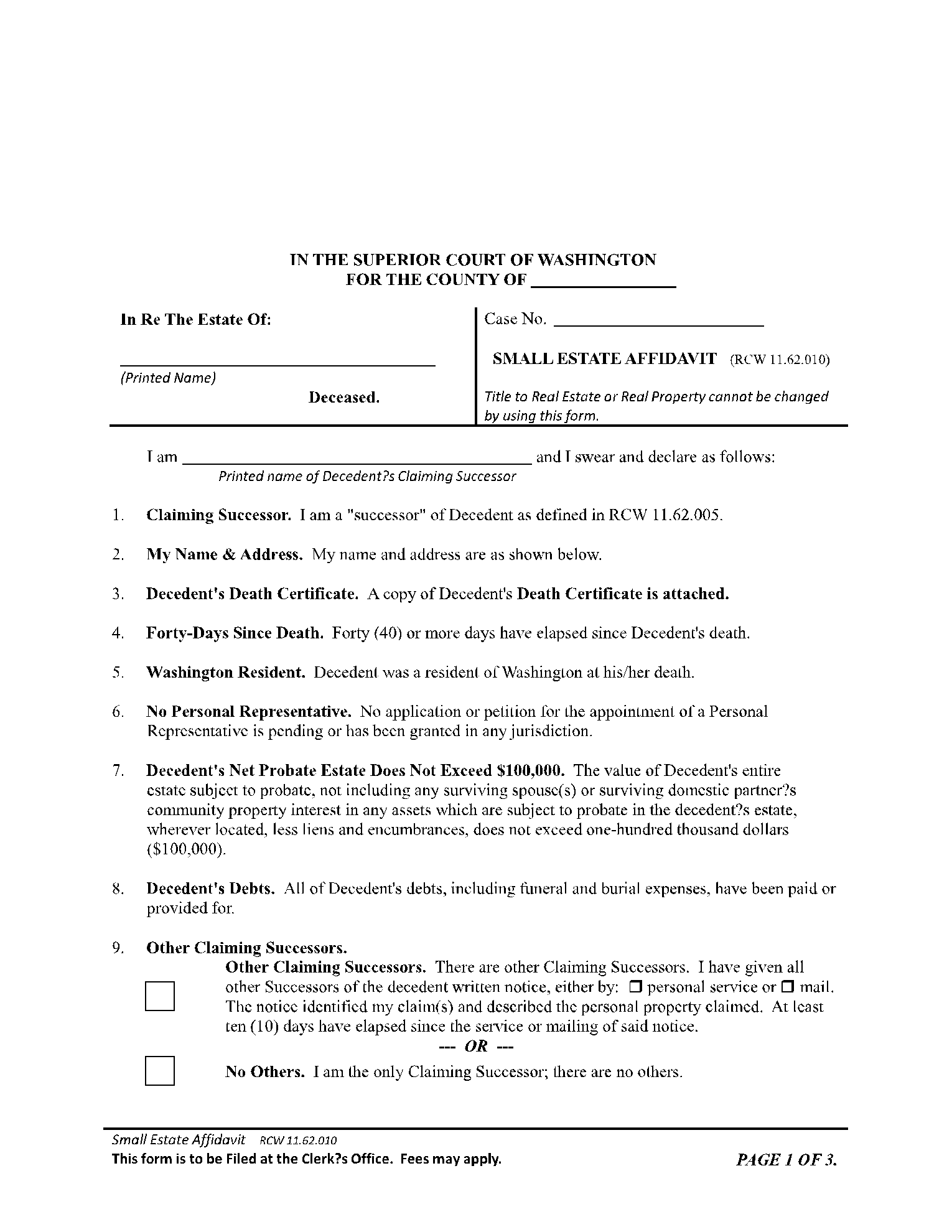

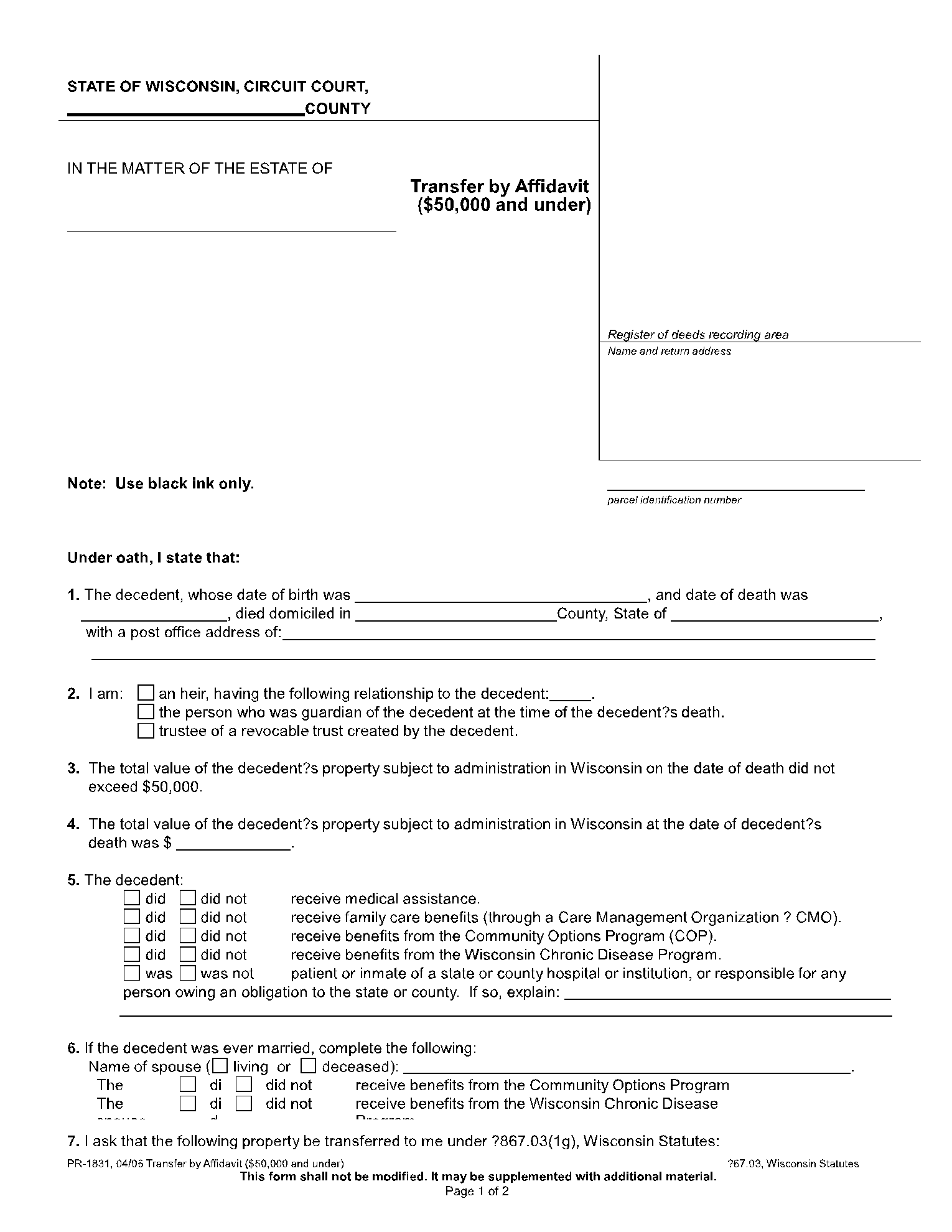

A small estate affidavit is a legal document or form you can use to transfer property from a deceased person without the need for lengthy probate. This affidavit form applies only if the deceased’s property is below a state-specified threshold – For example, $150,000.

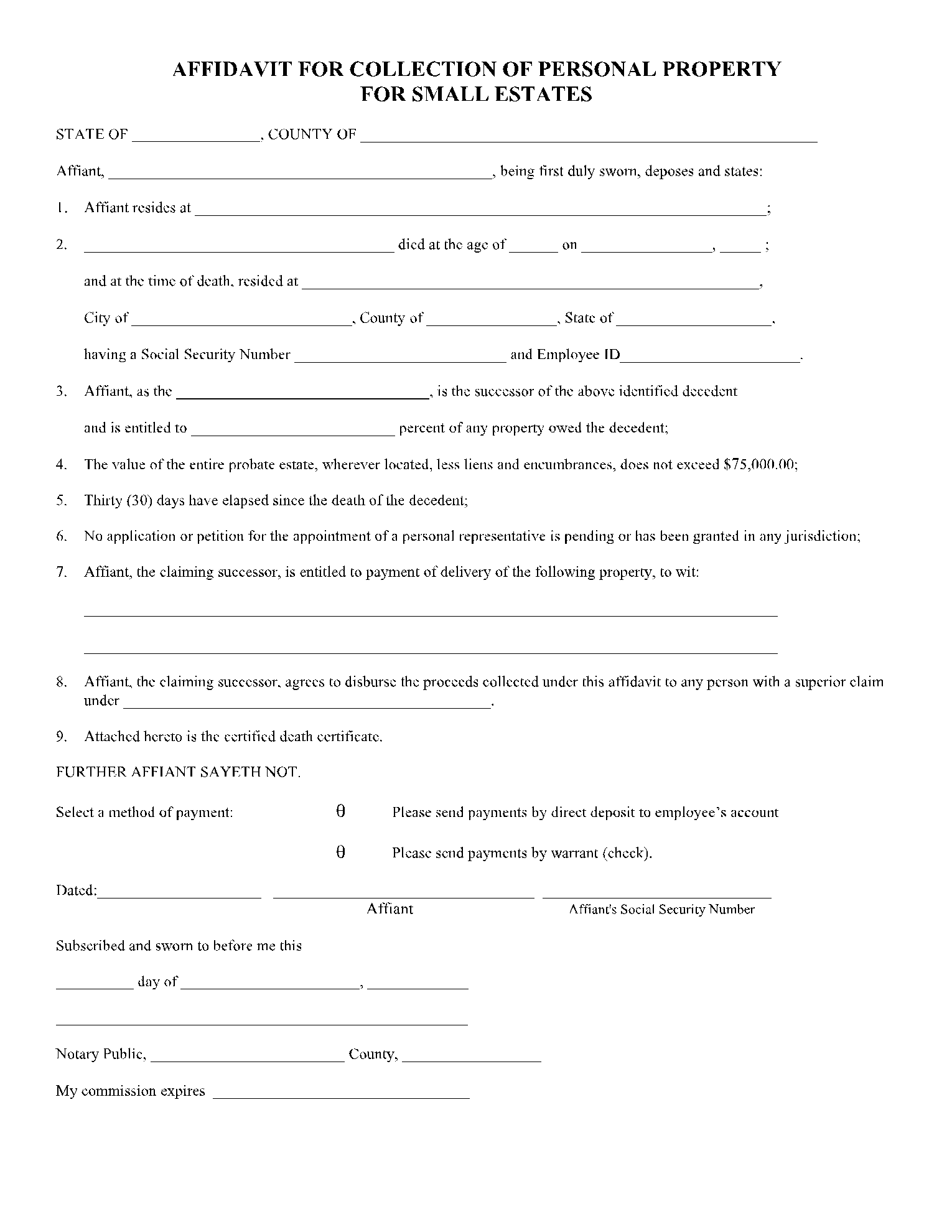

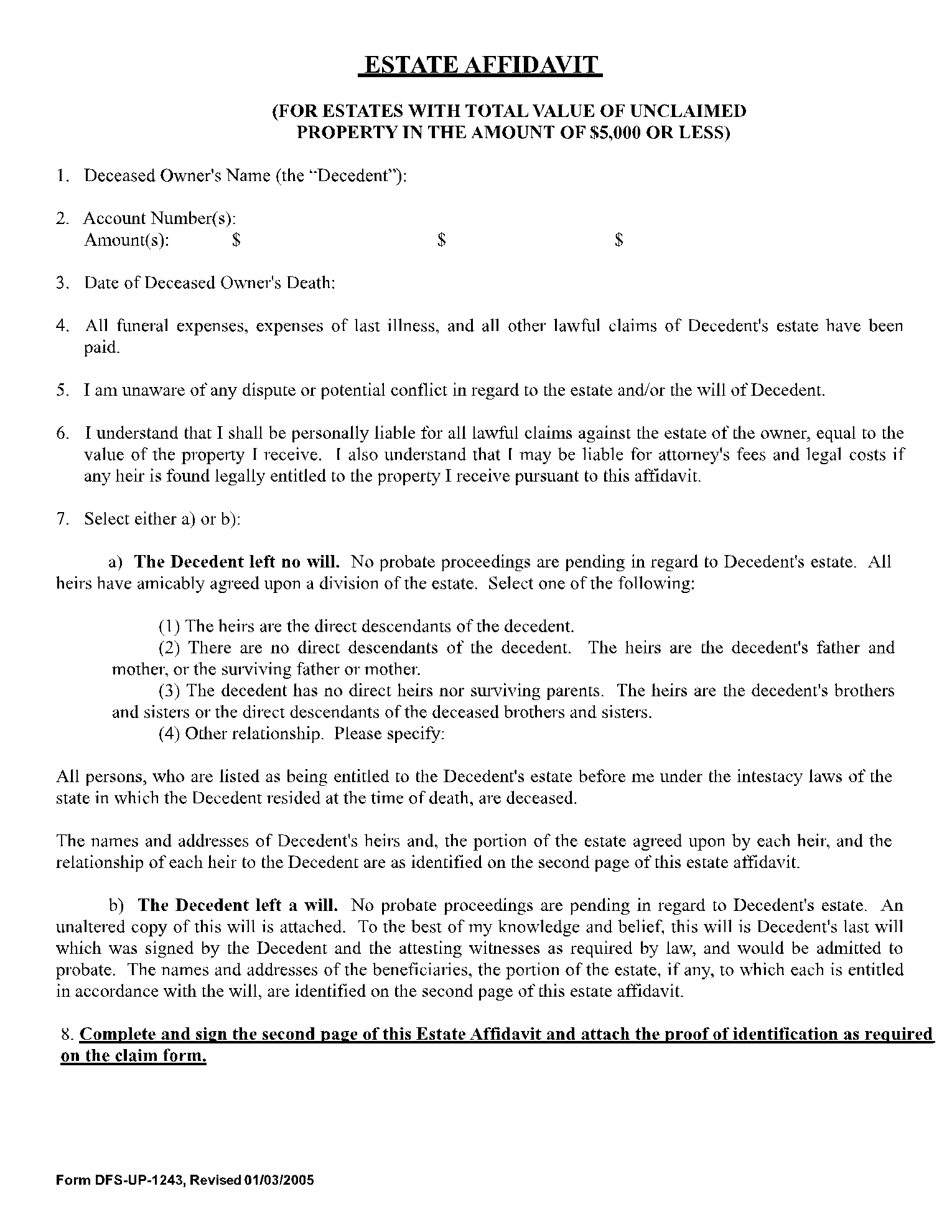

The small estate form will note the parties involved, cover relevant information related to the deceased, and list the property to be transferred.

The affidavit is later sent to parties holding any property on behalf of the deceased that may now belong to the beneficiary. It acts as an order requiring them to relinquish the property. In a handful of states, the small estate form is also sent to taxing agencies.

Sometimes the small affidavit form is used even when there is a last will. This is only possible if certain legal requirements are met. Consult with a local attorney for more details.

How Does a Small Estate Affidavit Work?

The small estate affidavit works differently from state to state. You must look up local state laws before you pen the affidavit. There are also several other requirements to keep in mind, which we list later.

You must get the affidavit signed off by a clerk at the probate office. Here is how the whole affidavit creation and acquisition process works:

1. Wait a Specified Number of Days

You can file for the small estate only after a specified number of days have passed after the deceased’s passing. The period varies from state to state. Usually, it ranges from 15 to 60 days. In the meantime, you can complete points 2 through 5.

2. Calculate the Net Worth of the Small Estate

Check your respective state laws and make sure the small estate is, indeed, considered as small. Then calculate the exact net worth of the small estate. Note that in some cases, some property is not considered small estate even if it doesn’t have high value, such as vehicles.

3. Acquire Legal Documents

You will need the death certificate for the deceased from the Bureau of Vital Statistics or another similar office. You will also need the titles, when applicable, to all the small property the deceased owned. Vehicles, for example, require a Certificate of Title.

4. Write the Affidavit

The small estate affidavit format and contents will differ from state to state. Check the local requirements before you begin drafting the affidavit. If necessary, you can consult with an attorney. You will need to sign the affidavit in front of a notary and, sometimes, witnesses.

5. Inform Other Beneficiaries

Anyone who may be entitled to the property will need to be notified of the affidavit filing. You must contact them by certified mail with a return receipt. The receipts are proof that the recipient was, indeed, notified by you.

6. File the Affidavit

Attach all your collected documents to the affidavit and submit it to the court clerk, at the probate office, for processing. You will need to pay a filing fee. If everything is as should be, the clerk will begin processing the affidavit. It takes 5 to 15 days on average.

The clerk may accept or reject your filing. If they accept it, the assets will be transferred.

When Can You File a Small Estate Affidavit?

When people don’t leave a will, the property is administered via a legal process. This process is called probate. It’s lengthy, time-consuming, and sometimes expensive, making it undesirable. You can file an affidavit in this case.

Even if the deceased does leave a will, the probate may not be desirable. In this case, assuming local laws agree, you can use a small estate affidavit.

In all cases, the small estate must be under the state-specified threshold. Usually, this is $50,000 to $150,000. If the items are of higher value, they will undergo probate.

These following two conditions must also be met:

- The person composing the affidavit must be the executor of the estate.

- The person composing the affidavit must be a close family member of the deceased. For example, a spouse, domestic partner, children, or a parent.

When Can You NOT Apply For a Small Estate Affidavit?

There are some cases where you CANNOT apply for a small estate affidavit:

- If regular probate proceedings are ongoing, then the small estate is not valid.

- The value of the small estate is over the local threshold.

- The small estate isn’t considered to be a small estate.

- Real estate is involved (depends on the state).

Evaluating the net worth of a small estate is sometimes difficult, which may cause problems with the estate filing.

What Is Included in a Small Estate Affidavit?

The following information is essential:

- Your name, if you’re the filer.

- Your address and mailing address.

- The deceased aka decedent’s name.

- The deceased’s date of passing and address.

- Receipts for funeral and other related expenses.

- The list of small estate assets, with descriptions and value.

- Details of unpaid debts and claims against the decedent.

- Details of spouses and children.

- Other information specified by the state.

Conclusion

In all cases, the small affidavit must be drafted precisely, in line with local laws and requirements. It’s alright to file an affidavit yourself if you want to avoid attorney fees. You can use our free small estate form template to compose an effective affidavit.

CocoSign provides free professional templates, forms, and other legal documents for individual and business needs.