For people making preparations for after they are gone, one such preparation is writing a last will and testament. This legal document explains in detail the wishes and instructions of individuals on how they want their properties and assets shared among their family members.

However, the recipients’ scope is not limited to family members or relatives alone. Individuals may also choose to bequeath their wealth to charitable organizations. This article discusses more about wills in nc, what should be contained in a nc will template and how to make a will in nc.

What Is a North Carolina Last Will And Testament & How Does It Work?

A last will and testament nc controls the disposition of a testator’s property to his or her designated beneficiaries, as well as provide guardianship for their minor children after the testator's death in the state of North Carolina. Unlike a power of attorney that terminates at the death of its principal, North Carolina wills become effective only after the death of the testator.

As long as the testator is of sound mind, he or she may later decide to draft a new will or make revisions to the old one. All a testator has to do is destroy the old one or add a “codicil” . All laws guiding the writing of a last will and testament nc and executing it are contained in Chapter 31: Wills of North Carolina Code.

Don’t leave your possessions at the mercy of the state with our last will and testament NC template.

Start creating your NC last will and testament today if you want your assets to be taken care of when you pass away. Secure your future and those of beneficiaries by downloading our free template.

What Should Be Covered In a North Carolina Last Will and Testament?

A North Carolina last will and testament should cover the following details:

- Name of testator, gender, city and county of residence

- Marital information

- List of beneficiaries including pets

- List of properties and the percentage in which they should be shared

- Details about life insurance

- Name of executor and alternative executor

- Name and contact information of guardian for minor children

- Name and contact information of Trustee

Other elements or section included in a North Carolina last will and testament are:

- Expenses and taxes

- Omission

- Bond

- Discretionary powers of personal representative

- Gender

- Assignment

- Governing Law

- Binding Agreement

Benefits and Limitations of a North Carolina Last Will and Testament

In North Carolina, not filling a North Carolina will form is leaving your assets at the mercy of the state law. Without a will, the intestacy laws apply. The following are the benefits residents of North Carolina stand to gain from writing a last will and testament.

- Your properties and assets will be shared according to your wishes

- The intestacy laws no longer apply

- It can be used as an instrument for creating a testamentary trust for a child or pet.

A North Carolina last will cannot be used to:

- Reduce estate tax

- Avoid probate

- Life insurance proceeds

- Share joint tenancy properties with survivorship rights

Don’t leave your possessions at the mercy of the state with our last will and testament NC template.

Start creating your NC last will and testament today if you want your assets to be taken care of when you pass away. Secure your future and those of beneficiaries by downloading our free template.

How to Write a Last Will and Testament in North Carolina?

For a will to be valid and effective in North Carolina, the following requirements must be met:

- The testator must be at least 18 years old

- The testator must be of sound mind at the time of writing

- The document must be signed in the presence of at least two witnesses

- The will must be in writing

Though oral wills (nuncupative) are also permissible, the testators must declare the will to the witnesses at the same time and must be in the last stages of their illness.

In writing a last will, the testators must write their names, cities, counties of residence and indicate their marital information. They must then list their beneficiaries. For minor children, they must indicate what ages these children can start receiving the benefits from the will and at what age the benefits will end. The testators can also use the will to appoint a guardian over their minor children.

Finally, they must sign the will in the presence of at least two witnesses and have these witnesses sign as well. In North Carolina, notarization is not a requirement.

Start drafting your NC last will and testament today. You can download any of CocoSign easy-to-use templates to begin to secure your future and those of your beneficiaries.

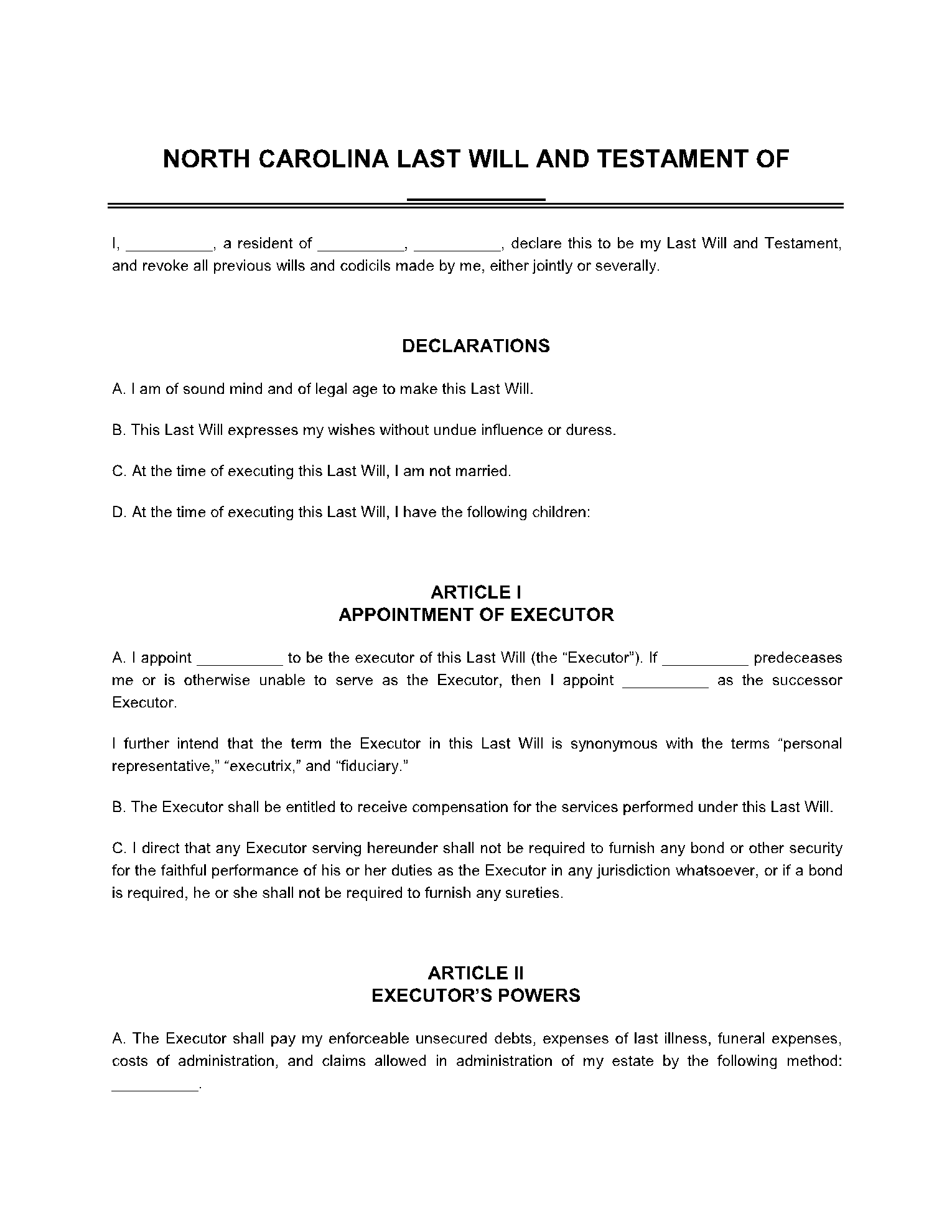

DOCUMENT PREVIEW

North Carolina Last Will and Testamentof

___________________________________

Pursuant to Chapter 31 (Wills)

I, ________________________, resident in the City of ____________________, County of ____________________, State of North Carolina being of sound mind, not acting under duress or undue influence, and fully understanding the nature and extent of all my property and of this disposition thereof, do hereby make, publish, and declare this document to be my Last Will and Testament, and hereby revoke any and all other wills and codicils heretofore made by me.

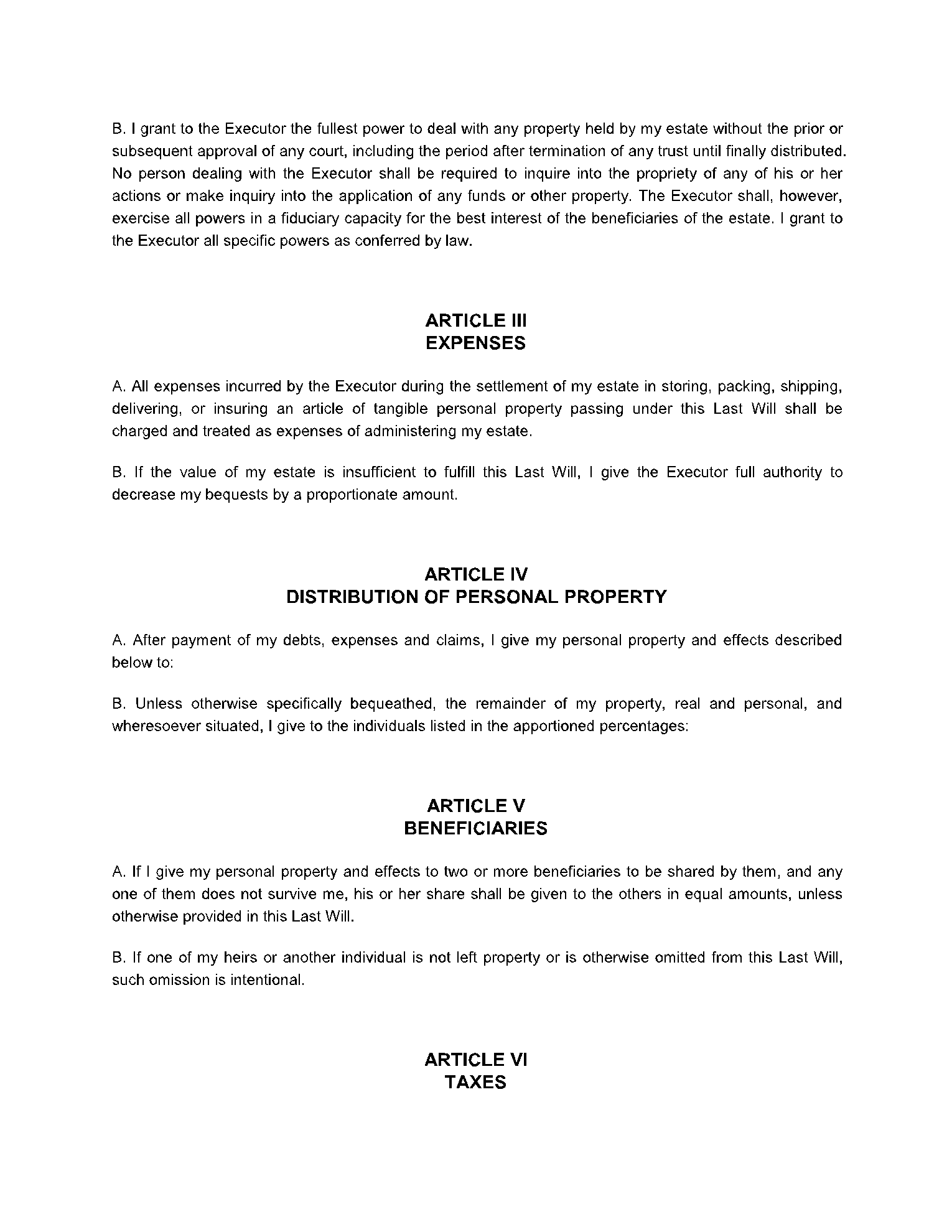

- EXPENSES & TAXES

I direct that all my debts, and expenses of my last illness, funeral, and burial, be paid as soon after my death as may be reasonably convenient, and I hereby authorize my Personal Representative, hereinafter appointed, to settle and discharge, in his or her absolute discretion, any claims made against my estate.

I further direct that my Personal Representative shall pay out of my estate any and all estate and inheritance taxes payable by reason of my death in respect of all items included in the computation of such taxes, whether passing under this Will or otherwise. Said taxes shall be paid by my Personal Representative as if such taxes were my debts without recovery of any part of such tax payments from anyone who receives any item included in such computation.

- PERSONAL REPRESENTATIVE

I nominate and appoint ________________________, of ___________________________, County of ________________________, State of ______________________________ as Personal Representative of my estate and I request that (he/she) be appointed temporary Personal Representative if (he/she) applies. If my Personal Representative fails or ceases to so serve, then I nominate _____________________________of __________________________, County of ____________________________, State of ______________________ to serve.

- DISPOSITION OF PROPERTY

I devise and bequeath my property, both real and personal and wherever situated, as follows:

1st Beneficiary

_______________________ [full name], currently of _______________________ [address], as my _______________________ [relation] whose last four (4) digits of their Social Security Number (SSN) are xxx-xx-_____ with the following property:

______________________________________________________________________

2nd Beneficiary

_______________________ [full name], currently of _______________________ [address], as my _______________________ [relation] whose last four (4) digits of their Social Security Number (SSN) are xxx-xx-_____ with the following property:

______________________________________________________________________

3rd Beneficiary

_______________________ [full name], currently of _______________________ [address], as my _______________________ [relation] whose last four (4) digits of their Social Security Number (SSN) are xxx-xx-_____ with the following property:

______________________________________________________________________

If any of my beneficiaries have pre-deceased me, then any property that they would have received if they had not pre-deceased me shall be distributed in equal shares to the remaining beneficiaries.

If any of my property cannot be readily sold and distributed, then it may be donated to any charitable organization or organizations of my Personal Representative’s choice. If any property cannot be readily sold or donated, my Personal Representative may, without liability, dispose of such property as my Personal Representative may deem appropriate. I authorize my Personal Representative to pay as an administration expense of my estate the expense of selling, advertising for sale, packing, shipping, insuring and delivering such property.

-

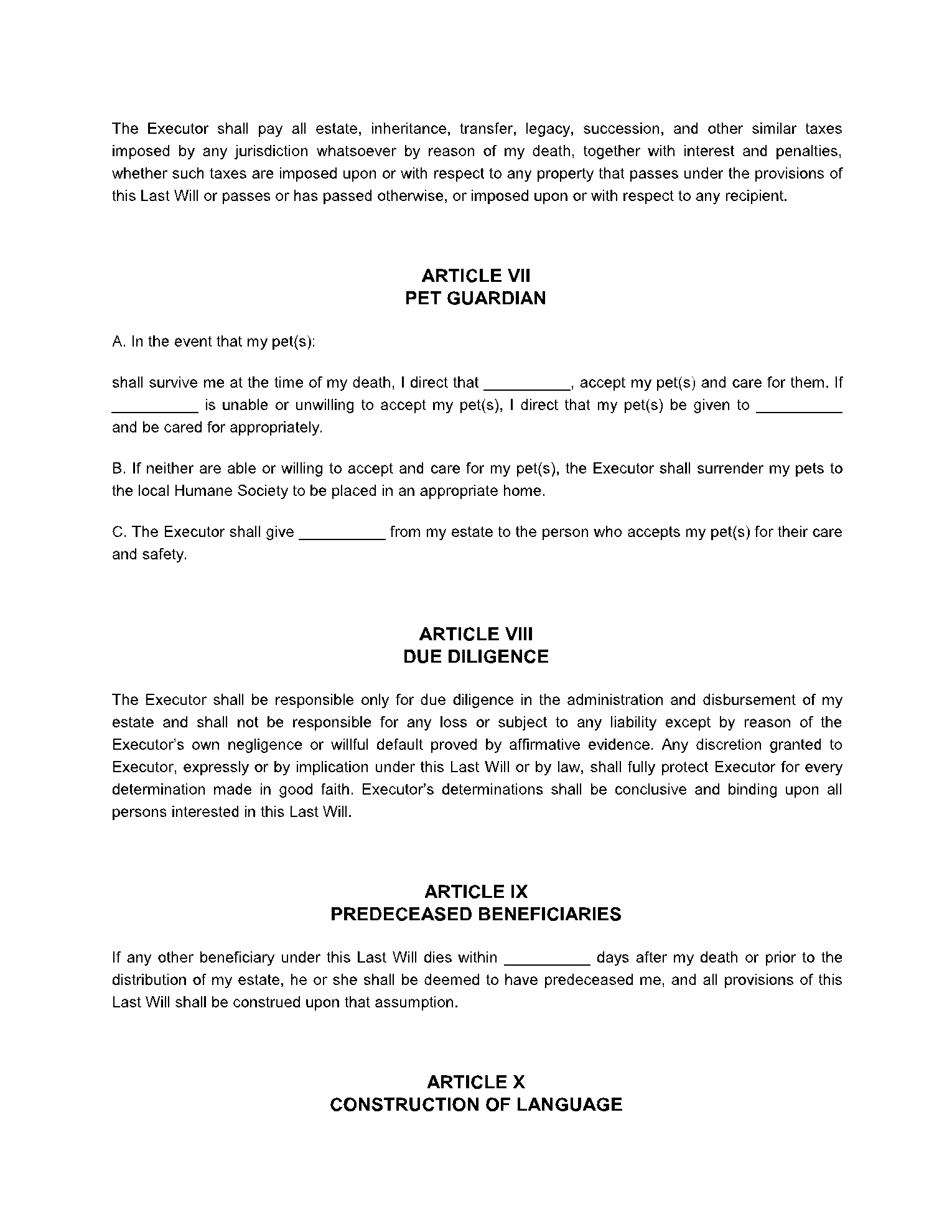

OMISSION

Except to the extent that I have included them in this Will, I have intentionally, and not as a result of any mistake or inadvertence, omitted in this Will to provide for any family members and/or issue of mine, if any, however defined by law, presently living or hereafter born or adopted.

-

BOND

No bond shall be required of any fiduciary serving hereunder, whether or not specifically named in this Will, or if a bond is required by law, then no surety will be required on such bond.

-

DISCRETIONARY POWERS OF PERSONAL REPRESENTATIVE

My Personal Representative, shall have and may exercise the following discretionary powers in addition to any common law or statutory powers without the necessity of court license or approval:

A. To retain for whatever period my Personal Representative deems advisable any property, including property owned by me at my death, and to invest and reinvest in any property, both real and personal, regardless of whether any particular investment would be proper for a Personal Representative and regardless of the extent of diversification of the assets held hereunder.

B. To sell and to grant options to purchase all or any part of my estate, both real and personal, at any time, at public or private sale, for consideration, whether or not the highest possible consideration, and upon terms, including credit, as my Personal Representative deems advisable, and to execute, acknowledge, and deliver deeds or other instruments in connection therewith.

C. To lease any real estate for terms and conditions as my Personal Representative deems advisable, including the granting of options to renew, options to extend the term or terms, and options to purchase.

D. To pay, compromise, settle or otherwise adjust any claims, including taxes, asserted in favor of or against me, my estate or my Personal Representative.

E. To make any separation into shares in whole or in part in kind and at values determined by my Personal Representative, with or without regard to tax basis, and to allocate different kinds and disproportionate amounts of property and undivided interests in property among the shares.

F. To make such elections under the tax laws as my Personal Representative shall deem appropriate, including elections with respect to qualified terminable interest property, exemptions and the use of deductions as income tax or estate tax deductions, and to determine whether to make any adjustments between income and principal on account of any election so made.

G. To make any elections permitted under any pension, profit sharing, employee stock ownership or other benefit plan.

H. To employ others in connection with the administration of my estate, including legal counsel, investment advisors, brokers, accountants and agents and to pay reasonable compensation in addition to my Personal Representative’s compensation.

I. To vote any shares of stock or other securities in person or by proxy; to assert or waive any stockholder’s rights or privilege to subscribe for or otherwise acquire additional stock; to deposit securities in any voting trust or with any committee.

J. To borrow and to pledge or mortgage any property as collateral, and to make secured or unsecured loans. My Personal Representative is specifically authorized to make loans without interest to any beneficiary hereunder. No individual or entity loaning property to my Personal Representative or trustee shall be held to see to the application of such property.

K. My Personal Representative shall also in his or her absolute discretion determine the allocation of any GST exemption available to me at my death to property passing under this Will or otherwise. The determination of my Personal Representative with respect to any elections or allocation, if made or taken in good faith, shall be binding upon all affected.

-

CONTESTING BENEFICIARY

If any beneficiary under this Will, or any trust herein mentioned, contests or attacks this Will or any of its provisions, any share or interest in my estate given to that contesting beneficiary under this Will is revoked and shall be disposed of in the same manner provided herein as if that contesting beneficiary had predeceased me.

-

GUARDIAN AD LITEM NOT REQUIRED

I direct that the representation by a guardian ad litem of the interests of persons unborn, unascertained or legally incompetent to act in proceedings for the allowance of accounts hereunder be dispensed with to the extent permitted by law.

-

GENDER

Whenever the context permits, the term “Personal Representative” shall include “Executor” and “Administrator,” the use of a particular gender shall include any other gender, and references to the singular or the plural shall be interchangeable. All references to the Internal Revenue Code shall mean the Internal Revenue Code of 1986 or any successor Code. All references to estate taxes shall include inheritance and other death taxes.

-

ASSIGNMENT

The interest of any beneficiary in this Will, shall not be alienable, assignable, attachable, transferable nor paid by way of anticipation, nor in compliance with any order, assignment or covenant and shall not be applied to, or held liable for, any of their debts or obligations either in law or equity and shall not in any event pass to his, her, or their assignee under any instrument or under any insolvency or bankruptcy law, and shall not be subject to the interference or control of creditors, spouses or others.

-

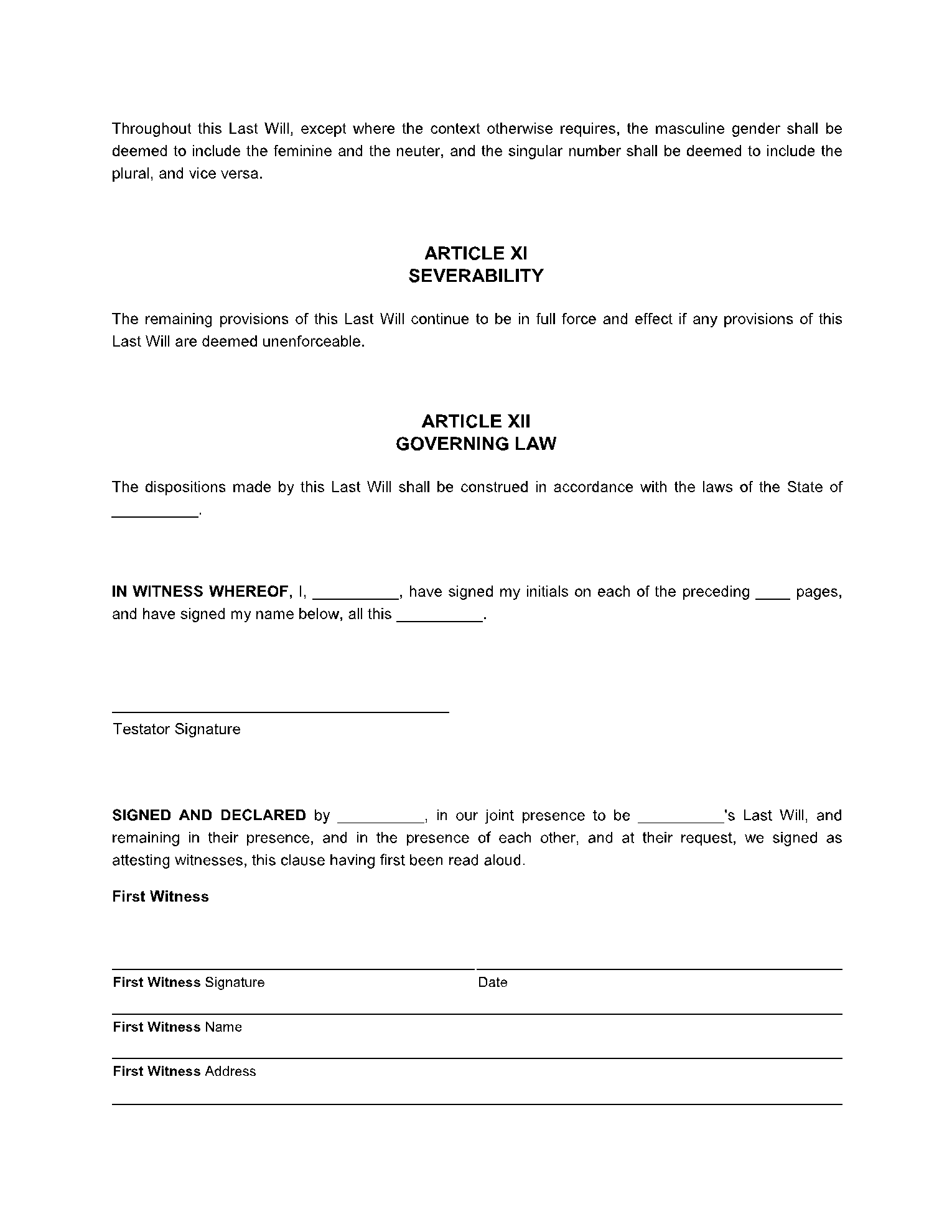

GOVERNING LAW

This document shall be governed by the laws in the State of North Carolina.

-

BINDING ARRANGEMENT

Any decision by my Personal Representative with respect to any discretionary power hereunder shall be final and binding on all persons interested. Unless due to my Executor’s own willful default or gross negligence, no Executor shall be liable for said Executor’s acts or omissions or those of any co‑Executor or prior Executor.

I, the undersigned ________________________, do hereby declare that I sign and execute this instrument as my last Will, that I sign it willingly in the presence of each of the undersigned witnesses, and that I execute it as my free and voluntary act for the purposes herein expressed, on this ____ day of ________________, 20____.

________________________________ ___________________________________

Testator Signature Testator (Printed Name)

The foregoing instrument, was on this ____ day of ________________, 20____, subscribed on each page and at the end thereof by ________________________, the above-named Testator, and by (him/her) signed, sealed, published and declared to be (his/her) LAST WILL AND TESTAMENT, in the presence of us and each of us, who thereupon, at (his/her) request, in (his/her) presence, and in the presence of each other, have hereunto subscribed our names as attesting witnesses thereto.

________________________________ ___________________________________

Witness Signature Address

________________________________ ___________________________________

Witness Signature Address

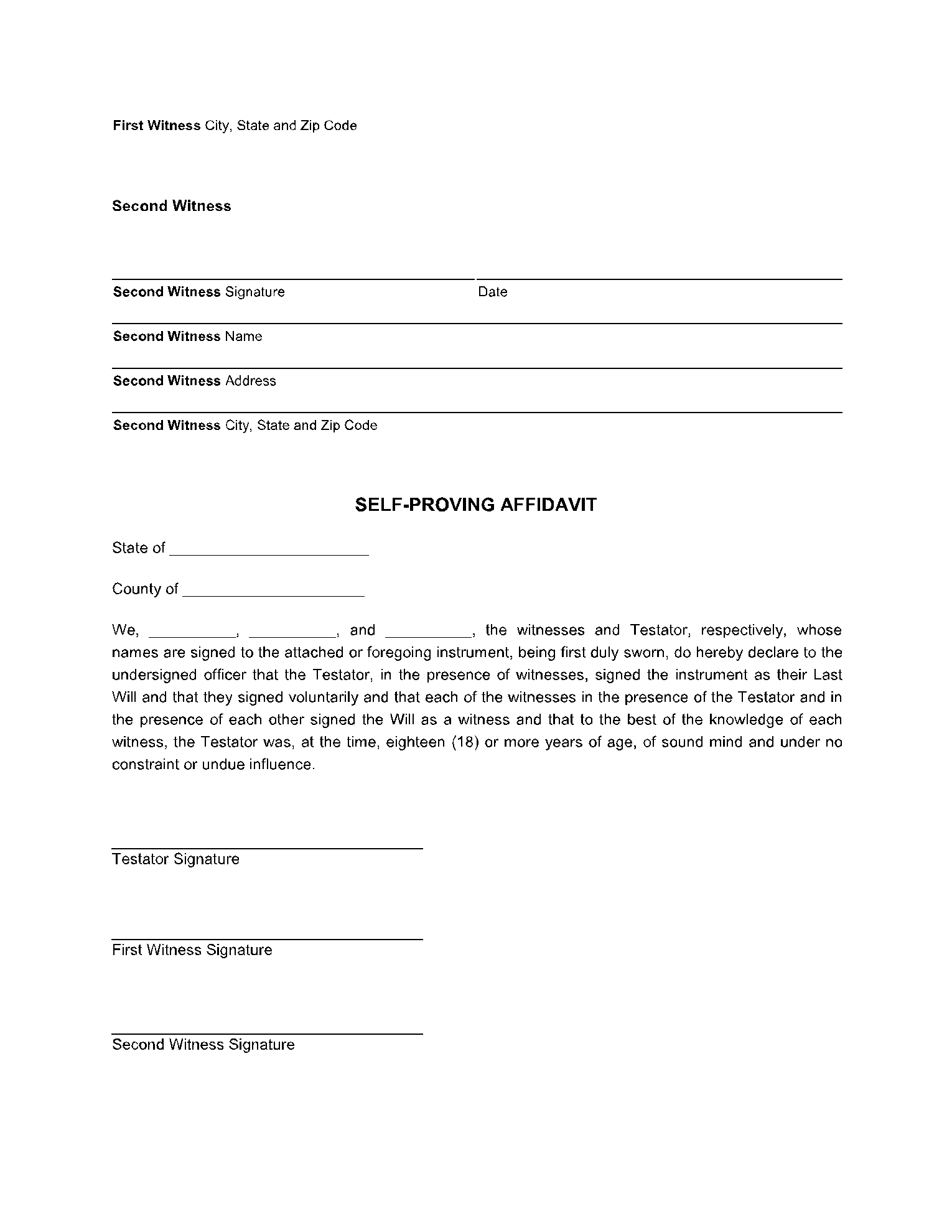

TESTAMENTARY AFFIDAVIT

STATE OF ____________________

COUNTY OF __________________, SS.

Before me, the undersigned authority, on this day personally appeared ___________, testator, ____________________, witness and ___________________, witness, known to me to be the testator and the witnesses, respectively, whose names are signed to the attached or foregoing instrument, and, all of these persons being by me duly sworn, the testator declared to me and to the witnesses in my presence that the instrument is the testator’s last will and that the testator has willingly signed or directed another to sign for him/her, and that the testator executed it as the testator’s free and voluntary act for the purposes therein expressed; and each of the witnesses stated to me, in the presence of the testator, that they signed the will as witnesses and that to the best of their knowledge the testator was eighteen (18) years of age or over, of sound mind and under no constraint or undue influence.

______________________________ ______________________________

Testator Signature Witness Signature

______________________________ Witness Signature

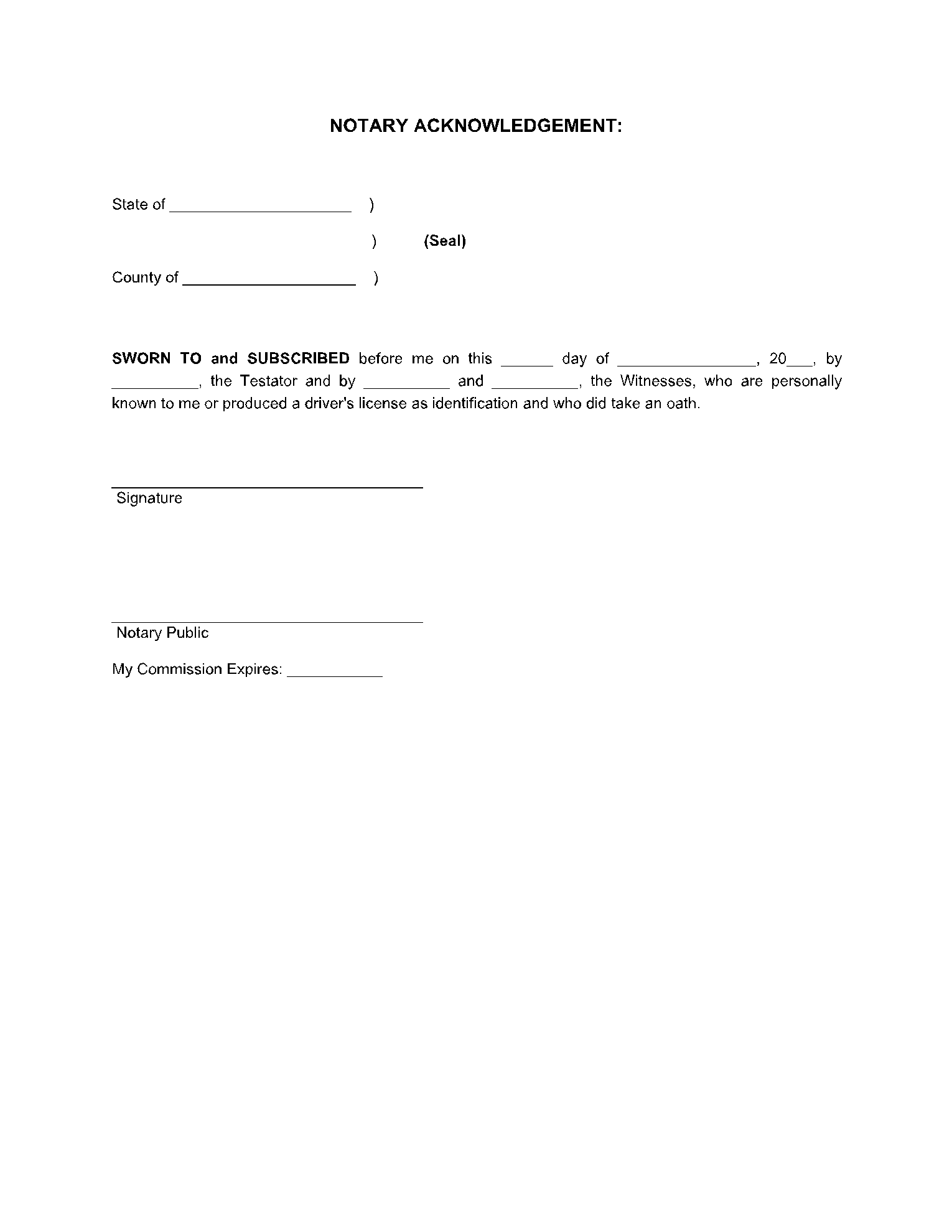

Subscribed and sworn to before me by the said testator and the said witnesses, this

____ day of ________________, 20____.

________________________________

Notary Public

My Commission expires: