A power of attorney form is arguably the most important document every adult must get. This is because it confers on another the rights to act on your behalf on special matters.

There is a rife myth that the power of attorney form trumps your will or trust. Students of this school of thought say that the agent can limit the actions of your will’s executor. However, that isn’t the case here. If you want to find more about Florida power of attorney, why you need one, the requirements and the types, read on.

What’s contained in a durable power of attorney:

-

- Details of principal

- Details of agent

- Powers granted to the agent

- Date of execution

- Responsibilities of the agent or attorney-in-fact

- Notarized

What is a Florida Power of Attorney?

A power of attorney form Florida includes several types such as the Florida durable poa, the Florida medical power of attorney. It hands an individual the rights to appoint another individual, business or organization legal permission to act on his/her behalf on general interests or specific ones.

The one who appoints one to act on his/her behalf is known as the principal while the one who the principal confers these rights upon is described as the agent or attorney-in-fact. Most often than not, the agent is usually an individual or two, as opposed to an organization or business.

A power of attorney can be non-durable or durable, specific or non-specific. The other types of power of attorney include limited, springing and non-springing power of attorney. However, the Florida Uniform Power of Attorney Act does not allow a non-springing power of attorney.

The principal of the power of attorney determines under what specific matters the agent acts on his/her behalf.

Should the principals be involved in a financial transaction with an entity in Florida or live in Florida, it is recommended that they create a power of attorney under the requirements of the laws of the State.

Although that of other states is tenable in Florida, there is a greater likelihood of running into problems when working with an out-of-state form in Florida, especially when the recipient is not familiar with the contents of the form.

Check out our power of attorney forms Florida template!

With our easy-to-read and complete power of attorney forms Florida template, you'll never have to worry about the troublesome legal details again. Our template makes sure everything you need for a Florida power of attorney form.

Click the buttons below to try this free POA template!

Why Would You Use a Florida Power of Attorney Form?

There are a host of reasons why an individual might want to obtain a Florida power of attorney form. In the event that your mental health begins to fail or you grow too old or weak to handle certain matters or decisions, you would need someone to act on your behalf. A power of attorney form is viable in situations like these.

However, a Florida power of attorney form isn’t only designed for a sick or elderly person. A healthy individual might also need someone to represent him/her in his/her business transactions.

If the principal is a business owner, occupying management positions at a company or another venture, he/she can appoint an agent capable of running the business, paying out employees and attending certain business meetings.

As it is with power of attorney forms elsewhere, the principal must indicate on the document what tasks and matters they need the agent to act on. The principal must also stipulate in clear and concise terms what the powers of the agent are or are not.

The principal must also note that the laws of the state entitle the agent to a reasonable sum of money as compensation. To make matters clear from the get-go, the principal should also write in concise terms the exact figures of this compensation. This helps to reduce the likelihood of any problems in the future.

What Are The Power of Attorney Requirements in Florida?

For a power of attorney form Florida to be valid and recognized by the law, certain requirements must be fulfilled. These are some of those requirements.

- It must comply with the laws of the state. These laws are listed under Chapter 709 of the Florida Statutes.

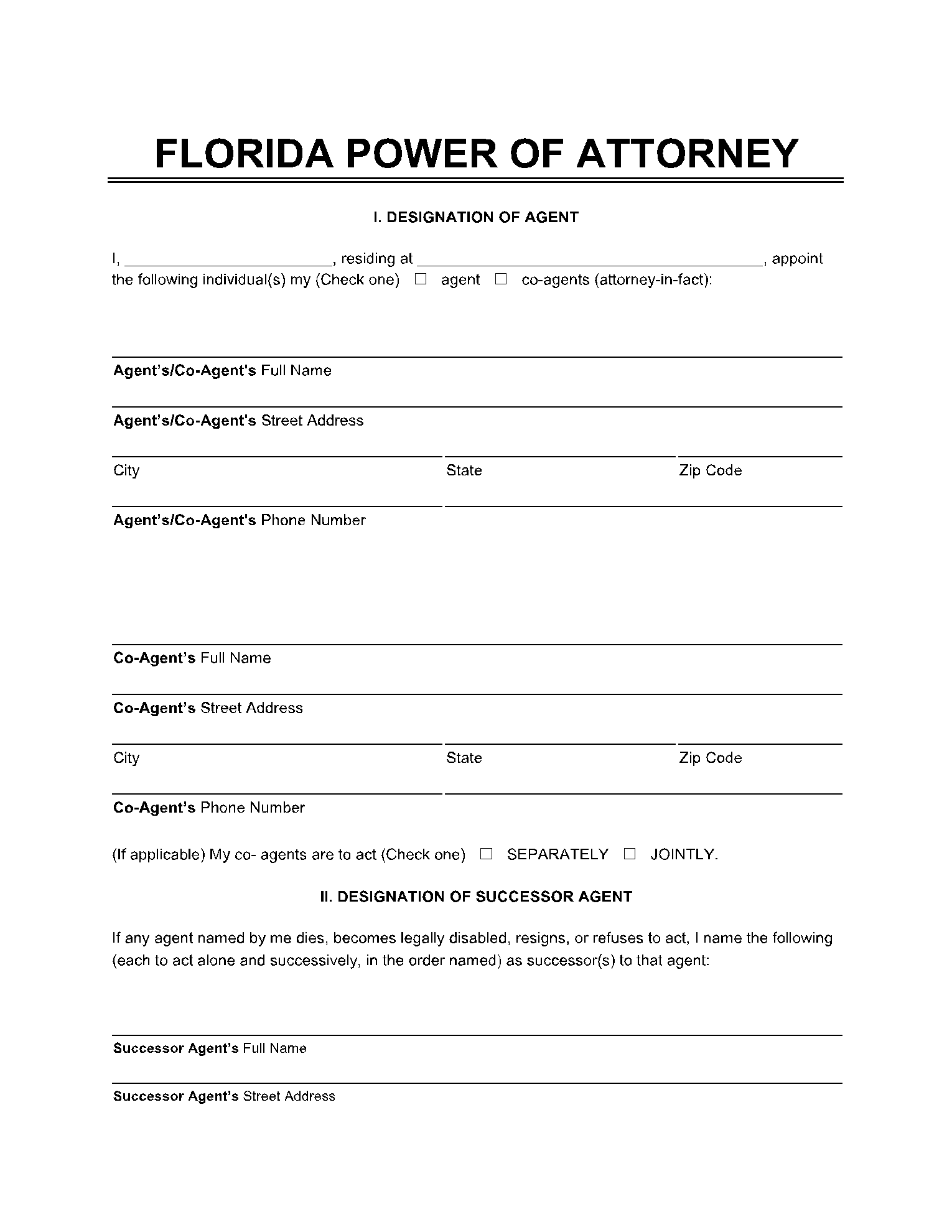

- It must also contain the names of the principal and agent, the powers granted to the agent, date the document was signed and becomes effective, and the exact responsibilities of the agent or attorney-in-fact.

- The agent must not be a minor. In other words, he/she must be above 18 years of age. If the agent is an institution or business organization, it must be within the confines of the state and must be legally permitted to conduct businesses in the state.

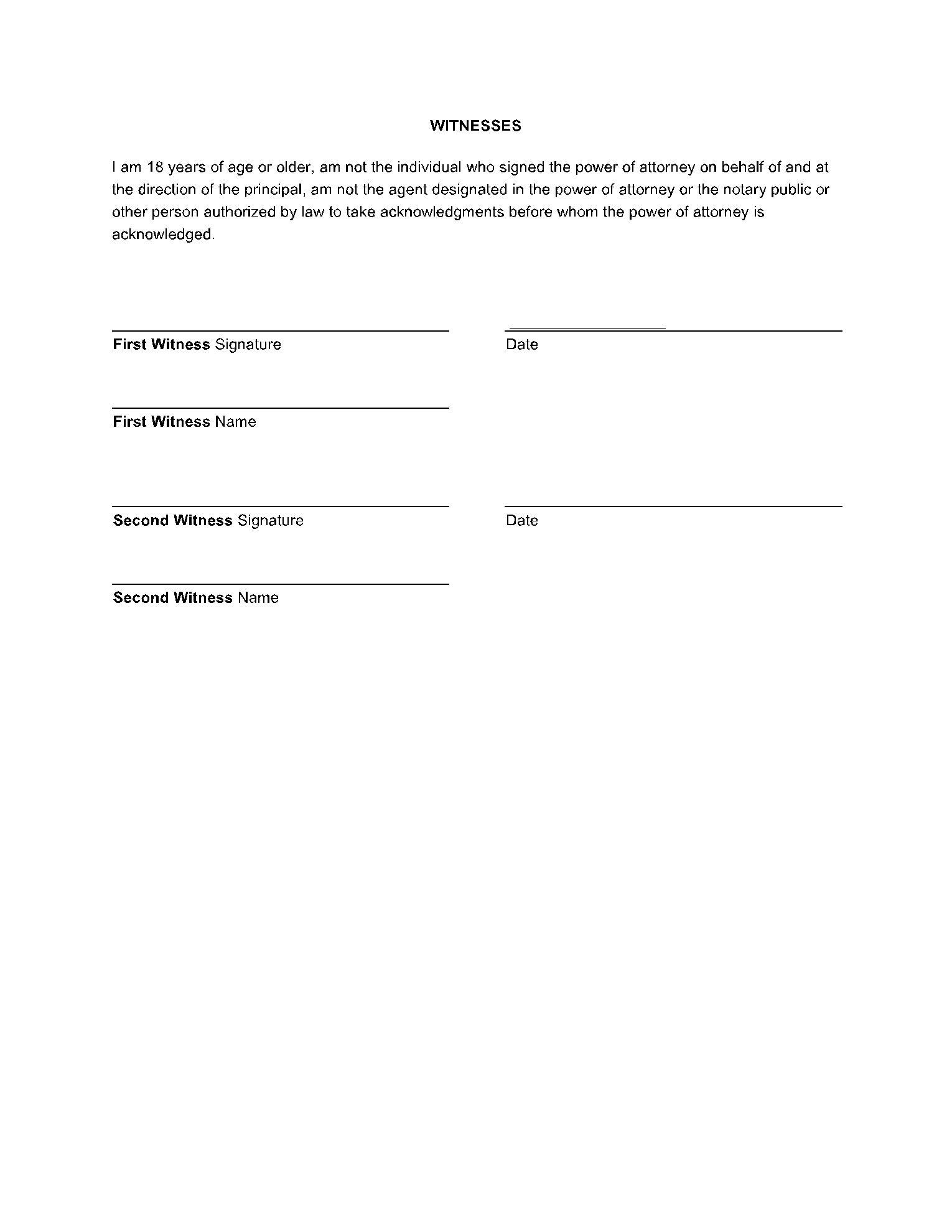

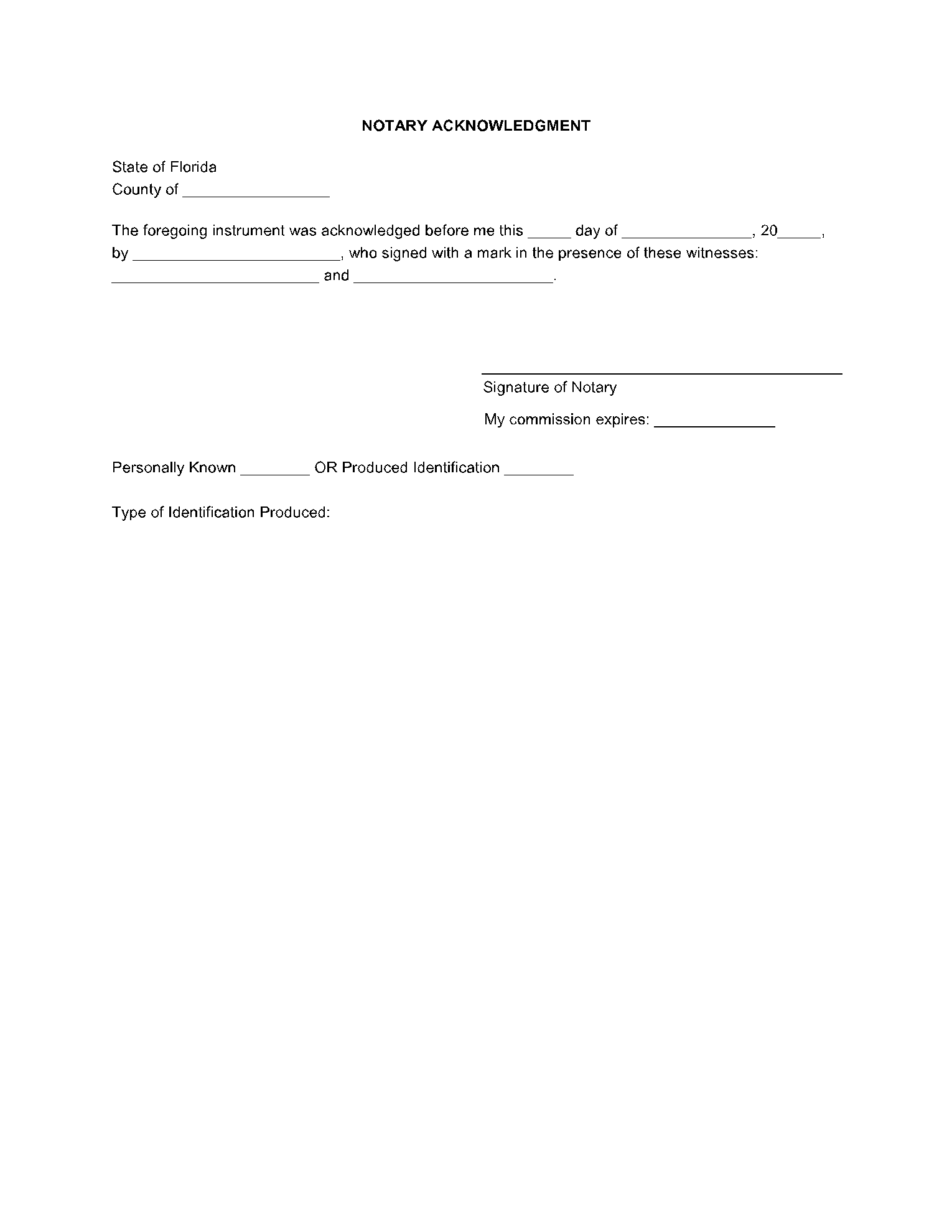

- The principal must sign the specific, non-durable or durable power of attorney form Florida in front of two or more witnesses. In addition, the witnesses must append their signatures and the document notarized. If the principal is deemed unable to sign, the notary public can sign on the power of attorney form on his/her behalf.

- Finally, the original copy of the document may be given to the clerk of the court to be stored away as public record.

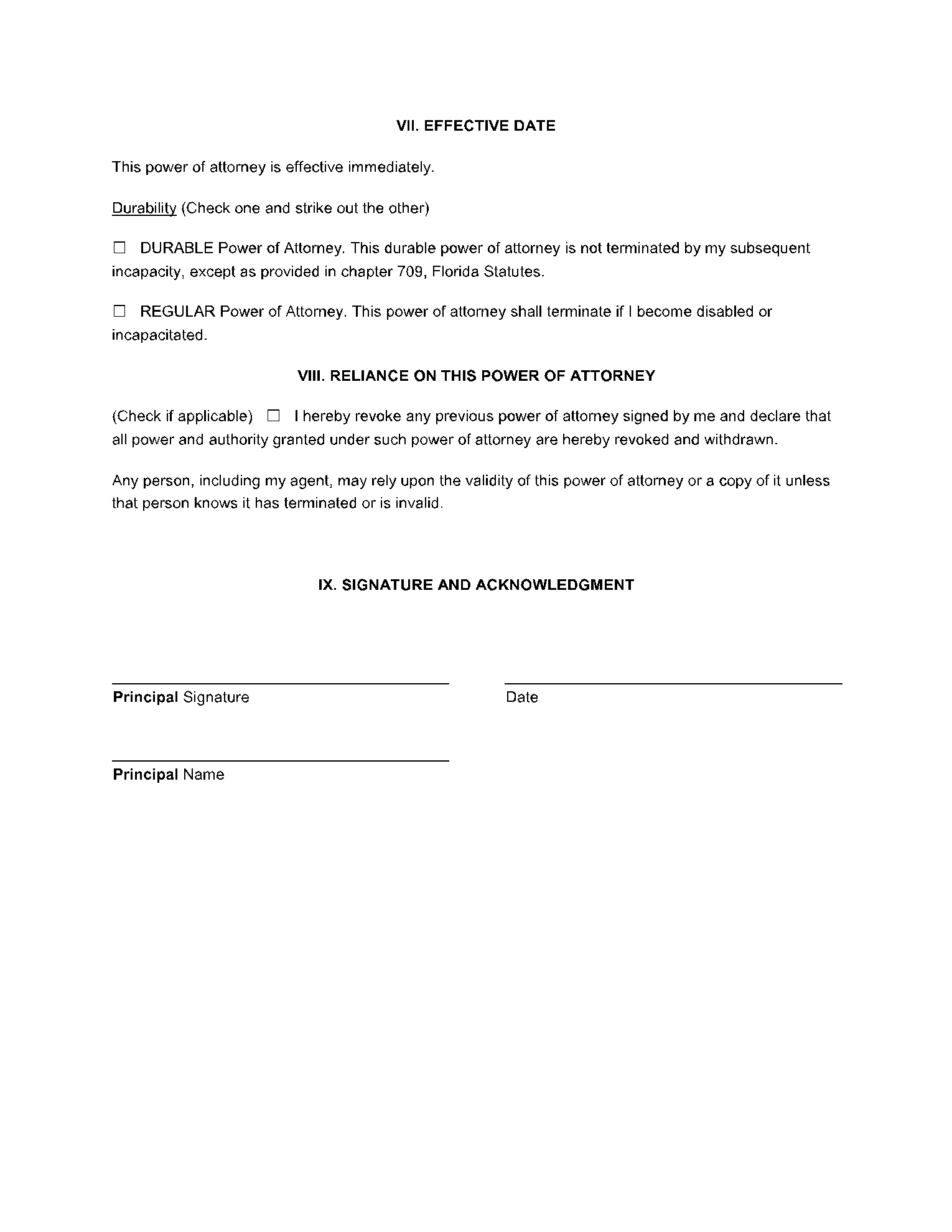

As for requirements of the content, there are no clear-cut requirements. However, it is stated that a durable power of attorney form Florida must contain the clause: “This durable power of attorney is not terminated by subsequent incapacity of the principal except as provided in Chapter 709, Florida Statutes.”

Types of Power of Attorney in Florida

There are different types of power of attorney operational in Florida. They include General power of attorney, limited or special power of attorney, incapacity or incapacitated power of attorney and durable power of attorney.

General power of attorney:

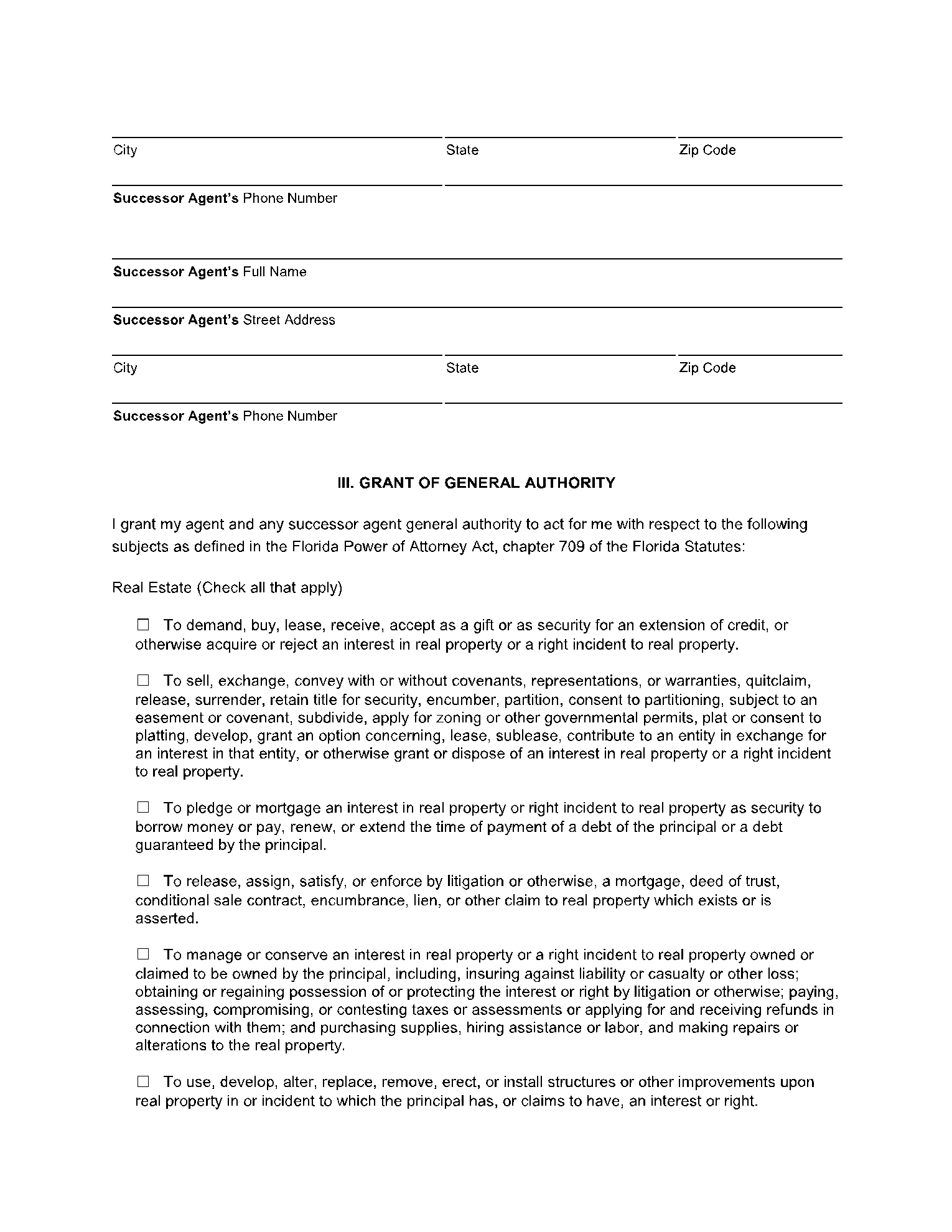

A general power of attorney Florida hands the agent the legal permission to assume the legal powers of the principal. The agent you appoint is responsible for representing you on all fronts, and all legal and financial matters.

Incapacity or incapacitated power of attorney:

According to the laws of the state, incapacity is the inability of a person to take necessary actions required to obtain, administer and dispose real, personal, business properties, as well as dispose all benefits that accrue to him/her.

Springing power of attorney:

This power of attorney does not become effective until you become incapacitated.

Durable power of attorney:

A durable power of attorney form Florida is one that continues even after the incapacitation of the principal. Here, your incapacitation does not invalidate the power of attorney.

Limited or special power of attorney:

This power of attorney limits the powers of the agent to specific tasks or matters. In other words, the agent can act on your behalf only on particular matters as defined or stipulated in the Florida power of attorney form.

Parent power of attorney:

This isn’t common in other states but is a thing in Florida. Here, the parents are allowed to give decision making rights over a child still below age 18 to a guardian who can make decisions on their behalf in the event that there is a medical emergency. This is commonly used in the absence of the parent.

Medical power of attorney:

Also known as Designation of Health care surrogate in Florida, this power of attorney confers on the agent the rights to make health decisions on behalf of the principal when he/she is deemed not fit to make healthcare decisions for him/herself.

Real estate power of attorney:

This power of attorney grants you the rights to appoint someone to sell or buy real estate properties on your behalf.

Other powers of attorney Florida include tax power of attorney, vehicle power of attorney, among others.

How to Get A Power of Attorney in Florida?

Asides the statute that specifies that a durable power of attorney form contains the phrase, “This durable power of attorney is not terminated by subsequent incapacity of the principal except as provided in Chapter 709, Florida Statutes”, there are no special regulations concerning the contents of a power of attorney form.

Rather than splurge cash hiring an attorney to help draw up a power of attorney form, a principal can download a template or fillable form online tallying with the type of power of attorney form they want to use

Check out our power of attorney forms Florida template!

With our easy-to-read and complete power of attorney forms Florida template, you'll never have to worry about the troublesome legal details again. Our template makes sure everything you need for a Florida power of attorney form.

Click the buttons below to try this free POA template!

Conclusion:

It has been established that a power of attorney form isn’t to be drawn only by an ailing, incapacitated individual. Indeed, it is a powerful legal document everyone is recommended to draft.

If you do not have a clue as to how to draft one, you can download any of CocoSign’s power of attorney templates for use. There are several fillable forms available on the site including general, real estate and limited power of attorney forms, among others.

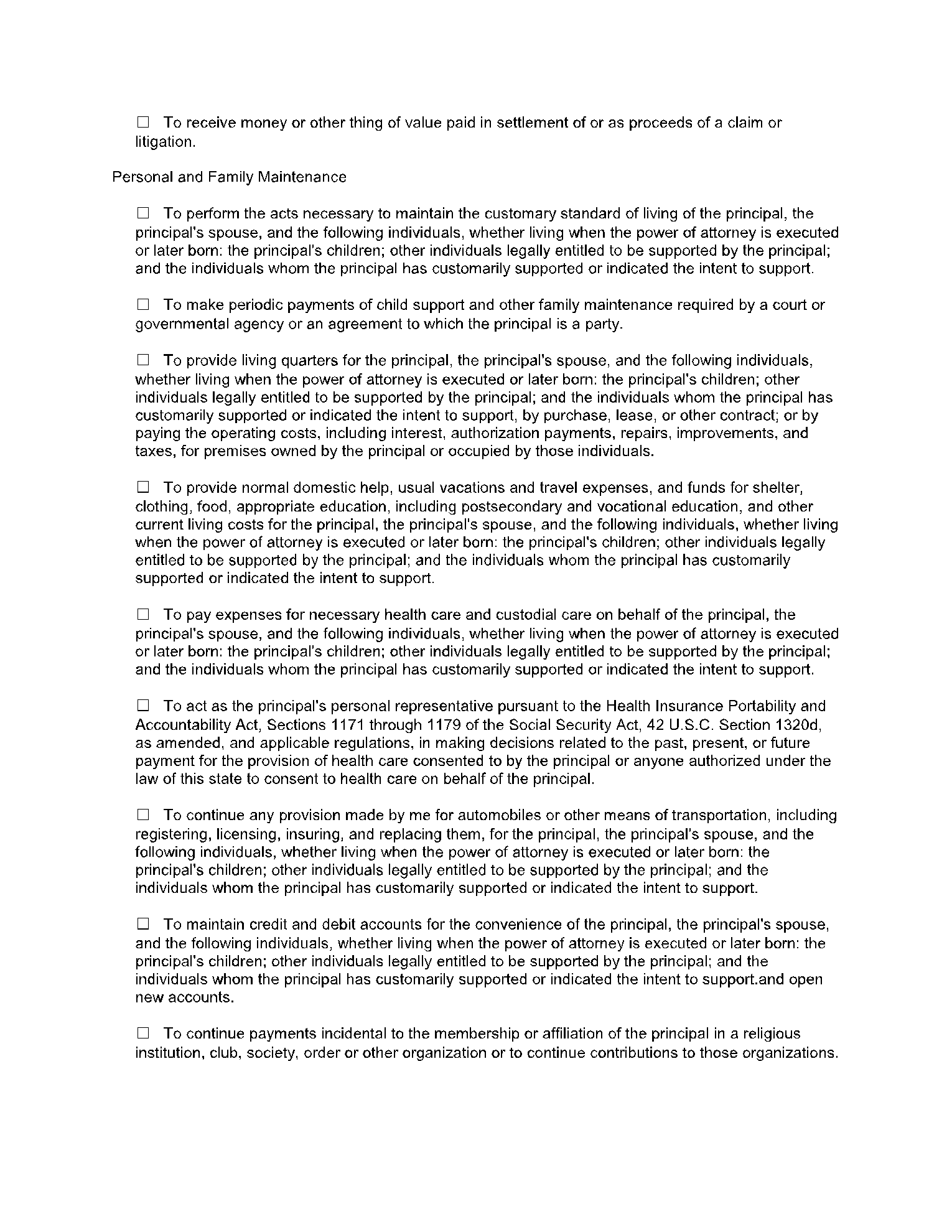

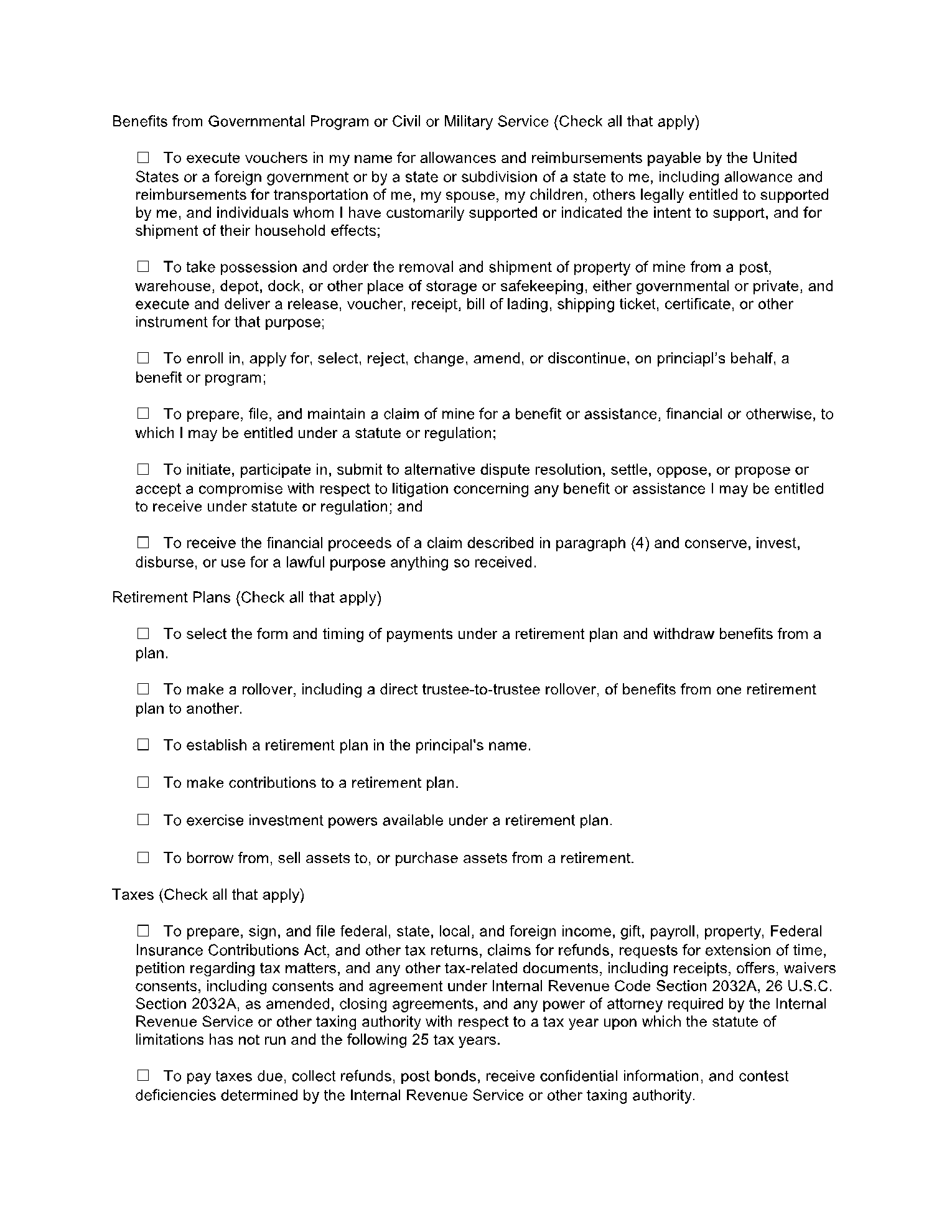

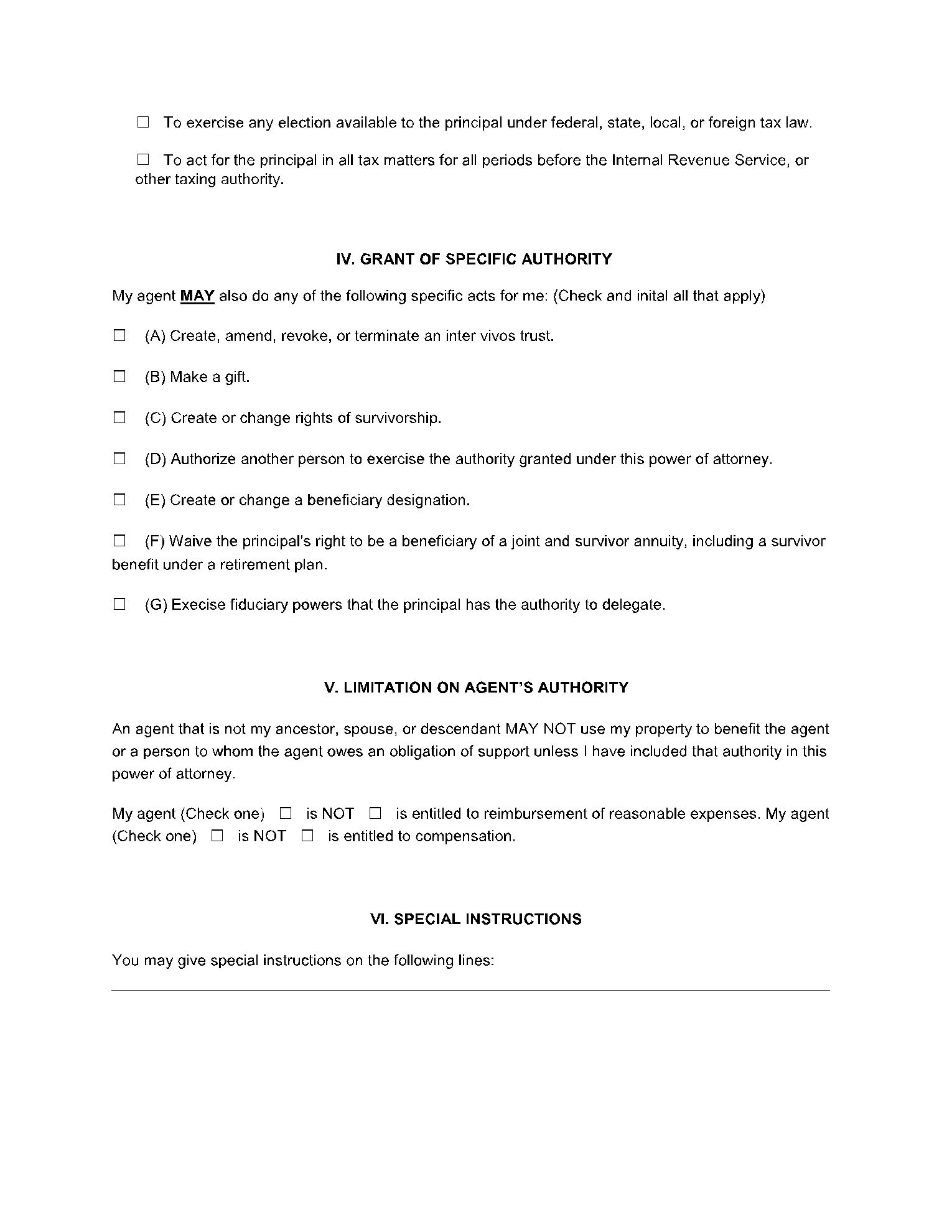

DOCUMENT PREVIEW

Establish, modify, and terminate an account or other banking arrangements with a bank, trust company, savings and loan association, credit union, thrift company, brokerage firm, or other financial institution selected by the Agent;

Contract for services available from a financial institution, including renting a safe deposit box or space in a vault;

Withdraw, by check, order, electronic funds transfer, or otherwise, money or property of the Principal deposited with or left in the custody of a financial institution;

Receive statements of account, vouchers, notices, and similar documents from a financial institution and act with respect to them;

Enter a safe deposit box or vault and withdraw or add to the contents;

Borrow money and pledge as security personal property of the Principal necessary to borrow money or pay, renew, or extend the time of payment of a debt of the Principal or a debt guaranteed by the Principal;

Make, assign, draw, endorse, discount, guarantee, and negotiate promissory notes, checks, drafts, and other negotiable or nonnegotiable paper of the Principal or payable to the Principal or the Principal's order, transfer money, receive the cash or other proceeds of those transactions, and accept a draft drawn by a person upon the Principal and pay it when due;

Receive for the Principal and act upon a sight draft, warehouse receipt, or other document of title whether tangible or electronic, or other negotiable or nonnegotiable instrument;

Apply for, receive, and use letters of credit, credit and debit cards, electronic transaction authorizations, and traveler's checks from a financial institution and give an indemnity or other agreement in connection with letters of credit; and

Consent to an extension of the time of payment with respect to commercial paper or a financial transaction with a financial institution.

________ SAFE DEPOSIT BOX - To have access at any time or times to any safe-deposit box rented by me or to which I may have access, wheresoever located, including drilling, if necessary, and to remove all or any part of the contents thereof, and to surrender or relinquish said safe-deposit box; and any institution in which any such safe-deposit box may be located shall not incur any liability to me or my estate as a result of permitting my attorney-in-fact to exercise this power.

________ LENDING OR BORROWING - To make loans in my name; to borrow money in my name, individually or jointly with others; to give promissory notes or other obligations therefor; and to deposit or mortgage as collateral or for security for the payment thereof any or all of my securities, real estate, personal property, or other property of whatever nature and wherever situated, held by me personally or in trust for my benefit.

________ GOVERNMENT BENEFITS - To apply for and receive any government benefits for which I may be eligible or become eligible, including but not limited to, Social Security, Medicare and Medicaid.

________ RETIREMENT PLAN - To contribute to, select payment option of, roll-over, and receive benefits of any retirement plan or IRA I may own, except my attorney-in-fact shall not have power to change the beneficiary of any of my retirement plans or IRAs.

________ TAXES - To complete and sign any local, state and federal tax returns on my behalf, pay any taxes and assessments due and receive credits and refunds owed to me and to sign any tax agency documents necessary to effectuate these powers.

________ INSURANCE - To purchase, pay premiums and make claims on life, health, automobile and homeowners' insurance on my behalf, except my attorney-in-fact shall not have the power to cash in or change the beneficiary of any life insurance policy.

________ REAL ESTATE - To acquire, purchase, exchange, lease, grant options to sell, and sell and convey real property, or any interests therein, on such terms and conditions, including credit arrangements, as my attorney-in-fact shall deem proper; to execute, acknowledge and deliver, under seal or otherwise, any and all assignments, transfers, deeds, papers, documents or instruments which my attorney-in-fact shall deem necessary in connection therewith.

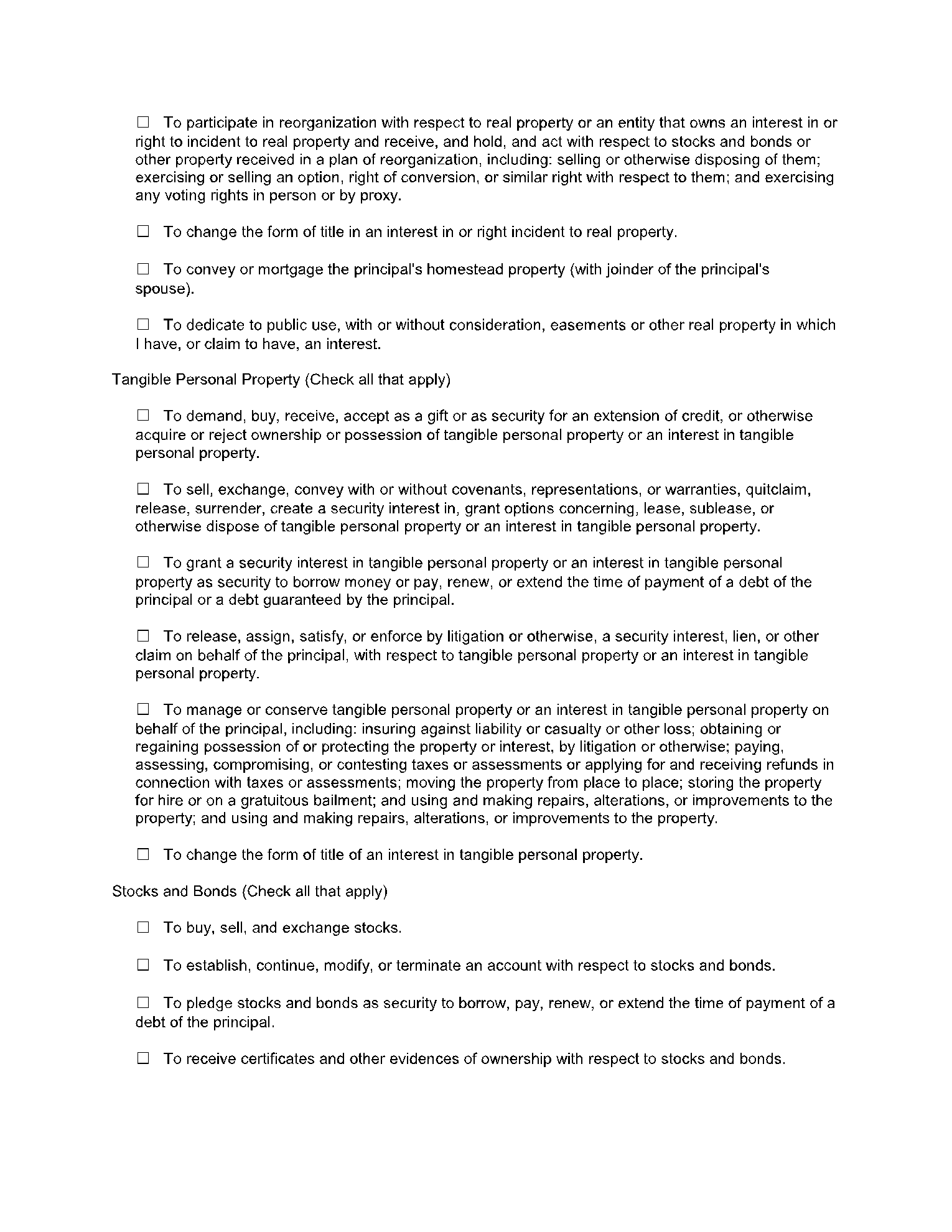

________ PERSONAL PROPERTY - To acquire, purchase, exchange, lease, grant options to sell, and sell and convey personal property, or any interests therein, on such terms and conditions, including credit arrangements, as my attorney-in-fact shall deem proper; to execute, acknowledge and deliver, under seal or otherwise, any and all assignments, transfers, titles, papers, documents or instruments which my attorney-in-fact shall deem necessary in connection therewith; to purchase, sell or otherwise dispose of, assign, transfer and convey shares of stock, bonds, securities and other personal property now or hereafter belonging to me, whether standing in my name or otherwise, and wherever situated.

________ POWER TO MANAGE PROPERTY- To maintain, repair, improve, invest, manage, insure, rent, lease, encumber, and in any manner deal with any real or personal property, tangible or intangible, or any interests therein, that I now own or may hereafter acquire, in my name and for my benefit, upon such terms and conditions as my attorney-in-fact shall deem proper.

________ STOCKS AND BONDS - With regard to stocks and bonds, to conduct investment transactions as provided in section 709.2208(2), Florida Statutes. Without limiting the foregoing, my agent shall have the general authority with respect to investment instruments to take the following actions:

Buy, sell, and exchange stocks and bonds;

Establish, continue, modify, or terminate an account with respect to stocks and bonds;

Pledge stocks and bonds as security to borrow, pay, renew, or extend the time of payment of a debt of the Principal;

Receive certificates and other evidence of ownership with respect to stocks and bonds; and

Exercise voting rights with respect to stocks and bonds in person or by proxy, enter into voting trusts, and consent to limitations on the right to vote.

________ COMMODITIES AND OPTIONS

- In regards to commodities and options, the Principal authorizes the Agent to buy, sell, exchange, assign, settle, and exercise commodity futures contracts and call or put options on stocks or stock indexes traded on a regulated option exchange; and establish, continue, modify, and terminate option accounts.

________ GIFTS - To make gifts, grants, or other transfers (including the forgiveness of indebtedness and the completion of any charitable pledges I may have made) without consideration, either outright or in trust to such person(s) (including my attorney-in-fact hereunder) or organizations as my attorney-in-fact shall select, including, without limitation, the following actions: (a) transfer by gift in advancement of a bequest or devise to beneficiaries under my will or in the absence of a will to my spouse and descendants in whatever degree; and (b) release of any life interest, or waiver, renunciation, disclaimer, or declination of any gift to me by will, deed, or trust

________ LEGAL ADVICE AND PROCEEDINGS - To obtain and pay for legal advice, to initiate or defend legal and administrative proceedings on my behalf, including actions against third parties who refuse, without cause, to honor this instrument.

SPECIAL INSTRUCTIONS: On the following lines are any special instructions limiting or extending the powers I give to my attorney-in-fact (Write “None” if no additional instructions are given):

______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

______________________________________________________________________

AUTHORITY OF ATTORNEY-IN-FACT: Any party dealing with my attorney-in-fact hereunder may rely absolutely on the authority granted herein and need not look to the application of any proceeds nor the authority of my attorney-in-fact as to any action taken hereunder. In this regard, no person who may in good faith act in reliance upon the representations of my attorney-in-fact or the authority granted hereunder shall incur any liability to me or my estate as a result of such act. I hereby ratify and confirm whatever my attorney-in-fact shall lawfully do under this instrument. My attorney-in-fact is authorized as he or she deems necessary to bring an action in court so that this instrument shall be given the full power and effect that I intend on by executing it.

LIABILITY OF ATTORNEY-IN-FACT: My attorney-in-fact shall not incur any liability to me under this power except for a breach of fiduciary duty.