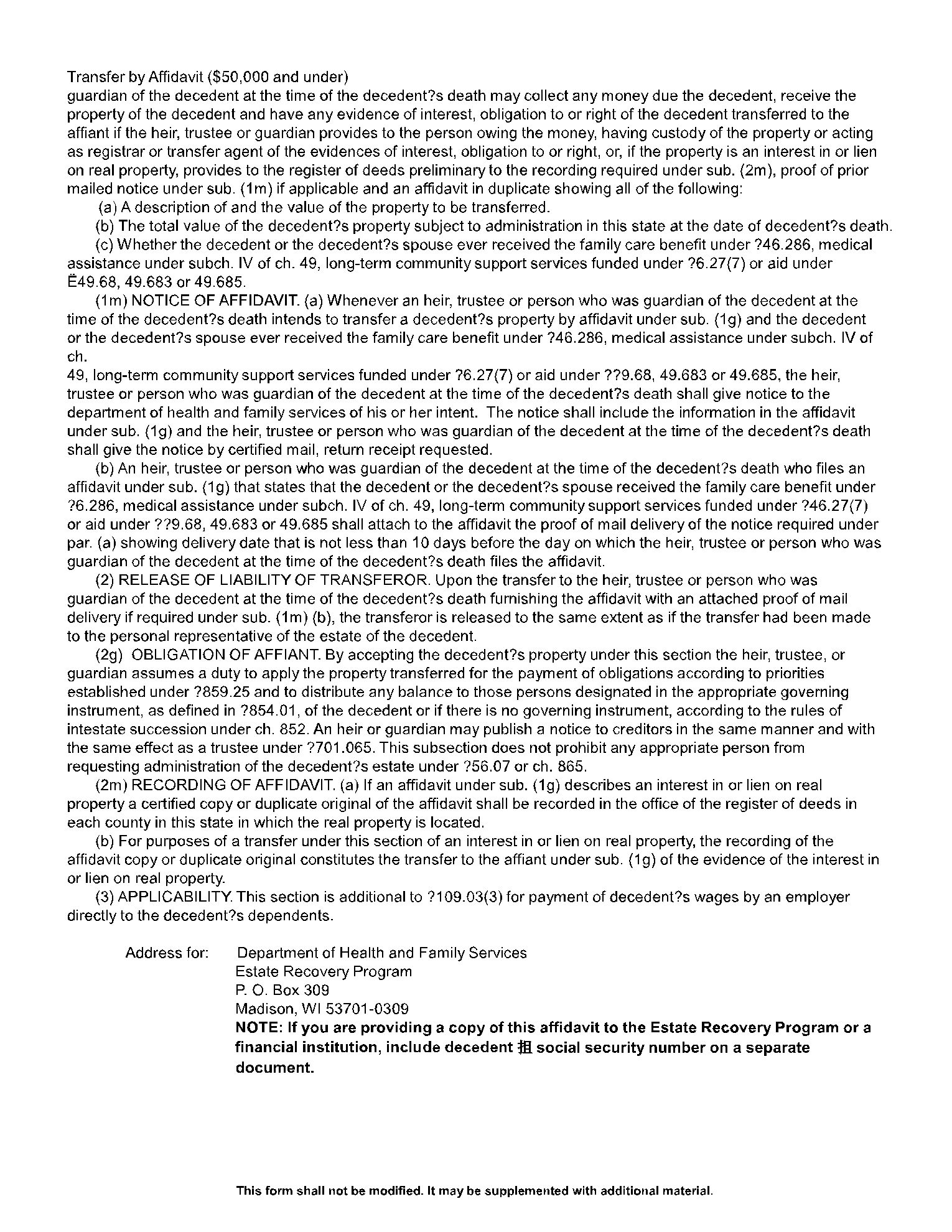

In the state of Wisconsin, you can use a small estate affidavit to transfer small estate assets after someone’s passing without court administrative proceedings. We explain how these small affidavits work in Wisconsin on this page as well as provides other helpful templates.

If you are looking for the Wisconsin small estate affidavit form (also known as the transfer by affidavit form), please check the above of the page.

Here are some of the fields and descriptions included in our Wisconsin small estate affidavit form:

-

- Decedent name and other details

- County of residence

- Statement that the demise died without a will

- Value of estate

- List of Decedent’s estate assets

- The decedent’s debts and liabilities

- Decedent’s family history

- List of all heirs and distributee

What is a Wisconsin Small Estate Affidavit?

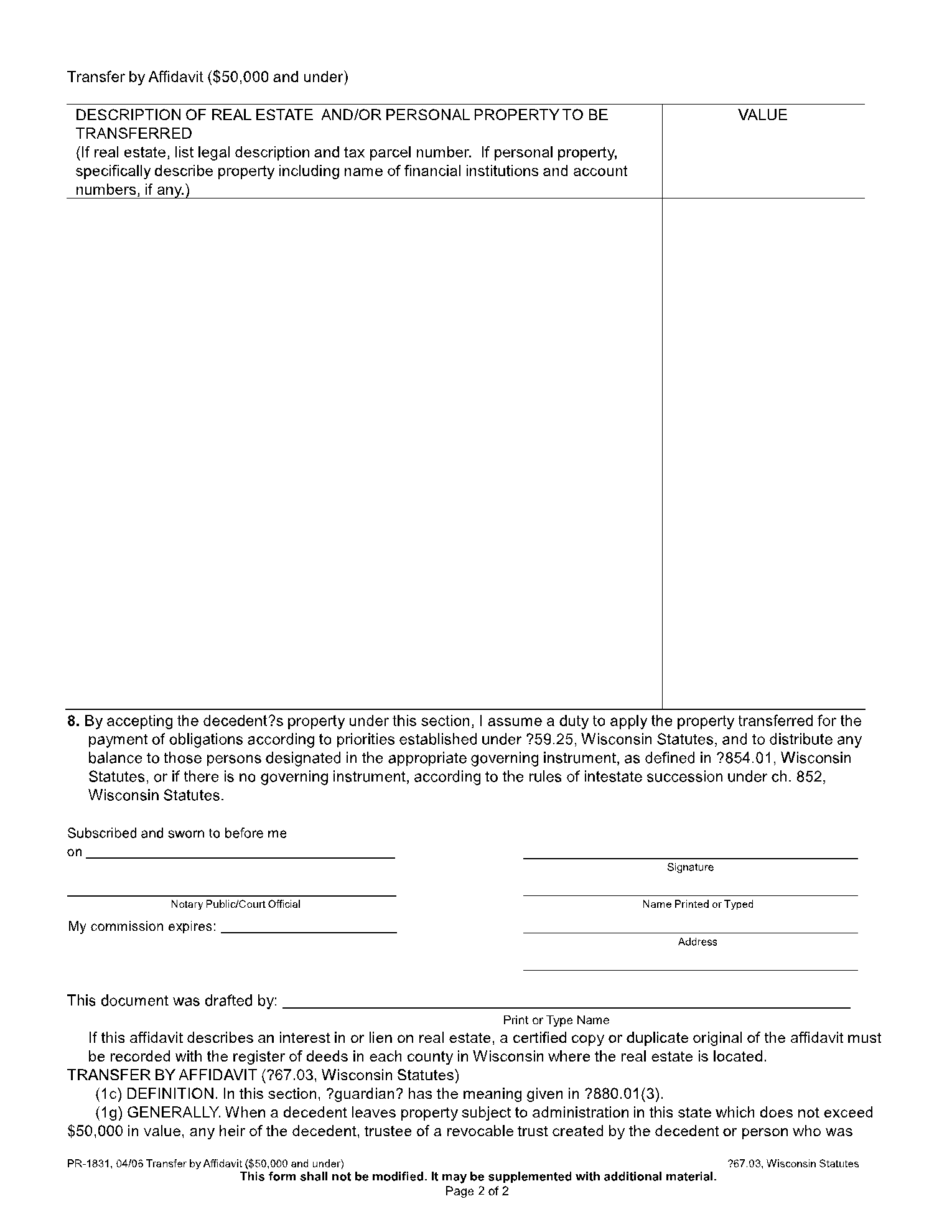

Typically, when someone dies, their assets are distributed through a court-administered probate process. The Wisconsin small estate affidavit is a formal document that allows you to transfer low-value assets without such court administration.

The small estate affidavit in Wisconsin is also called the affidavit of transfer or transfer of affidavit. You can only transfer small estate, probate assets worth $50,000 or less in value in total. The small estate affidavit is essentially a shortcut to having the assets distributed. It allows you to avoid lengthy court proceedings and all the associated fees.

When Do You Need to File a Small Estate Affidavit in Wisconsin?

You don’t need to formally file this document in court after you create it. You are, however, still required to follow intestacy distribution laws and the person’s will (if available) after acquiring control of the assets.

Is there a waiting period after the person’s death before you can create this affidavit? There is no waiting period. However, you may be required to give notice to health services if they provided medical treatment to the decedent (the deceased).

Further, after you provide the affidavit to a party that’s holding the decedent’s property, there is a 30-day waiting period before they can transfer the assets to you.

What Are the Requirements to File a Wisconsin Small Estate Affidavit?

You must follow the laws laid down in the Wisconsin State Legislature. The Transfer by Affidavit is Section 867.03.

Here is a summary of the major requirements:

- You must be a guardian, an heir, or a trustee.

- You must transfer only probate assets worth $50,000 or less in total.

- You must sign the document under an oath before a notary.

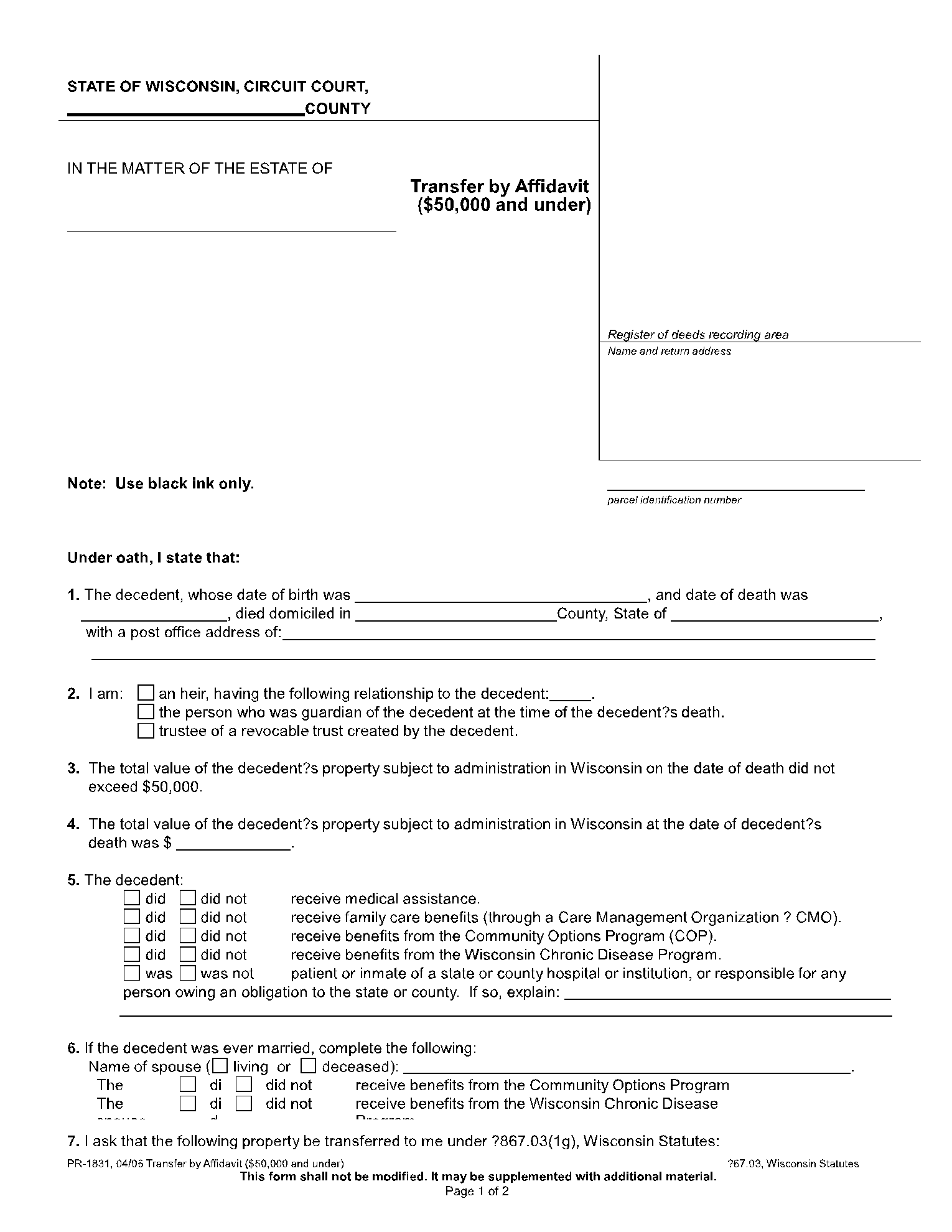

- The document must describe the property and list the property value.

- You must state whether the decedent and his spouse received medical services provided by the state (and then give an “intent to file affidavit” notice to health services).

- You must pay for any care provided but not paid for.

- You must agree to follow the state asset distribution laws.

- You must mention relevant details about the decedent and yourself.

Non-Probate Assets Don’t Require a Transfer by Affidavit

In Wisconsin, like in other states, not all assets undergo the probate process. They are transferred directly to the heirs instead. Here are some examples of assets considered non-probate:

- Joint bank accounts.

- Jointly-owned vehicles.

- Life insurance.

- Bank accounts with POD (payable on death) stipulations.

- Transfer on death deeds.

Conclusion

If you aren’t sure about what qualifies as “probate” assets and what doesn’t, you may want to consult with an attorney before you file the Wisconsin small estate affidavit. For straightforward cases, this document will allow you to save a great deal of time and money.

You can use the free Wisconsin small estate affidavit form template below to create a formal document in minutes. CocoSign offers a variety of free helpful resources and document creation tools for individual and business use.