Planning for life is important, but keeping in mind, death, the day to leave, is also one of the vitalities of life. Humans work their lifetime, earn money, buy properties, and other stuff; every single being has the right to give their earnings to the ones they trust and the ones they want.

This is the job performed by any California Transfer on Death Deed Form. It allows the transfer of property to a new owner after the death of the previous owner. It is one of the simple methods for the transfer of any property owner.

What is Transfer on Death Deed in California?

The first transfer of death deed form was authorized in California on January 1, 2016. This form allows the non-probate transfer of property to any next owner. It is the easiest and low-cost method for property transfer under Division 5 of the California Probate Code.

Before California transfer on death deed form, there were only three known methods for property transfer after the owner’s death. These methods include:

- Joint tenancy or community property.

- Living trust.

- Will by the owner in his life.

Though these are verified methods, quite meticulous at the same time. Living trusts have been one of the most adopted practices, these work by transferring property to the trust accounts and used for welfare purposes.

In the case of a will, the property transfer is carried by the probate process and proper legal methods. The California transfer on Death Deed is undoubtedly the best replacement for all this mess.

Our California Transfer on Death Deed Form Template Serves Always: In Life And In Death

We let you secure your property title even after your death when you use the transfer on death deed form California template.

Save this template in PDF format by clicking below.

Advantages and Disadvantages of California Transfer on Death Deed

The following are some of the highlighted advantages of California TOD deed.

- It helps protect your property from the probate court.

- It provides the least expensive alternative to your hard cash, bye to the legal fee.

- Even after the transfer, you’re still the owner of your property till your death.

- Overruling the advantages, are some drawbacks of this process.

- Your property will be exposed to probate processes if the heirs check out.

- In case of joint tenancy, despite being the owner, you cannot name the property to someone else until your co-owner, as well as transfers the property to that particular person.

Who Will Need a Transfer on Death Deed in California?

Anyone who wants a non-probate transfer of his property, this California transfer on death deed, is helpful for that person. It helps protect the property from probate until challenged by any successor of the former owner.

When and Why Do You Need a California Transfer on Death deed?

The California Transfer on Death Deed is one of the recently introduced property transfer methods that is verified legally. This is required by someone who wants to ensure the transfer of their property to their loved ones after their death.

What Is Included in California Transfer on Death Deed Form?

California Transfer on death deed form contains several traits making it distinct from other methods and making it a vital estate planning tool for California citizens. It is satisfactory and easy to adopt. The following information has to be included in a California Death Deed Form:

Details of grantor

In the first place, Insert the name and address of the property grantor.

Property Details

List all the possible details of the property transferred by the California transfer on death deed. Mention the structure, agricultural, and type of property on the basis of location, commercial, or residential.

APN

Fill in the Assessor’s Parcel Number of “APN” that can be located on a previous tax document.

Legally Comprehensible

Properly address the transfer, keeping in mind the legal methods. You must be over 18 in age for signing the contract and should be able to understand the results.

Beneficiary Details

Highlight names of beneficiary and their relations with the grantor.

Grantee Details

Name and contact details for the grantee should be stated on the California transfer on death deed form.

Acknowledgment by the notary public

The signed California transfer on death deed form should be notarized, dated, and recorded.

Our California Transfer on Death Deed Form Template Serves Always: In Life And In Death

We let you secure your property title even after your death when you use the transfer on death deed form California template.

Save this template in PDF format by clicking below.

Conclusion

California transfer on death deed form is an inexpensive, easy, and non-probate process of granting property to your trusted and loved ones. It, therefore, allows citizens of California an alternative to keep their properties out of probate.

Farewell to those messy legal methods for making wills and all that fuss and hello to innovative methods for property transfer. CocoSign has got all the straightforward deed templates ready for your use. All you need is to fill in the required information and that’s it.

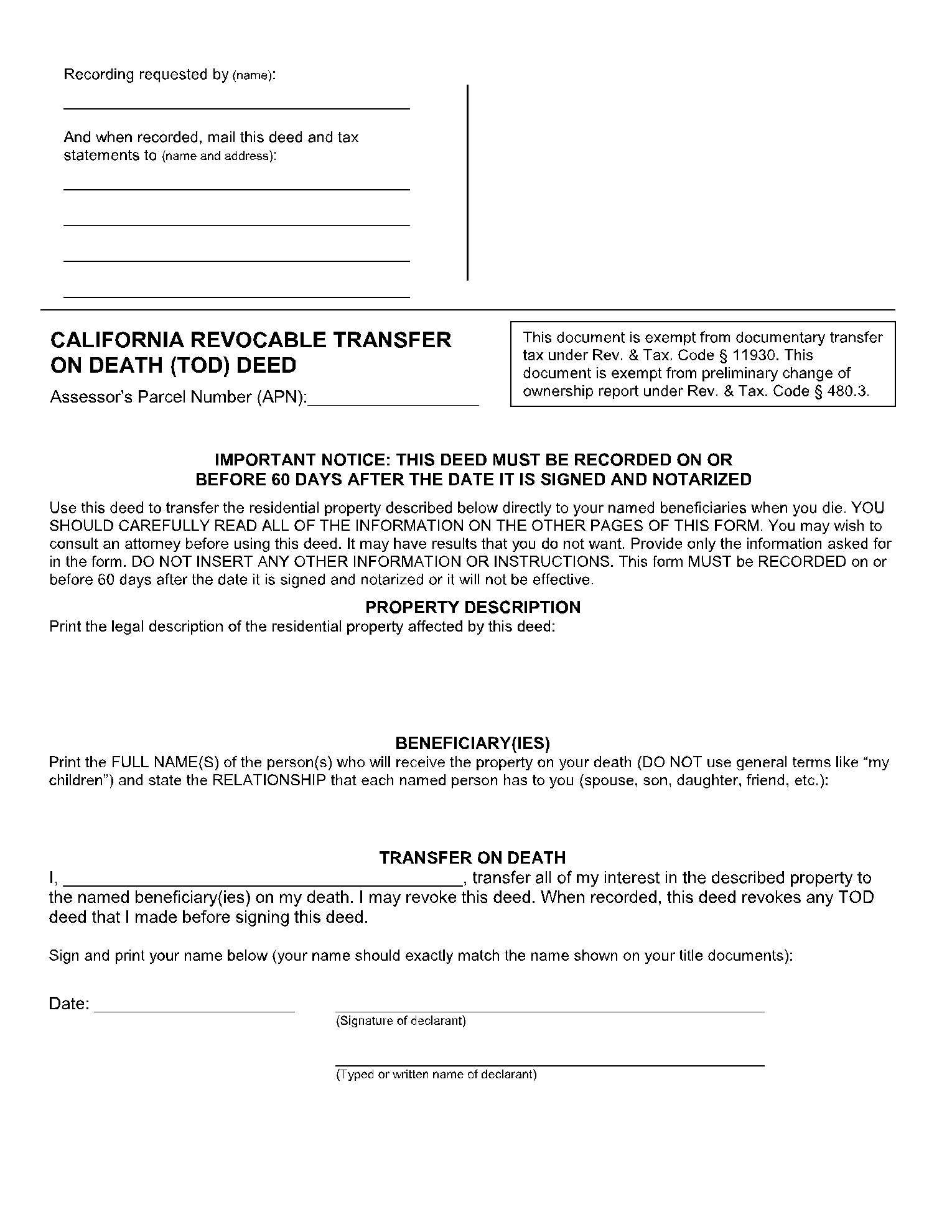

DOCUMENT PREVIEW

Recording requested by (name):

________________________________________

And when recorded, mail this deed and tax

statements to (name and address):

________________________________________

________________________________________

________________________________________

________________________________________

|

This document is exempt from documentary transfer tax under Rev. & Tax. Code § 1 1930. This document is exempt from preliminary change of ownership report under Rev. & Tax. Code § 480.3.

|

IMPORTANT NOTICE: THIS DEED MUST BE RECORDED ON OR BEFORE 60 DAYS AFTER THE DATE IT IS SIGNED AND NOTARIZED

Use this deed to transfer the residential property described below directly to your named beneficiaries when you die. YOU SHOULD CAREFULLY READ ALL OF THE INFORMATION ON THE OTHER PAGES OF THIS FORM. You may wish to consult an attorney before using this deed. It may have results that you do not want. Provide only the information asked for in the form. DO NOT INSERT ANY OTHER INFORMATION OR INSTRUCTIONS. This form MUST be RECORDED on or before 60 days after the date it is signed and notarized or it will not be effective.

PROPERTY DESCRIPTION

Print the legal description of the residential property affected by this deed:

BENEFICIARY(IES)

Print the FULL NAME(S) of the person(s) who will receive the property on your death (DO NOT use general terms like “ my children” ) and state the RELATIONSHIP that each named person has to you (spouse, son, daughter, friend, etc.):

TRANSFER ON DEATH

I, __________________________________________, transfer all of my interest in the described property to the named beneficiary(ies) on my death. I may revoke this deed. When recorded, this deed revokes any TOD deed that I made before signing this deed.

Sign and print your name below (your name should exactly match the name shown on your title documents):

Date:

(Signature of declarant)

(Typed or written name of declarant)

COMMON QUESTIONS ABOUT THE USE OF THIS FORM

WHAT DOES THE TOD DEED DO? When you die, the identified property will transfer to your named beneficiary without probate. The TOD deed has no effect until you die. You can revoke it at any time.

CAN I USE THIS DEED TO TRANSFER BUSINESS PROPERTY? This deed can only be used to transfer ( 1) a parcel of property that contains one to four residential dwelling units, (2) a condominium unit, or (3) a parcel of agricultural land of 40 acres or less, which contains a single-family residence.

HOW DO I USE THE TOD DEED? Complete this form. Have it notarized. RECORD the form in the county where the property is located. The form MUST be recorded on or before 60 days after the date you sign it or the deed has no effect.

IS THE “LEGAL DESCRIPTION” OF THE PROPERTY NECESSARY? Yes.

HOW DO I FIND THE “LEGAL DESCRIPTION” OF THE PROPERTY? This information may be on the deed you received when you became an owner of the property. This information may also be available in the office of the county recorder for the county where the property is located. If you are not absolutely sure, consult an attorney.

HOW DO I “RECORD” THE FORM? Take the completed and notarized form to the county recorder for the county in which the property is located. Follow the instructions given by the county recorder to make the form part of the official property records.

WHAT IF I SHARE OWNERSHIP OF THE PROPERTY? This form only transfers YOUR share of the property. If a co-owner also wants to name a TOD beneficiary, that co-owner must complete and RECORD a separate form.

CAN I REVOKE THE TOD DEED IF I CHANGE MY MIND? Yes. You may revoke the TOD deed at any time. No one, including your beneficiary, can prevent you from revoking the deed.

HOW DO I REVOKE THE TOD DEED? There are three ways to revoke a recorded TOD deed: ( 1) Complete, have notarized, and RECORD a revocation form. (2) Create, have notarized, and RECORD a new TOD deed. (3) Sell or give away the property, or transfer it to a trust, before your death and RECORD the deed. A TOD deed can only affect property that you own when you die. A TOD deed cannot be revoked by will.

CAN I REVOKE A TOD DEED BY CREATING A NEW DOCUMENT THAT DISPOSES OF THE PROPERTY (FOR EXAMPLE, BY CREATING A NEW TOD DEED OR BY ASSIGNING THE PROPERTY TO A TRUST)? Yes, but only if the new document is RECORDED. To avoid any doubt, you may wish to RECORD a TOD deed revocation form before creating the new instrument. A TOD deed cannot be revoked by will, or by purporting to leave the subject property to anyone via will.

IF I SELL OR GIVE AWAY THE PROPERTY DESCRIBED IN A TOD DEED, WHAT HAPPENS WHEN I DIE? If the deed or other document used to transfer your property is RECORDED before your death, the TOD deed will have no effect. If the transfer document is not RECORDED before your death, the TOD deed will take effect.

I AM BEING PRESSURED TO COMPLETE THIS FORM. WHAT SHOULD I DO? Do NOT complete this form unless you freely choose to do so. If you are being pressured to dispose of your property in a way that you do not want, you may want to alert a family member, friend, the district attorney, or a senior service agency.

DO I NEED TO TELL MY BENEFICIARY ABOUT THE TOD DEED? No. But secrecy can cause later complications and might make it easier for others to commit fraud.

WHAT DOES MY BENEFICIARY NEED TO DO WHEN I DIE? Your beneficiary must RECORD evidence of your death (Prob. Code § 210), and file a change in ownership notice (Rev. & Tax. Code § 480). If you received Medi-Cal benefits, your beneficiary must notify the State Department of Health Care Services of your death and provide a copy of your death certificate (Prob. Code § 215).

WHAT IF I NAME MORE THAN ONE BENEFICIARY? Your beneficiaries will become co-owners in equal shares as tenants in common. If you want a different result, you should not use this form.

HOW DO I NAME BENEFICIARIES? You MUST name your beneficiaries individually, using each beneficiary’s FULL name. You MAY NOT use general terms to describe beneficiaries, such as “my children.” For each beneficiary that you name, you should briefly state that person’s relationship to you (for example, my spouse, my son, my daughter, my friend, etc.).

WHAT IF A BENEFICIARY DIES BEFORE I DO? If all beneficiaries die before you, the TOD deed has no effect. If a beneficiary dies before you, but other beneficiaries survive you, the share of the deceased beneficiary will be divided equally between the surviving beneficiaries. If that is not the result you want, you should not use the TOD deed.

WHAT IS THE EFFECT OF A TOD DEED ON PROPERTY THAT I OWN AS JOINT TENANCY OR COMMUNITY PROPERTY WITH RIGHT

OF SURVIVORSHIP? If you are the first joint tenant or spouse to die, the deed is VOID and has no effect. The property transfers to your joint tenant or surviving spouse and not according to this deed. If you are the last joint tenant or spouse to die, the deed takes effect and controls the ownership of your property when you die. If you do not want these results, do not use this form. The deed does NOT transfer the share of a co-owner of the property. Any co-owner who wants to name a TOD beneficiary must complete and RECORD a SEPARATE deed.

CAN I ADD OTHER CONDITIONS ON THE FORM? No. If you do, your beneficiary may need to go to court to clear title.

IS PROPERTY TRANSFERRED BY THE TOD DEED SUBJECT TO MY DEBTS? Yes.

DOES THE TOD DEED HELP ME TO AVOID GIFT AND ESTATE TAXES? No.

HOW DOES THE TOD DEED AFFECT PROPERTY TAXES? The TOD deed has no effect on your property taxes until your death. At that time, property tax law applies as it would to any other change of ownership.

DOES THE TOD DEED AFFECT MY ELIGIBILITY FOR MEDI-CAL? No.

AFTER MY DEATH, WILL MY HOME BE LIABLE FOR REIMBURSEMENT OF THE STATE FOR MEDI-CAL EXPENDITURES? Your home may be liable for reimbursement. If you have questions, you should consult an attorney.