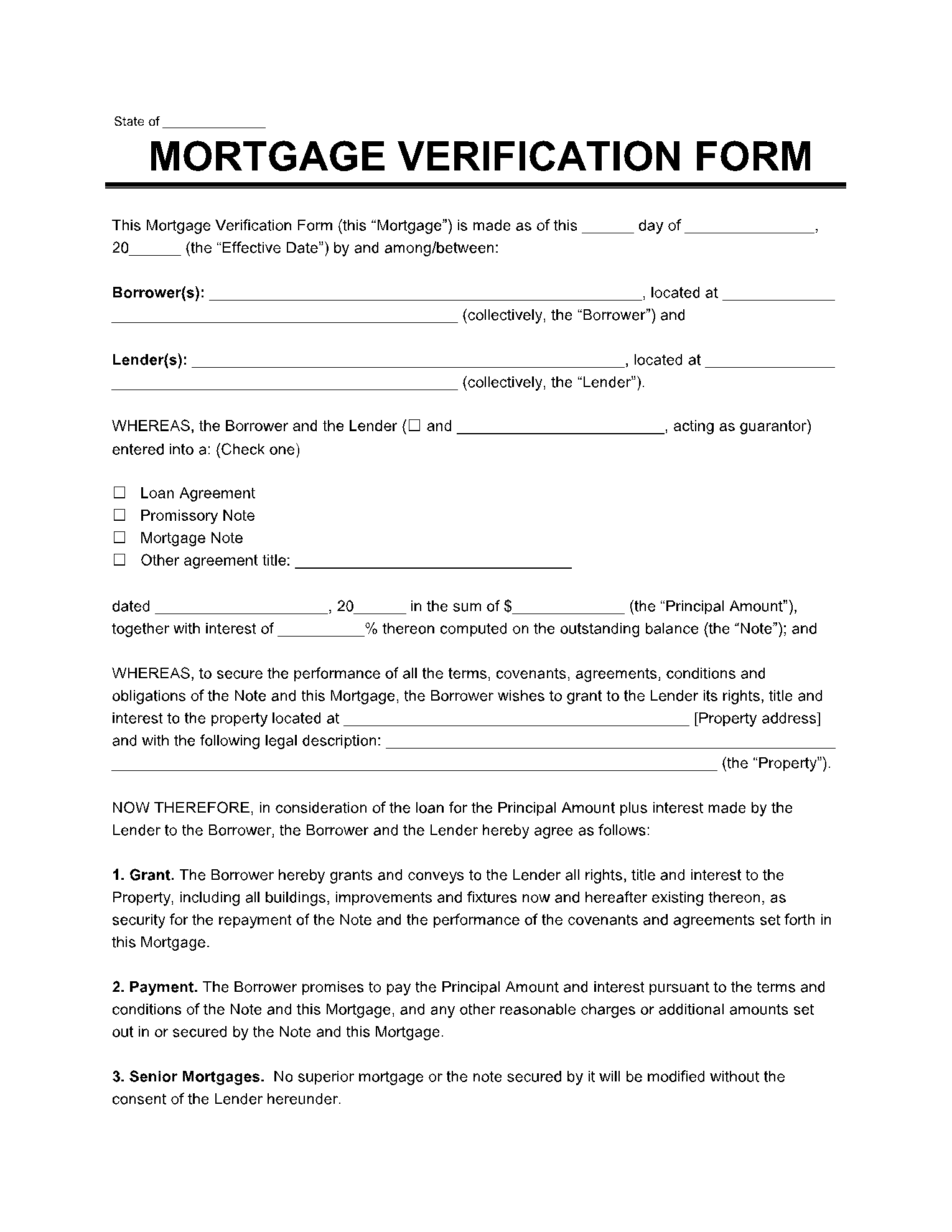

A verification of mortgage form is required in applying for a loan. The document proves that a borrower is capable of repaying the loan amount provided by the lender. It contains records of a borrower’s mortgage payment history.

The verification of mortgage form is utilized by lenders to check the existing balance of monthly payments and to see if there are any late or pending payments.

The following are the key inclusions in the mortgage verification form:

- Pre-written mortgage balance information

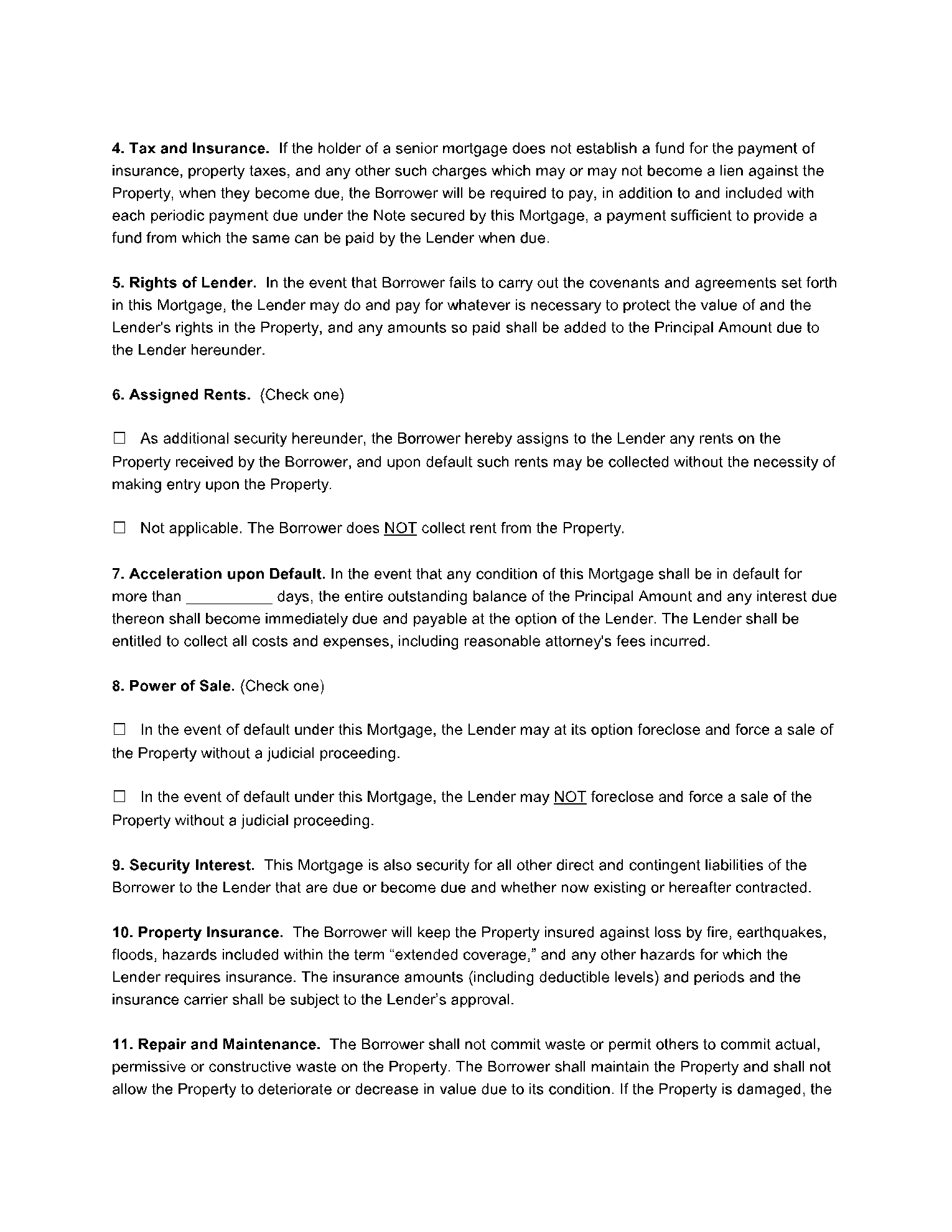

- Mortgage number blank line

- Interest information inquiry

What Does A Verification Of Mortgage (VOM) Form Include?

The verification of mortgage form specifies whether a person is creditworthy or not and whether the individual would be able to make his/her payments continuously and punctually. The form is requested by financial institutions where an individual would be applying for a loan.

The mortgage verification form is sent to the current mortgage provider detailing information about the borrower’s mortgage details. The mortgage provider needs to specify the mortgage amount, interest rate, the existing balance, the entire payment history of the borrower as well as his/her previous report for any delayed payments.

The verification of mortgage form will contain details of whether a payment has been made 30, 50, or 90 days late too. It includes details of the individual’s current mortgage, providing the company’s name address, and contact details.

The mortgage company filling the form must also state whether the mortgage is payable or not and if the mortgage is insured. Once all the details are filled out, the company signs the form with the date and sends it directly to the financial institution who had requested it to verify the credibility of the borrower.

When And Where Is A Verification Of Mortgage Form Used?

A verification of mortgage form contains a detailed statement of a borrower’s mortgage payment details. Lenders such as banks, mortgage companies, loan associations, and other financial institutions may frequently ask individuals for this document when they are applying for a loan or credit.

The document is extremely important and used by homeowners who already have an existing mortgage and want to take out another loan to pay off their mortgage. This process is commonly known as refinancing a mortgage.

Importance of Verification of Mortgage Forms

The verification of mortgage form is extremely important for individuals looking to refinance a mortgage as it provides important details such as the following:

- Whether the individual applying for the loan is capable of managing money and resources productively. It determines whether an individual is financially responsible or not.

- Payment behavior of the individual - whether he is punctual with his payments or has a habit of dealing with arrears.

- The entire payment history of the individual.

- Provides details on the total existing balance of the mortgage and if it can be cleared off or not

You can find a variety of ready to download verification of form templates on CocoSign. Print and download them on the go now!