Getting too tired of handling the legal requirements of your day to day life? There are certain situations that we come across in life where it becomes important to use the help of someone else for fulfilling legal requirements.

This is when you have to trust someone else to handle those matters for you with better experience and knowledge. This could be your finances, your medical treatment decisions, or simply appointing a guardian.

This is when the Power of Attorney comes into being.

Following are some of the salient features of power of attorney form Maryland template:

-

- Details of the parties involved,

- Description of the guardianship,

- Information on Applicable Laws

What is a Maryland Power of Attorney?

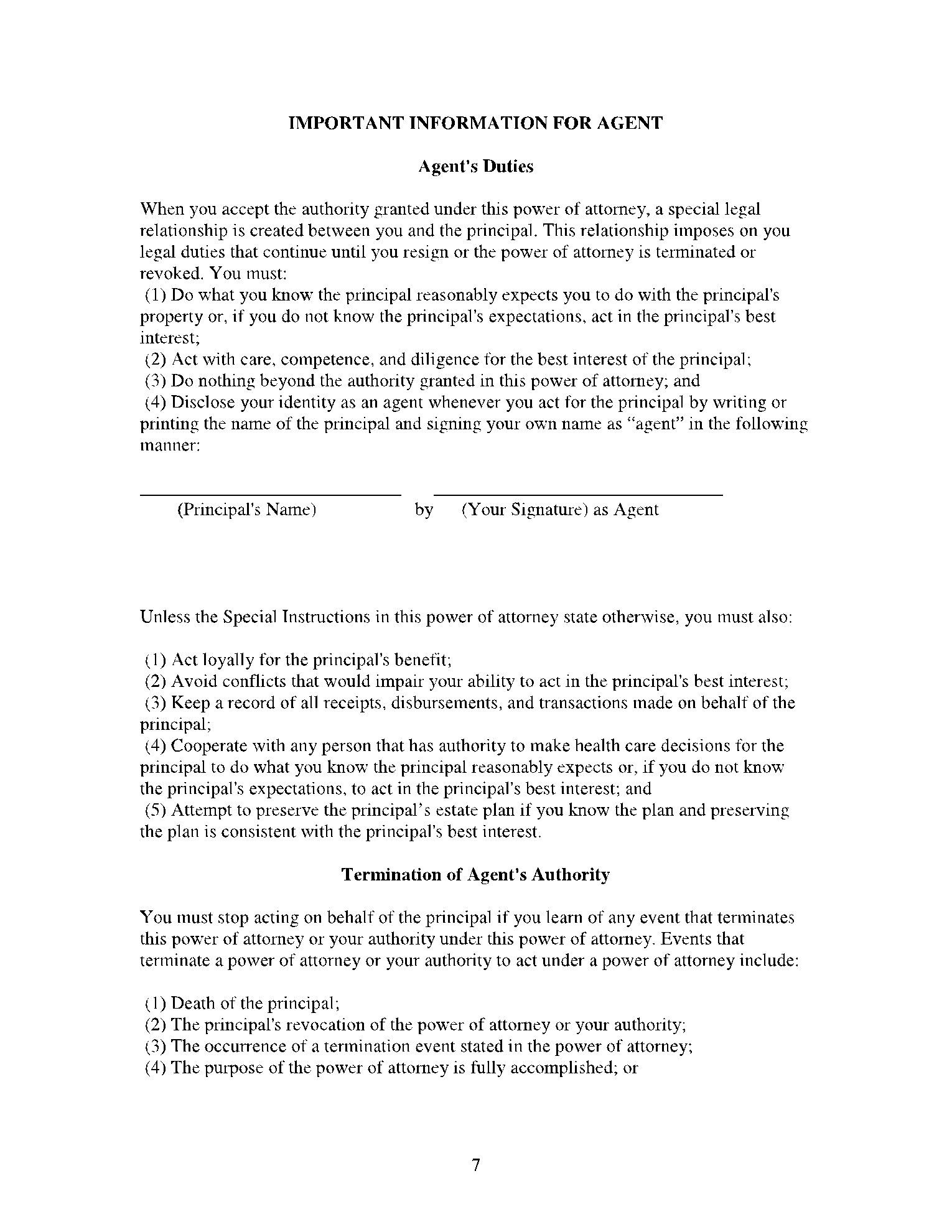

In general, a power of attorney is a legal document that binds two parties, namely the agent and the principal, in an agreement. An agent is someone given the authority to perform on behalf of the incapacitated person. A principal is the one on whose behalf the agent works.

The principal may find the need of such an agent when he/she is incapable and unavailable to do so by himself/herself. The Maryland power of attorney works in a certain way and has its own rules compliant with the Maryland laws.

Assign PoA Rights In A Jiffy Using Our Power of Attorney Maryland Form

We are always ready to help you with the power of Attorney form Maryland template. Download it now and assign responsibilities to others smoothly.

Download our power of attorney Maryland template by clicking below.

How Does Maryland Power Of Attorney Works?

A power of attorney Maryland works quite smoothly after the Power of Attorney Act was introduced in 2010. The agent representing your POA documents should present the original documents when acting on your behalf.

The agent is responsible for making the POA documents be it financial, medical, or legal, and present it to the bank or healthcare representative. The agent has to sign the POA documents followed by ‘Attorney in fact for your name.’

Types of Maryland Power of Attorney

When it comes to power of attorney forms Maryland, you are likely to hear two words springing and non-springing power of attorney.

This is the most common form of POA that is signed and notarized but is executed only when the principal is incapacitated or unavailable.

A durable or non-springing POA is executable even after the incapacitation of the principal. A DPOA gives the authority to the agent to make the life decisions for the principal on his/her behalf. It also gives the agent authority to make decisions related to medications and if the principal should be put off from the life-supporting machines as well.

In Maryland, there is also a third type of power of attorney known as healthcare POA. This POA is both durable and springing in nature. It gives authority to the agent to make all healthcare treatment decisions when the principal is unavailable or unable to do so.

The various other types of Maryland power of attorney forms include minor power of attorney form, power of attorney revocation form, real estate power of attorney form, and limited power of attorney form.

Why Is The Maryland Power Of Attorney Important?

It is highly important and favorable in the interests of the Maryland-based principal to get Maryland power of attorney in certain circumstances. Life is unpredictable, and the fear of losing your hard-earned wealth without a financial handler is the last thing you want.

- Keeps your finances secured

Power of attorney is important to handle your finances, taxes, healthcare issues, and much more in case you become incapable of doing so. It provides future safety to your finances.

- Helps in gaining guardianship/ conservatorship

A well-drafted Maryland power of attorney is helpful if you need to obtain guardianship to help manage your decisions and handle your life affairs. If you don’t have a power of attorney and become incapacitated in the future, the only way to gain guardianship/ conservatorship is through filing a court petition, which can turn out to be an expensive and time-consuming process.

Assign PoA Rights In A Jiffy Using Our Power of Attorney Maryland Form

We are always ready to help you with the power of Attorney form Maryland template. Download it now and assign responsibilities to others smoothly.

Download our power of attorney Maryland template by clicking below.

Maryland Power Of Attorney Requirements

For Maryland power of attorney, certain requirements need to be fulfilled by the principal to make the legal document valid.

- The principal should be more than 18 years old

- The principal should have the intention to give powers to the designated person

- The principal should be mentally sound

Here are the legal requirements of Maryland POA:

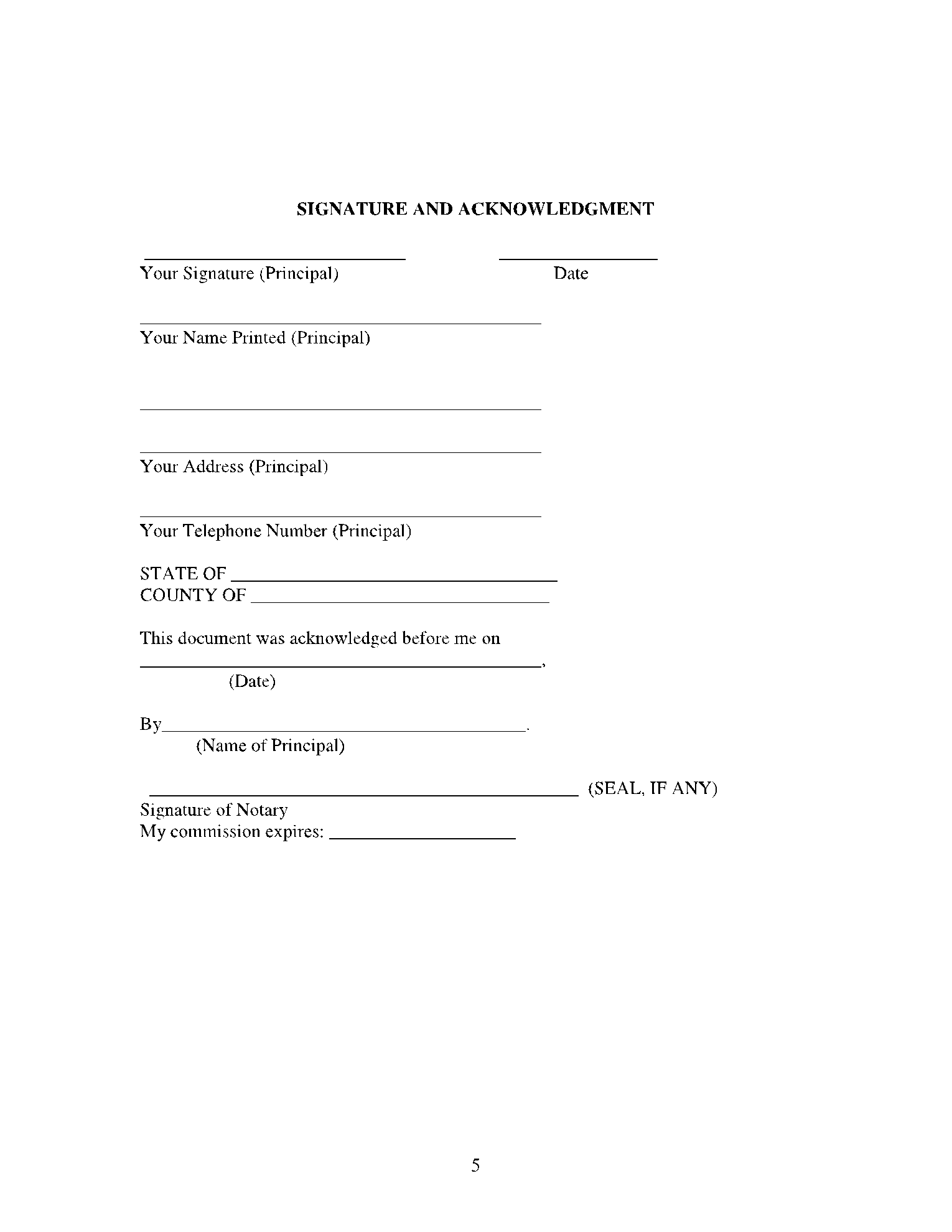

- The POA should be signed by the principal. If the principal is incapable or unable to sign, any other person in the direction of the principal should sign the documents on behalf of the principal in his/her presence.

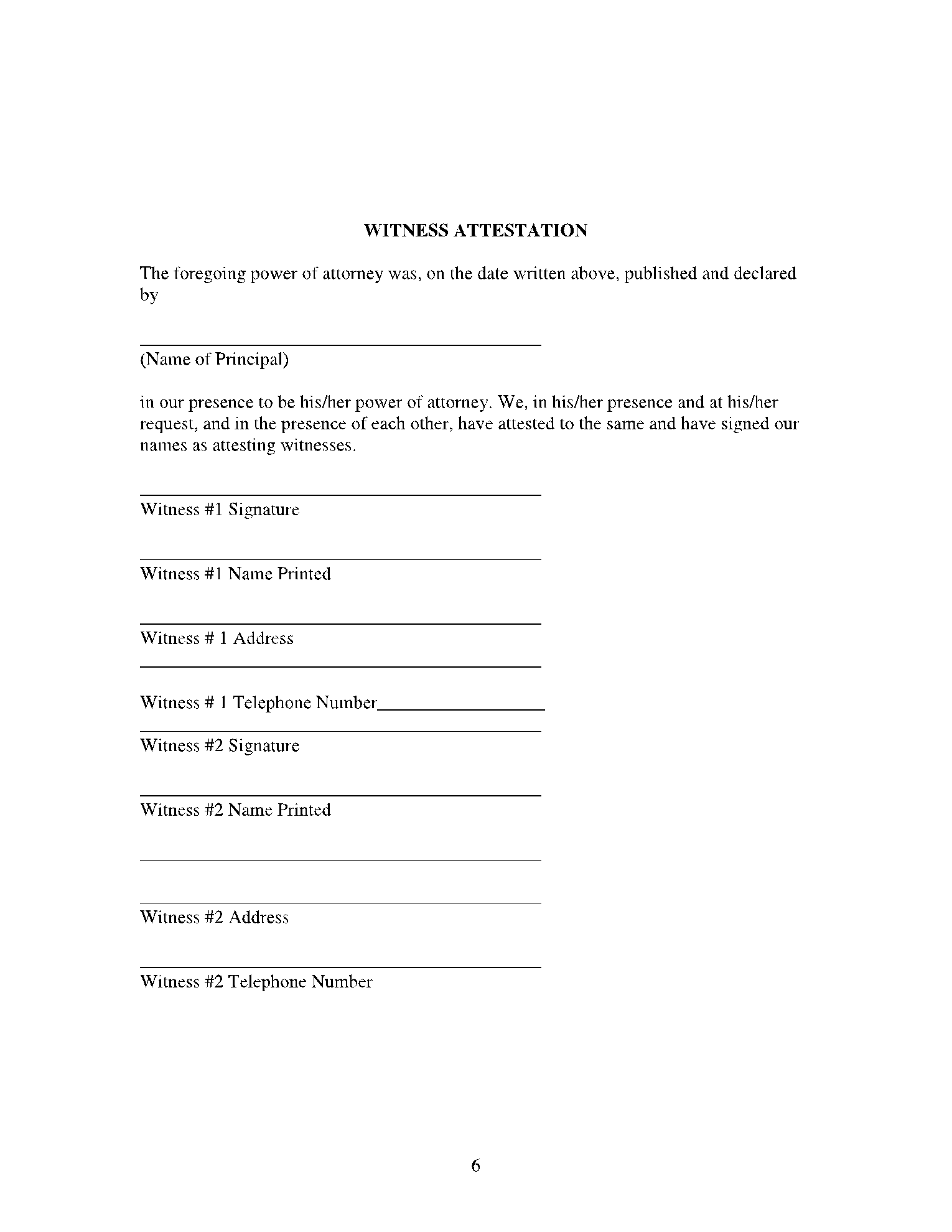

- The POA should be signed by one adult witness or more. Notary public can serve as one of the two adult witnesses.

- The POA should also be signed by the notary public or someone authorized to administer the oaths. Such a person cannot be one of the witnesses.

- All the parties involved should be present when each of the above-mentioned parties sign.

If you are a principal or agent and looking for Maryland Power of Attorney forms, there is hardly any way you can create it yourself. Isn’t it? Cocosign comes to your rescue. You can find numerous templates for the Power of Attorney form Maryland on and other forms of Power of Attorney forms on CocoSign. These templates are easily downloadable, printable, and customizable.

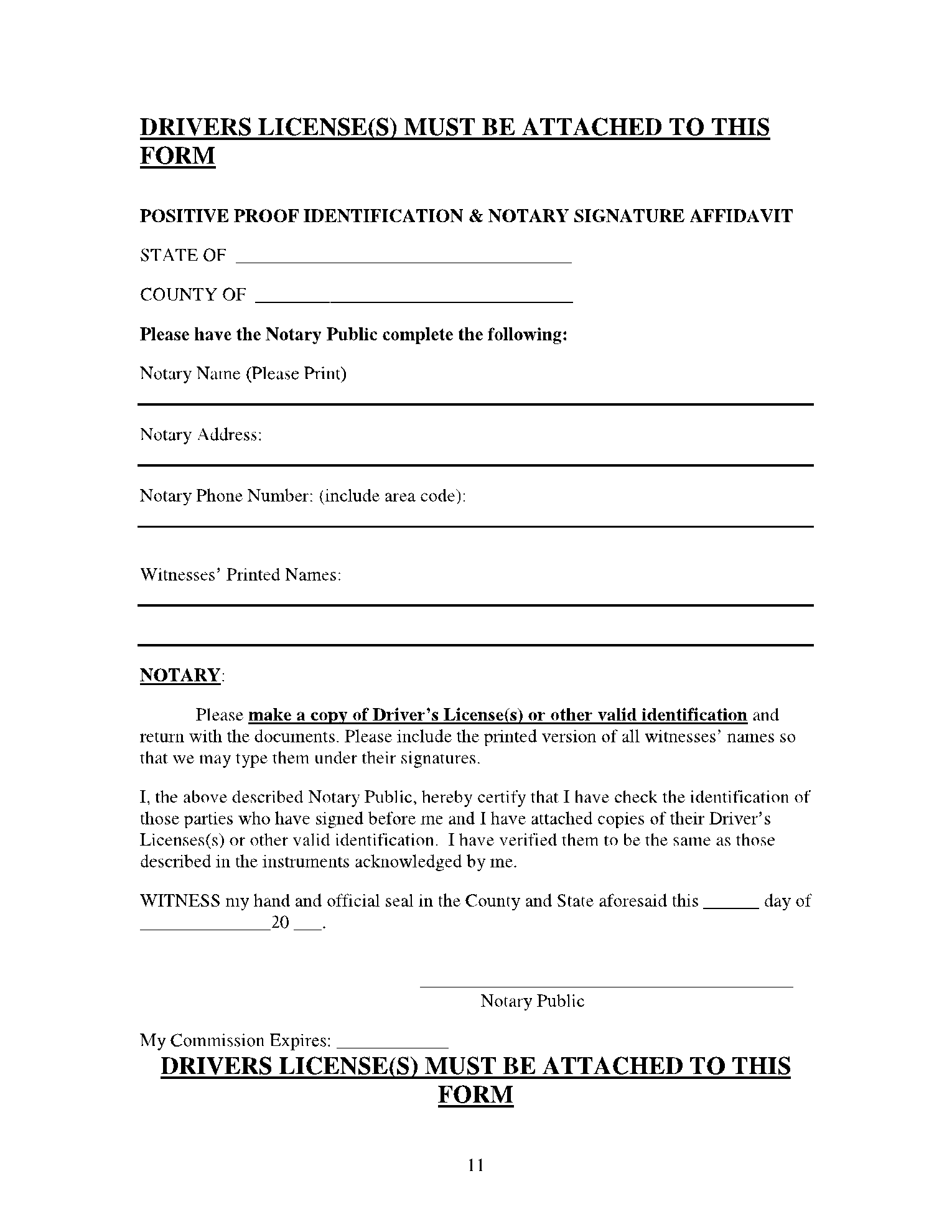

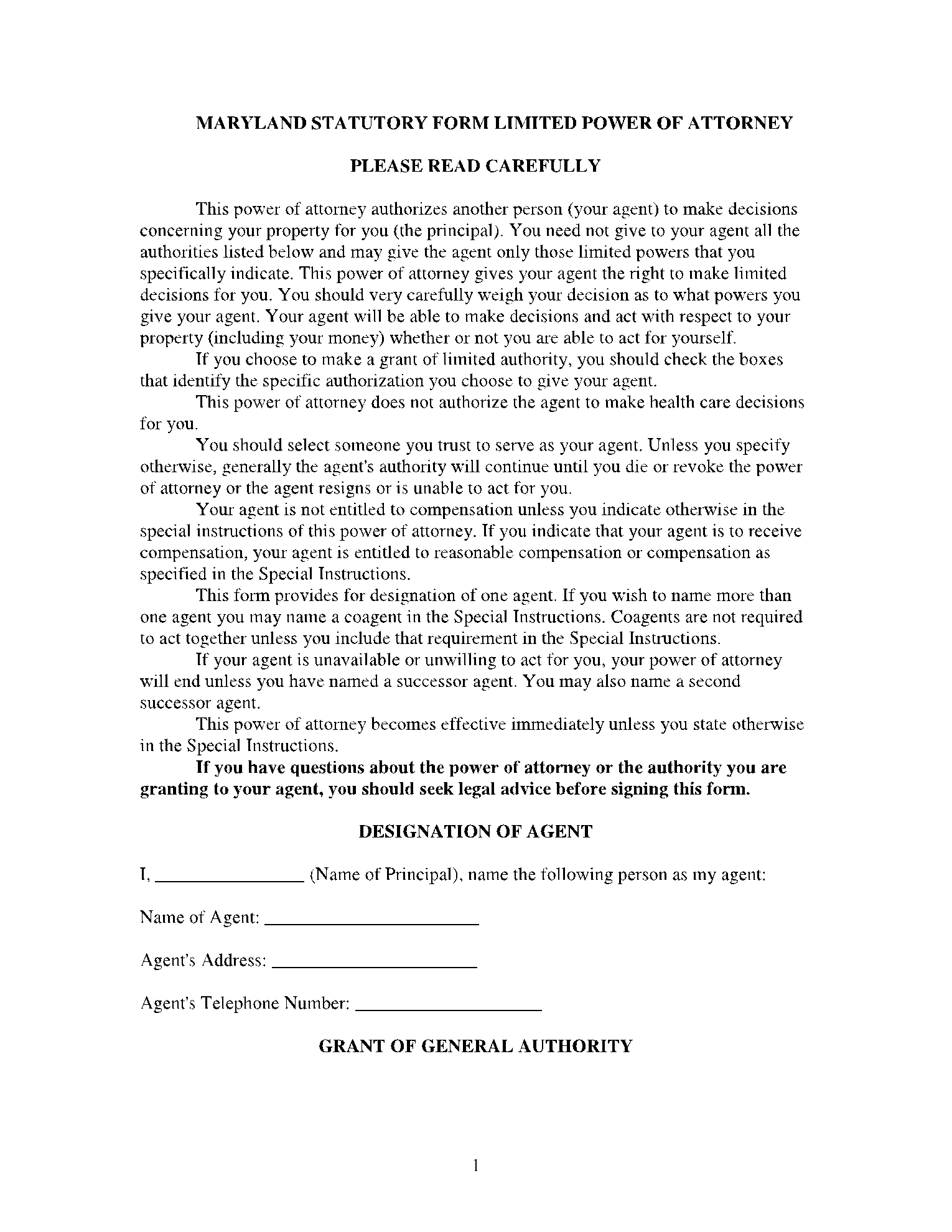

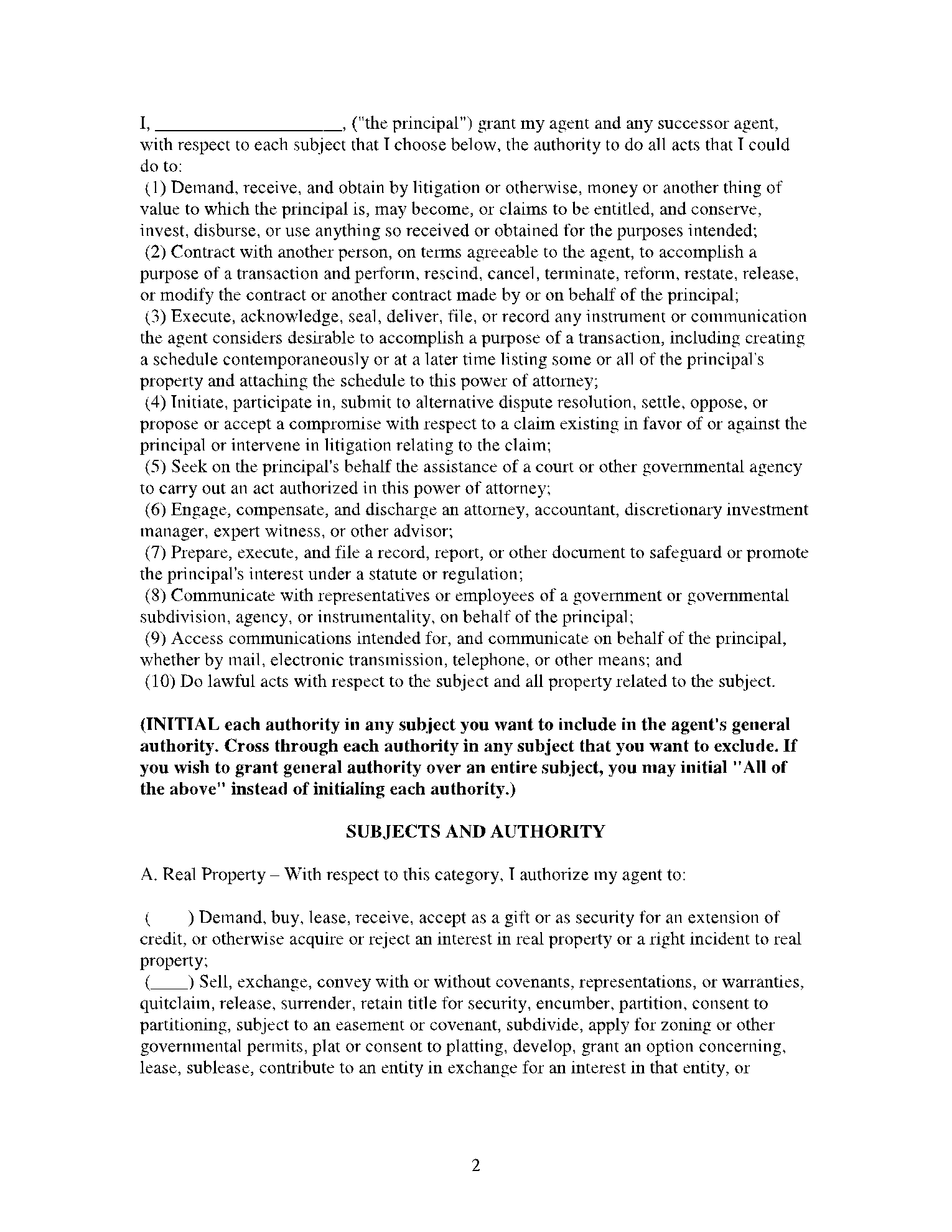

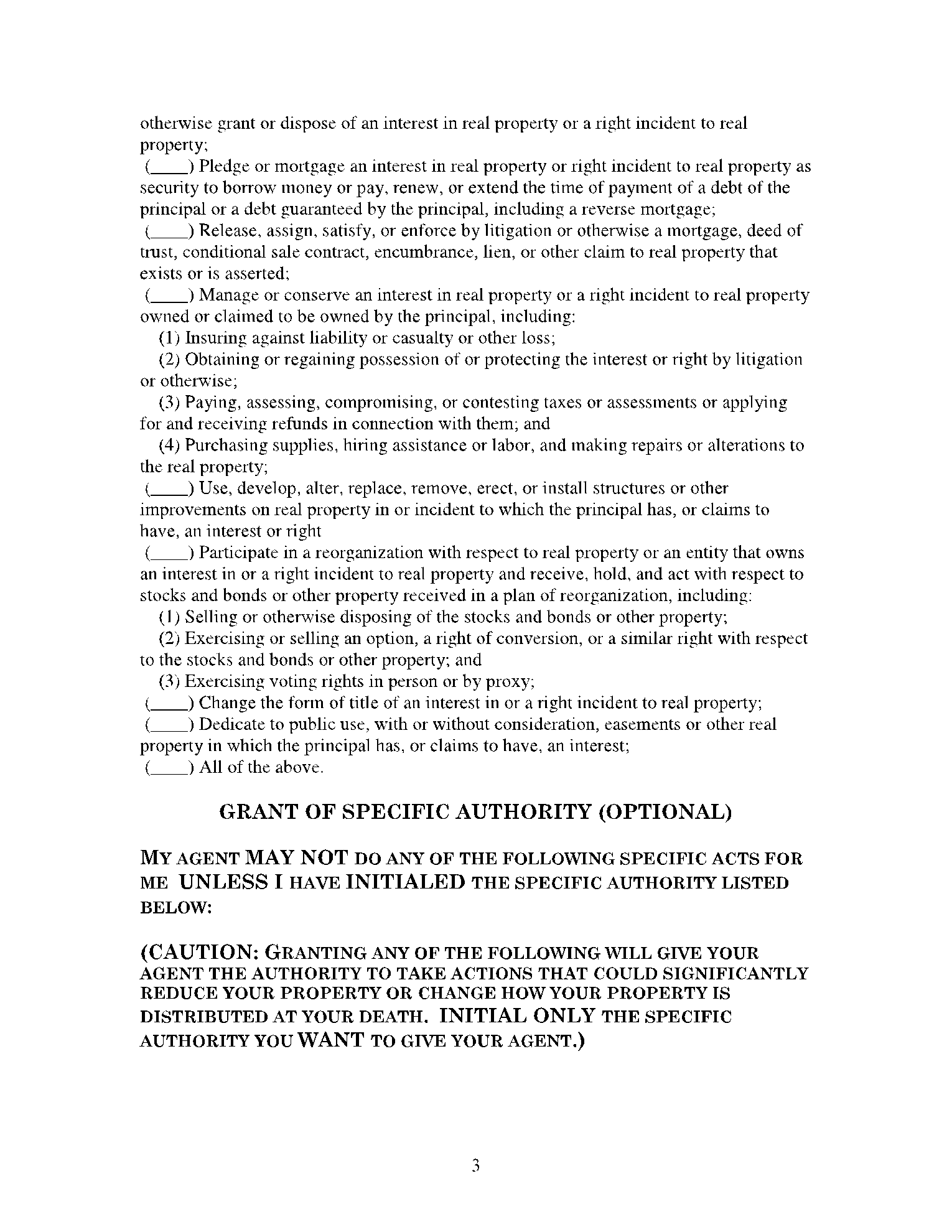

DOCUMENT PREVIEW

Successor Agent’s Address: ______________________________________________

Successor Agent’s Telephone Number: _______________________

If my successor agent is unable or unwilling to act for me, I name as my second

successor agent:

Name of 2nd Successor Agent: _______________________

Successor 2nd Agent’s Address: ____________________________________________

Successor 2nd Agent’s Telephone Number: _______________________

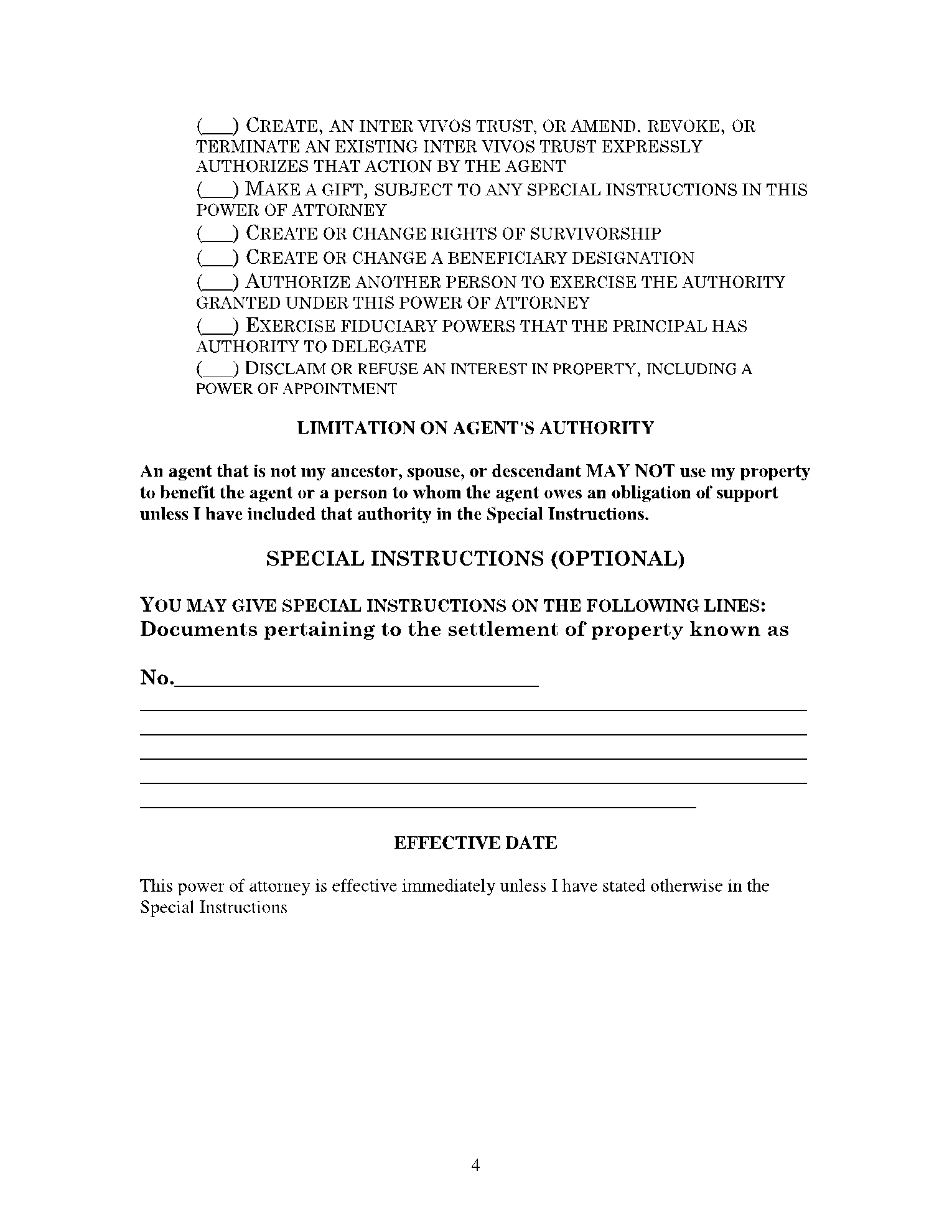

GRANT OF GENERAL AUTHORITY

I (“the principal”) grant my agent and any successor agent, with respect to each subject listed below, the authority to do all acts that I could do to:

(1) Contract with another person, on terms agreeable to the agent, to accomplish a purpose of a transaction and perform, rescind, cancel, terminate, reform, restate, release, or modify the contract or another contract made by or on behalf of the principal;

(2) Execute, acknowledge, seal, deliver, file, or record any instrument or communication the agent considers desirable to accomplish a purpose of a transaction;

(3) Seek on the principal’s behalf the assistance of a court or other governmental agency to carry out an act authorized in this power of attorney;

(4) Initiate, participate in, submit to alternative dispute resolution, settle, oppose, or propose or accept a compromise with respect to a claim existing in favor of or against the principal or intervene in litigation relating to the claim;

(5) Engage, compensate, and discharge an attorney, accountant, discretionary investment manager, expert witness, or other advisor;

(6) Prepare, execute, and file a record, report, or other document to safeguard or promote the principal’s interest under a statute or regulation and communicate with representatives or employees of a government or governmental subdivision, agency, or instrumentality, on behalf of the principal; and

(7) Do lawful acts with respect to the subject and all property related to the subject.

SUBJECTS AND AUTHORITY

My agent’s authority shall include the authority to act as stated below with regard to each of the following subjects:

Real property – With respect to this subject, I authorize my agent to: demand, buy, sell, convey, lease, receive, accept as a gift or as security for an extension of credit, or otherwise acquire or reject an interest in real property or a right incident to real property; pledge or mortgage an interest in real property or right incident to real property as security to borrow money or pay, renew, or extend the time of payment of a debt of the principal or a debt guaranteed by the principal, including a reverse mortgage; release, assign, satisfy, or enforce by litigation or otherwise a mortgage, deed of trust, conditional sale contract, encumbrance, lien, or other claim to real property that exists or is asserted; and manage or conserve an interest in real property or a right incident to real property owned or claimed to be owned by the principal, including: (1) insuring against liability or casualty or other loss; (2) obtaining or regaining possession of or protecting the interest or right by litigation or otherwise; (3) paying, assessing, compromising, or contesting taxes or assessments or applying for and receiving refunds in connection with them; and (4) purchasing supplies, hiring assistance or labor, and making repairs or alterations to the real property.

Stocks and bonds

– With respect to this subject, I authorize my agent to: buy, sell, and exchange stocks and bonds; establish, continue, modify, or terminate an account with respect to stocks and bonds; pledge stocks and bonds as security to borrow, pay, renew, or extend the time of payment of a debt of the principal; receive certificates and other evidences of ownership with respect to stocks and bonds; exercise voting rights with respect to stocks and bonds in person or by proxy, enter into voting trusts, and consent to limitations on the right to vote.

Banks and other financial institutions – With respect to this subject, I authorize my agent to: continue, modify, transact all business in connection with, and terminate an account or other banking arrangement made by or on behalf of the principal; establish, modify, transact all business in connection with, and terminate an account or other banking arrangement with a bank, trust company, savings and loan association, credit union, thrift company, brokerage firm, or other financial institution selected by the agent; contract for services available from a financial institution, including renting a safe deposit box or space in a vault; deposit by check, money order, electronic funds transfer, or otherwise with, or leave in the custody of, a financial institution money or property of the principal; withdraw, by check, money order, electronic funds transfer, or otherwise, money or property of the principal deposited with or left in the custody of a financial institution; receive statements of account, vouchers, notices, and similar documents from a financial institution and act with respect to them; enter a safe deposit box or vault and withdraw or add to the contents; borrow money and pledge as security personal property of the principal necessary to borrow money or pay, renew, or extend the time of payment of a debt of the principal or a debt guaranteed by the principal; make, assign, draw, endorse, discount, guarantee, and negotiate promissory notes, checks, drafts, and other negotiable or nonnegotiable paper of the principal or payable to the principal or the principal’s order, transfer money, receive the cash or other proceeds of those transactions; and apply for, receive, and use credit cards and debit cards, electronic transaction authorizations, and traveler’s checks from a financial institution.

Insurance and annuities

– With respect to this subject, I authorize my agent to: continue, pay the premium or make a contribution on, modify, exchange, rescind, release, or terminate a contract procured by or on behalf of the principal that insures or provides an annuity to either the principal or another person, whether or not the principal is a beneficiary under the contract; procure new, different, and additional contracts of insurance and annuities for the principal and select the amount, type of insurance or annuity, and mode of payment; pay the premium or make a contribution on, modify, exchange, rescind, release, or terminate a contract of insurance or annuity procured by the agent; apply for and receive a loan secured by a contract of insurance or annuity; surrender and receive the cash surrender value on a contract of insurance or annuity; exercise an election; exercise investment powers available under a contract of insurance or annuity; change the manner of paying premiums on a contract of insurance or annuity; change or convert the type of insurance or annuity with respect to which the principal has or claims to have authority described in this section; apply for and procure a benefit or assistance under a statute or regulation to guarantee or pay premiums of a contract of insurance on the life of the principal; collect, sell, assign, hypothecate, borrow against, or pledge the interest of the principal in a contract of insurance or annuity; select the form and timing of the payment of proceeds from a contract of insurance or annuity; pay, from proceeds or otherwise, compromise or contest, and apply for refunds in connection with a tax or assessment levied by a taxing authority with respect to a contract of insurance or annuity or the proceeds or liability from the contract of insurance or annuity accruing by reason of the tax or assessment.

Claims and litigation – With respect to this subject, I authorize my agent to: assert and maintain before a court or administrative agency a claim, claim for relief, cause of action, counterclaim, offset, recoupment, or defense, including an action to recover property or other thing of value, recover damages sustained by the principal, eliminate or modify tax liability, or seek an injunction, specific performance, or other relief; act for the principal with respect to bankruptcy or insolvency, whether voluntary or involuntary, concerning the principal or some other person, or with respect to a reorganization, receivership, or application for the appointment of a receiver or trustee that affects an interest of the principal in property or other thing of value; pay a judgment, award, or order against the principal or a settlement made in connection with a claim or litigation; and receive money or other thing of value paid in settlement of or as proceeds of a claim or litigation.

Benefits from governmental programs or civil or military service (including any benefit, program, or assistance provided under a statute or regulation including Social Security, Medicare, and Medicaid) – With respect to this subject, I authorize my agent to: execute vouchers in the name of the principal for allowances and reimbursements payable by the United States or a foreign government or by a state or subdivision of a state to the principal; enroll in, apply for, select, reject, change, amend, or discontinue, on the principal’s behalf, a benefit or program; prepare, file, and maintain a claim of the principal for a benefit or assistance, financial or otherwise, to which the principal may be entitled under a statute or regulation; initiate, participate in, submit to alternative dispute resolution, settle, oppose, or propose or accept a compromise with respect to litigation concerning a benefit or assistance the principal may be entitled to receive under a statute or regulation; and receive the financial proceeds of a claim described above and conserve, invest, disburse, or use for a lawful purpose anything so received.

Retirement plans (including a plan or account created by an employer, the principal, or another individual to provide retirement benefits or deferred compensation of which the principal is a participant, beneficiary, or owner, including a plan or account under the following sections of the Internal Revenue Code: (1) an individual retirement account under Internal Revenue Code Section 408, 26 U.S.C. § 408; (2) a Roth individual retirement account under Internal Revenue Code Section 408A, 26 U.S.C. § 408A; (3) a deemed individual retirement account under Internal Revenue Code Section 408(q), 26 U.S.C. § 408(q); (4) an annuity or mutual fund custodial account under Internal Revenue Code Section 403(b), 26 U.S.C. § 403(b); (5) a pension, profit–sharing, stock bonus, or other retirement plan qualified under Internal Revenue Code Section 401(a), 26 U.S.C. § 401(a); (6) a plan under Internal Revenue Code Section 457(b), 26 U.S.C. § 457(b); and (7) a nonqualified deferred compensation plan under Internal Revenue Code Section 409A, 26 U.S.C. § 409A) – With respect to this subject, I authorize my agent to: select the form and timing of payments under a retirement plan and withdraw benefits from a plan; make a rollover, including a direct trustee–to–trustee rollover, of benefits from one retirement plan to another; establish a retirement plan in the principal’s name; make contributions to a retirement plan; exercise investment powers available under a retirement plan; borrow from, sell assets to, or purchase assets from a retirement plan. I recognize that granting my agent the authority to create or change a beneficiary designation for a retirement plan may affect the benefits that I may receive if that authority is exercised. If I grant my agent the authority to designate the agent, the agent’s spouse, or a dependent of the agent as a beneficiary of a retirement plan, the grant may constitute a taxable gift by me and may make the property subject to that authority taxable as a part of the agent’s estate. Therefore, if I wish to authorize my agent to create or change a beneficiary designation for any retirement plan, and in particular if I wish to authorize the agent to designate as my beneficiary the agent, the agent’s spouse, or a dependent of the agent, I will explicitly state this authority in the Special Instructions section that follows or in a separate power of attorney.

Taxes – With respect to this subject, I authorize my agent to: prepare, sign, and file federal, state, local, and foreign income, gift, payroll, property, federal insurance contributions act, and other tax returns, claims for refunds, requests for extension of time, petitions regarding tax matters, and other tax–related documents, including receipts, offers, waivers, consents, including consents and agreements under Internal Revenue Code Section 2032(A), 26 U.S.C. § 2032(A), closing agreements, and other powers of attorney required by the Internal Revenue Service or other taxing authority with respect to a tax year on which the statute of limitations has not run and the following 25 tax years; pay taxes due, collect refunds, post bonds, receive confidential information, and contest deficiencies determined by the Internal Revenue Service or other taxing authority; exercise elections available to the principal under federal, state, local, or foreign tax law; and act for the principal in all tax matters for all periods before the Internal Revenue Service, or other taxing authority.

Digital assets – With respect to this subject, in accordance with the Maryland

Fiduciary Access to Digital Assets Act, my agent shall have authority over and the

right to access: (1) the content of any of my electronic communications; (2) any

catalogue of electronic communications sent or received by me; and (3) any other

digital asset in which I have a right or interest.