A donation is an act of giving someone a gift for a charitable purpose to support some cause. This kind gesture can be any form, it can include money, clothing, services, goods, toys, food vehicles, or any other thing which can help the needy or support some cause.

It also includes fulfilling someone’s medical needs, like organ transplant or blood donation, or helping people buy medicine. Written proof of this kind gesture should be provided to the donor as a token of appreciation. It can also help engage more people and can improve the charitable donation process.

What Is a Donation Receipt?

When someone gives charity to some needy person or some non-profitable organizations, as a token of love and appreciation a donation receipt is provided. It can boost up the charity collection of charitable organizations as well as encourages the donors to contribute as much as they can.

A donation receipt is a written document that proves that someone has donated that amount of money, food, services, goods, vehicle clothing, or any medical assistance to some needy person or some organization.

It is also used by different forums and people to prove that they have donated something as a gift to some individual or some organization. Organizations can use this donation receipt for the filing and individuals can use it to get some deductions in their (IRS) State and Federal income tax.

In order to claim for the deduction, the donation receipt must be kept safe for a period of 2-3 years.

Why Are Donation Receipts Important?

Scamming is a big issue these days. A great number of organizations scam people on the name of charity, and thousands of people become their victims each year.

A donation receipt is an appropriate way of keeping the record of the donation and it also helps in maintaining check and balance on the charitable organizations.

Both the donor and the organization must keep the record of their transactions of donation in the form of donation receipts, it can help them in the long run. They can show the donation receipt as a transaction proof to the IRS. In order to avail of tax exemption from the IRS, you should demand the donation receipt from the organization.

What Should Be Included in a Donation Receipt?

Donation Receipts are helpful in the record-keeping and accountability of the donor as well as the recipient. You cannot claim your donation if you have not obtained the donation receipt. A blank or incompletely filled donation receipt will not give you any benefit.

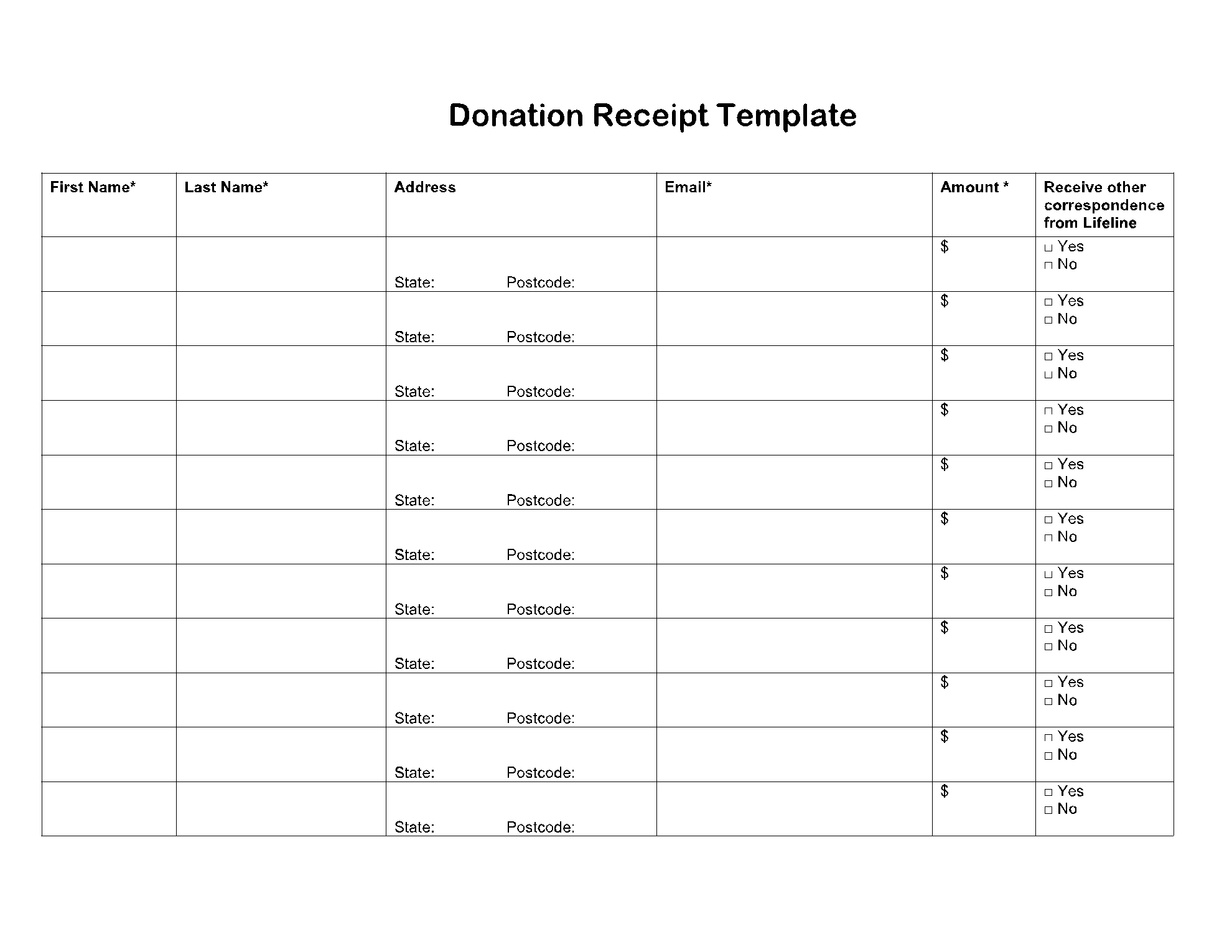

The receipt should be properly filled with all the credentials and required information. The following information must be carefully filled and cross-checked.

- Name of Donor and Contact information.

- Name of Organization and Contact Information.

- Tax ID.

- Date.

- Payment Method.

- The Total Amount of Donation.

- In the case of property donation, a complete description of the property should be mentioned.

- If some services provided, a detailed description of services should be mentioned.

- If some services or goods were given in return to the free gift, details should be mentioned on the receipt.

- If religious institutions are concerned, they should state that “intangible religious benefits” were given but have no “monetary value for tax purposes".

Conclusion

A donation is an act of kindness, but it has many other benefits too. If you want to claim your donation to get a tax exemption, you must have a properly filled Donation Receipt. Without some evidence of donation, you cannot claim for any benefit.

On the other hand, by not demanding a donation receipt you can be in trouble and will easily become a victim of potential scammers that are scamming on the name of Non-Profit charitable organizations.

In order to make your job easy and save you from potential scammers, we have a free template for donation receipts. CocoSign website has got a collection of templates for different types of donation receipts. You can download your template totally free from CocoSign.