The pandemic affects the world on many levels, and economically, we already see severe effects. Apart from a few lucky companies that were in the right line of business for this particular situation, the rest are either struggling to survive or have already collapsed.

For retailers, things weren’t even looking very well in 2019, so 2020 came as an even more critical blow. They are not the only ones affected. The number of bankruptcies that this year has brought is dramatic. The worst part is there are many others right on edge.

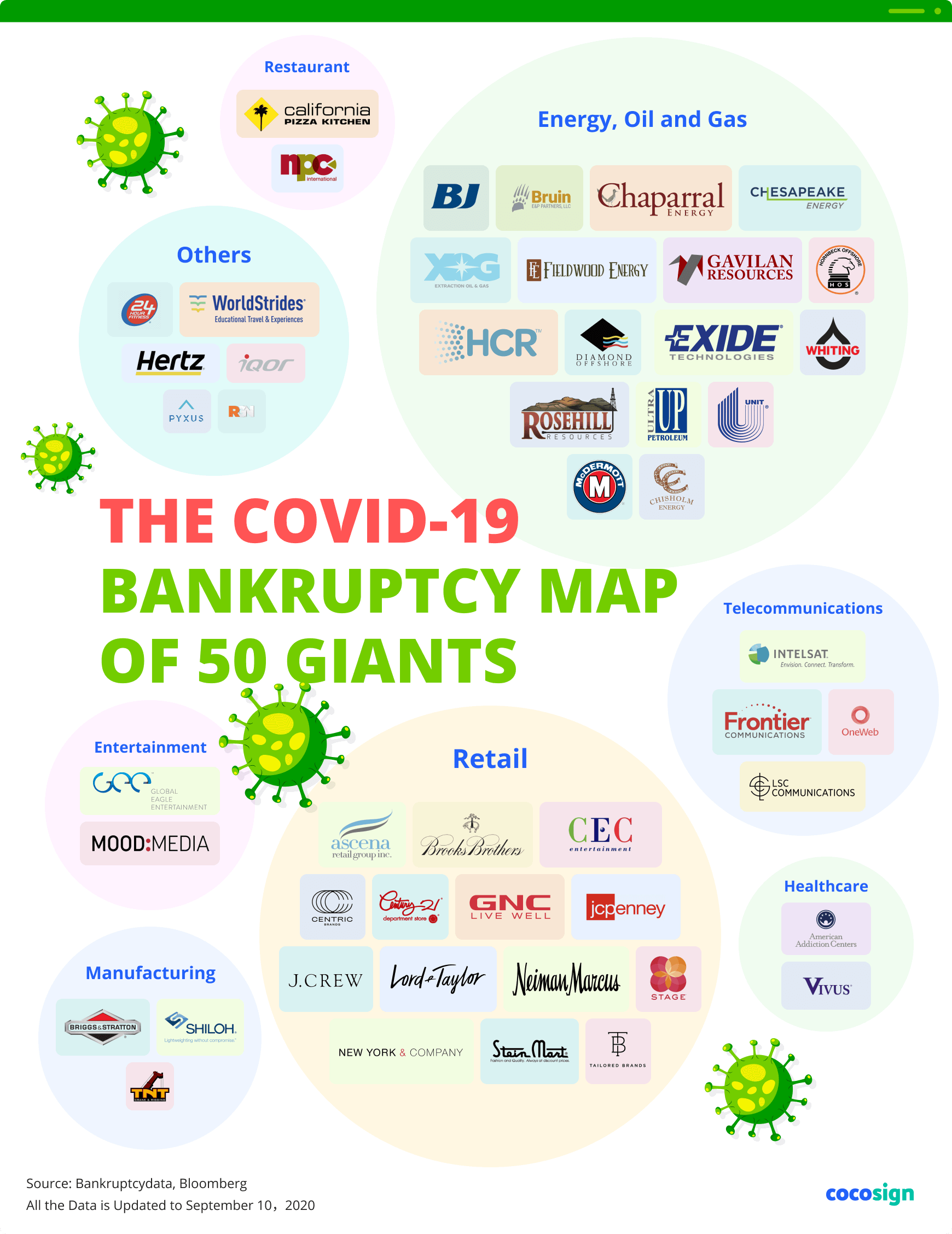

Bankruptcy has hit many industries of the economy, from oil and gas, fitness, restaurants, entertainment to manufacturing, and car rental businesses. So many parts of the economy were frozen by the restrictions COVID-19 has brought that a chain reaction started, and it won’t be easy to stop.

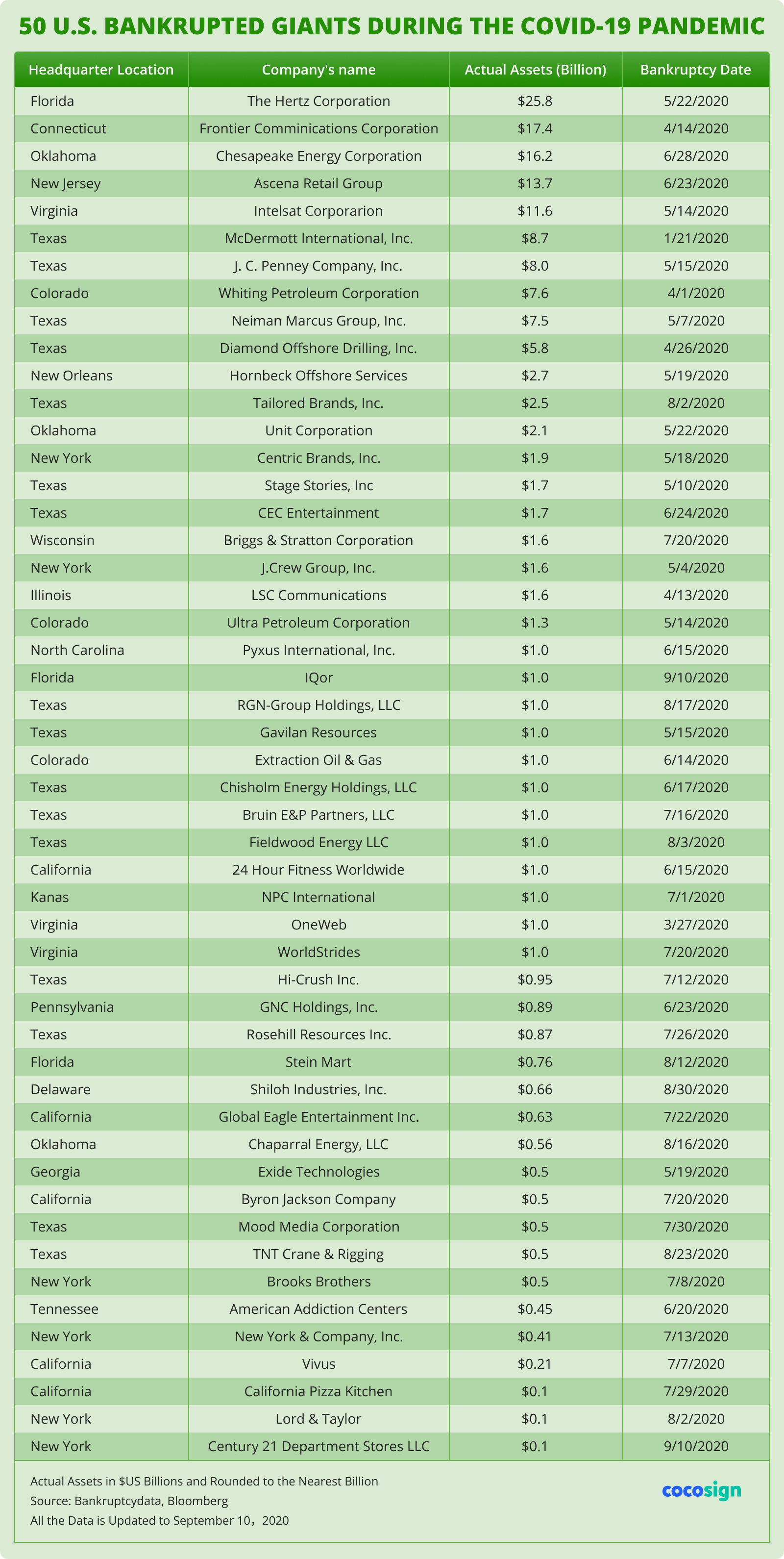

The 50 Biggest Companies That Have Filed for Bankruptcy

The U.S. is taking a genuinely severe hit during this pandemic. Many large companies were already facing difficulties, so the lockdowns and drop of demand on the market were too much to handle.

The below map has listed 50 companies, but the end may be near for many others, including surprisingly big names. Along with major players, we will soon see a long list of small businesses, which are now partially protected by the Paycheck Protection Program.[1]

The situation is already worse than in 2008, and the acceleration of bankruptcies is ‘unprecedented,’ as James Hammond, CEO of New Generation Research, has declared.[2] Many are accumulating significant debt that they are unlikely to pay in the near future.

The Hertz Corporation

Hetz filed for bankruptcy on May 22, 2020, after being in business for 100 years. The iconic car rental company accumulated 19 billion in debt as its fleet of 700,000 vehicles was taken out of business by the pandemic.

The company had previously made budget cuts, and they had to let go of 12,000 workers, but it wasn’t enough. With people staying at home, car rental services became obsolete. Apart from that, some voices consider that part of the descending path was due to their faulty marketing strategy and inability to adjust to a changing market.[3]

Frontier Communications

It has been providing Americans with telecommunication services since 2000. But in April, they filed for bankruptcy, as part of their strategy to reduce debt by $10 billion.

Some of their prominent investors, owning almost half of the company, are actually involved in the bankruptcy process, despite the Frontier’s representatives declaring that there will be no changes in the management of the company.

Chesapeake Energy Corporation

Chesapeake Energy Corporation from Oklahoma is in the field of hydrocarbon exploration, founded in 1989. With a long history and after having played an essential part in making the U.S. a leader when it comes to energy, they filed for bankruptcy for a debt of $9 billion that they cannot manage.

The oil and gas pioneer has spent months negotiating with creditors before coming to this decision. The company is planning serious restructuring, which includes partially handing control to its major investors.

Ascena Retail Group

This leading retailer for women’s clothing, selling brands like Ann Taylor, Lane Bryant, and Catherines, is an old and well-established company founded in 1962. Their struggle had become before the health crisis, and in 2019 they closed over 600 locations.

Then, on July 23, 2020, they filed for bankruptcy due to the massive blow they received when shopping malls were closed because of the pandemic.

Intelsat Corporation

The Intelsat Corporation is a major telecommunications company with headquarters in Virginia, with actual assets of $11.6 billion. It’s another old and vital company, going back to 1964.

What brought them to bankruptcy was the combination of significant debt and the costs of updating their technology. While their Chapter 11 bankruptcy case is going forward, they are continuing operations, as they are the satellite provider for most TV providers in the U.S.

McDermott International, Inc.

McDermott is a Panamanian company with its headquarters in Texas that offers infrastructure solutions for the oil and gas industry. Many sectors rely on their activity, including the U.S. Department of Energy.[4]

The company filed for bankruptcy on January 21, 2020, but obtained DIP financing to continue its operations. And the strategy worked, as in June, they exited bankruptcy, managing to eliminate over $4 billion of debt.

J. C. Penney Company, Inc.

JCPenny is an American chain of department stores with locations all over the U.S. It’s one of America’s most famous companies, founded back in 1902. Still, the crisis affected them just like it did with many other retailers, so they filed for bankruptcy on April 15, 2020.

The strategy this brick-and-mortar seller has planned includes closing part of the stores and maybe even selling the rest. It seems that the pandemic came as the last drop after a chain of questionable decisions and organizational inefficiency over the previous ten years.[5]

Whiting Petroleum Corporation

Founded in 1980, the Whiting Petroleum Corporation has produced and sold oil and gas products for decades. Yet on April 1st, 2020, the Colorado-based company filed for bankruptcy, planning to restructure its debts.

After a debt-for-equity swap, they exited bankruptcy in September and changed their CEO and CFO. In their case, the Chapter 11 bankruptcy procedure went very well. They renegotiated contracts and are planning a serious return on the market.

Neiman Marcus Group, Inc.

This is another iconic retailer in the U.S., filed for bankruptcy on May 7th, 2020. This group of luxury retailers, founded in 1907, is one of the most severe falls this market sector has seen this year. After planning a strict strategy, they expect to exit bankruptcy in September, eliminating about $4 billion of the debt.[6]

Diamond Offshore Drilling, Inc.

Diamond Offshore Drilling is a massive offshore drilling contractor from Texas, is another major player in the oil and gas sector facing severe difficulties.

Founded in 1964 and with offices in several parts of the world, the company filed for bankruptcy in April as the COVID-19 triggered a severe oil and gas crisis. In their case, it seems bankruptcy will last longer, as they haven’t presented a reorganization plan.

Just as it happened to other giants in this business, their struggle had started before the beginning of the health crisis, and the current economic situation was only one more significant boost downwards.

Hornbeck Offshore Services

This company from New Orleans has been providing offshore supply vessels since 1997. After filing for bankruptcy in May, they have prepared a thorough reorganization plan which was approved by the Court.

They are currently waiting for governmental approvals and are hoping to exit bankruptcy soon. Their hopes are justified since they received massive support from lenders and noteholders. They also managed to go through this challenging process without interrupting their activity.

Tailored Brands, Inc.

Another member of the retail sector affected by the pandemic is Tailored Brands, Inc. This retailer from Texas has been selling men’s apparel since 1973 and got to a level of actual assets of $2.5 billion.

Their bankruptcy filing came later, in August, and was followed by a restructuring agreement. With people not needing office attire[7] anymore during this difficult period when business meetings happen online, and budgets are cut frequently, their fall was not that unexpected.

Unit Corporation

Another victim of the crisis that affected the gas and oil industry is Unit Corporation. The Oklahoma-based company has been drilling onshore for oil and natural gas since 1963.

COVID-19 forced them to file for bankruptcy on May 22, 2020, and they are currently going through a reorganization so that they can reduce their substantial debt. However, it seems they will have no disruptions in their activity during this process.

Centric Brands, Inc.

Going back to 1987, this company has a long history of selling kids’, women’s, and men’s apparel, with clients all over the world.[8] The New York-based company filed for bankruptcy in May and has reached an agreement with most of its lenders to support the restructuring process.

Stage Stores, Inc

Stage Stores is another retailer, from Texas, with a history going back to 1988. With department stores in 42 states, they changed their strategy from full-price retail to off-price, but still went through a tough time in 2019.

When the crisis came, they were trying to find a buyer for the chain of department stores. Failing to accomplish that, they decided to file for bankruptcy in May 2020.

CEC Entertainment

This company is behind the famous Chuck E. Cheese. People have loved these restaurants since 1977, but the Coronavirus has affected them severely, as it happened with most businesses in this sector.

When the health crisis started, and people stopped going out to eat, rent became a severe problem. The company tried to obtain rent forgiveness from a landlord in Dallas based on the pandemic context, but they ended up in Court.

On July 25, 2020, they filed for bankruptcy, to help them plan a strong return. They are trying to keep their operations going and to slowly reopen their locations.

Briggs & Stratton Corporation

Briggs & Stratton is an American company that manufactures and sells small engines, particularly for lawnmowers. They have been in business since 1908 and have opened many facilities in the U.S. and other countries.

But their sales started to drop, and when the crisis came, they accumulated more debt than they could handle.[9] On July 27, 2020, they filed for Chapter 11 bankruptcy and are planning to sell a significant part of the company to KPS Capital Partners.

J.Crew Group, Inc.

This New York based retailer has been running specialty apparel stores since 2005. The pandemic hit them quite seriously, so they filed for bankruptcy in May 2020. They prepared a plan to reorganize the company, with the support of most stakeholders, and the Court approved the plan.

They are handing over the control of their business to lenders, and the company has already announced they are exiting bankruptcy in September.

LSC Communications

LSC Communications is a commercial printing company based in Chicago, and is relatively new on the market, being founded in 2016. With 20,000 employees in 2020, the pandemic brought them severe losses, and they were forced to file for bankruptcy on April 13.

Their reorganization plan includes a stock and asset purchase agreement with Atlas Holdings LLC covering all the significant aspects, including the company’s pension plan. That way, the company is expected to exit bankruptcy at the end of 2020.

Ultra Petroleum Corporation

Another major company in the field of energy, oil, and gas, that was seriously affected by the pandemic is Ultra Petroleum Corporation. With operations mainly in the Green River Basin in Wyoming and Pennsylvania, they have been struggling for a while.

In May, the company filed for bankruptcy for the second time in only four years and designed a plan to reduce its debt by $2 billion dollars. The current pandemic has hit them as they were still fighting with debt remaining from their previous Chapter 11 bankruptcy in 2017, so the situation became critical.

Pyxus International, Inc.

As an agricultural company based in North Carolina, founded in 2005, Pyxus International, Inc. serves both the U.S. and the U.K. They are one of the major players in the tobacco supplying sector, but their problems started before the health crisis, as tobacco consumption started to decrease.

The company filed for bankruptcy in June 2020, along with its subsidiaries. What followed was a restructuring support agreement, and in August, they announced they are emerging from Chapter 11.

iQor

iQor based in Florida handles business process outsourcing with many call centers worldwide. Despite being on the market since 1998, 2020 proved to be a significantly tough year, and they filed for bankruptcy in September.

They expect to continue their operations as usual during the process and are hoping to cut a significant part of the debt that was preventing their progress.

RGN-Group Holdings, LLC

RGN is a major coworking business in Texas, having over 1,000 locations in the U.S. and Canada, filed for Chapter 11 protection on August 17, 2020.

Since what they offer is temporary office space, the pandemic closed their activity completely, with people working from home. Their liquidity was severely affected, and the bankruptcy procedure was the only way of reducing the debt.

Gavilan Resources

It activates in the oil and gas industry, and its headquarters are in Houston, Texas. It’s a new company, founded in 2017, and the pandemic turned out to be too big a challenge that came too soon in its existence.

They filed for bankruptcy on May 15, 2020, as a result of the oil crisis but also due to a legal conflict with a rival driller in Texas. This dispute has taken a lot of time and many resources and the health crisis that came on top of their other problems was too much to handle.

Extraction Oil & Gas

This large producer in the energy, oil, and gas industry bases in Colorado. They have been covering natural gas liquid extraction since 2012. They had their share of problems even before the Coronavirus changed the economic world.

They sued local authorities, which have been investigating noise complaints against the company. While, they claim it’s all a prosecution meant to shut down their extraction activity. The company filed for bankruptcy on June 14, 2020, and even had to pay their executives and managers considerable amounts to stay on their jobs.

Chisholm Energy Holdings, LLC

Still in the oil business, but this time in Texas, Chisholm Energy Holdings LLC, has been serving clients since 2016. The young age of the company, combined with the oil crisis, meaning price issues and production difficulties, have caused them to accumulate significant debt.

That’s why on June 17, 2020, the company filed for Chapter 11 bankruptcy, hoping for a way to reduce debt.

Bruin E&P Partners, LLC

Based in Texas, Bruin E & P Partners deals with the exploration and production of oil and gas. Active on the market since 2015, they became one more casualty of the oil crisis that the COVID-19 has caused.

They filed for bankruptcy on July 16, 2020, in the Southern District of Texas. The private equity firm ArcLight backed them, and in September, they managed to exit bankruptcy after significantly reducing their debt.

Fieldwood Energy, LLC

This significant player in the oil and gas industry in the Gulf of Mexico has been on the market since 2012. They had already filed for bankruptcy in 2018.

When the Coronavirus has affected the world’s economy, the company was forced to file for relief under Chapter 11 on August 3, 2020. They are currently looking for a buyer for an important part of their deepwater assets.

24 Hour Fitness Worldwide

Fitness clubs were seriously affected by the COVID-19 crisis, and 24 Hour Fitness Worldwide from California took a particularly severe hit. Having to close their locations down for several months proved to be too much for this chain of fitness clubs, and they filed for bankruptcy on June 15, 2020.

This measure helped them find the funds they needed to reopen at least part of their facilities, but at the same time, they have permanently closed a significant portion of the locations.

NPC International

It is one of the biggest restaurant operators in the U.S. and has been serving Americans since 1962.[10] They have an impressive number of Pizza Hut and Wendy’s franchises. Still, as it happened to many companies in the restaurant business.

The pandemic has caused them to accumulate severe amounts of debt. They filed for bankruptcy in July 2020, as apart from the current crisis, they have also been dealing with a low sales level for years.

They have made a restructuring plan that includes selling their Wendy’s business, and are hoping to bring back their Pizza Hut locations on an ascending path soon.

OneWeb

OneWeb is an important space internet company with headquarters both in London, U.K., and McLean, Virginia. In February 2019, they started an ambitious project of launching a constellation of over 650 satellites.

Their goal was to bring internet access even to remote places. However, they weren’t able to gather the necessary capital, and also had most of their employees go. On March 27, 2020, they filed for bankruptcy, while having 74 satellites still in orbit.

In July, there was an auction for selling SpaceX’s rival, and it was controversially won by a consortium that includes the U.K. government.

WorldStrides

Traveling-related services were significantly affected by the COVID-19, and WorldStrides was no exception. The Virginia-based company is the most prominent accredited travel organization in the U.S.

Still, since travel was drastically reduced in 2020, they ended up filing for bankruptcy in the Southern District of New York in July. However, they declared they would keep paying their active employees and will also reimburse their customers.

Hi-Crush Inc.

The North American Hi-Crush Inc. has been a significant player in the petroleum industry since 2010. They handle sand reserves, more specifically monocrystalline sand, used for wells.[11]

The Texas-based company was affected by the current situation the same way as most businesses in the oil and gas industry have suffered, and filed for bankruptcy in June 2020. Then they began a reorganizational process and managed to get $65 million post-bankruptcy loans.

GNC Holdings, Inc.

GNC has been producing health supplements in Pennsylvania since 1935, and they have many locations all over the U.S. and in Canada. In 2018 they sold 40% of the company to Harbin Pharmaceutical Group, a company owned by the Chinese state.

The purchase was later under scrutiny on national security grounds.[12] Then, due to severely decreased sales, they had to close many of their mall locations and filed for bankruptcy on June 23, 2020, and are planning to shut down more than 800 stores.

Rosehill Resources Inc.

The plunging oil prices that affected everyone in the oil and gas industry took a severe toll on Rosehill Resources Inc. Founded in 2017, the Texas company has assets in the Delaware Basin and was created by combining two major oil companies.

Their filing for bankruptcy came on July 26, 2020, and they started making plans to restructure and reduce their debt. The company is now owned by its creditors and is no longer traded on the Nasdaq stock exchange.

Stein Mart

Stein Mart is a large chain of department stores selling men and women’s clothing at discount prices. Founded in 1902, it has almost 300 locations, mostly in Texas and California.

When the current economic crisis hit them, the accumulated debt determined them to file for bankruptcy in August 2020 and to prepare to close most of their stores. They had actually found a buyer in January, but the pandemic canceled those plans and set the company on a steep downward path.

Shiloh Industries, Inc.

Shiloh Industries is a large manufacturer based in Delaware that produces chassis and propulsion systems, as well as other mobile components. Their primary focus is on noise and vibration reduction.

But upon accumulating severe debt, they filed for bankruptcy on August 30, 2020. They are now planning to sell their assets in an auction, to the private equity firm MiddleGround Capital LLC, unless a better offer appears.

Global Eagle Entertainment Inc.

The entertainment sector was also severely hit by the pandemic, and Global Eagle Entertainment Inc., a media and satellite internet company, was significantly affected. Their main activity has been to provide airlines with content and connectivity services[13] since 2011.

The company filed for Chapter 11 bankruptcy on July 22, 2020, and the plan is to sell its assets to the creditors. The bankruptcy protection was a measure meant to ease the sale.

Chaparral Energy LLC

This company has been active in the oil and gas industry since 1988. The Oklahoma-based company handles exploration and production services. However, because of the oil crisis that the Coronavirus pandemic has brought, they were forced to file for bankruptcy on August 16, 2020.

Then they entered into a restructuring support agreement with their main creditors, hoping to reduce the debt and get the company back on the right track.

Exide Technologies

Founded in 1888, the company also has recycling plants and over 10,000 employees. It is based in Georgia and produces lead-acid batteries for the automotive industry. However, their path hasn’t been smooth, as they had already filed for bankruptcy twice, in 2002 and 2013.

The COVID-19 pandemic caused the third filing, on May 19, 2020, and they are now planning to sell the assets to an affiliate of Atlas Holdings. The current situation also meant they had to lay off almost 300 of their employees.

Byron Jackson Company

Providing pressure pumping and other services for the oil and gas industry, this company was founded in California in 1872, by an inventor, and gradually developed into a multinational operation.

Despite being a leader in its field, The Byron Jackson Company was significantly affected by the Coronavirus crisis, and they filed for bankruptcy on July 20, 2020, after having to lay off hundreds of employees since March. In September, their cementing services business was bought by Argonaut Private Equity.

Mood Media Corporation

It has been active in the entertainment business since 2004. Based in Texas, the company provides music and various other services to businesses, and they have slowly expanded to other continents as well.

However, their challenging period started years ago, and in 2017 they had to perform a restructuring of their capital structure. The 2020 pandemic proved to be too difficult to handle, and they had to file for bankruptcy on July 30.

However, things progressed in a particular manner in their case, as they exited bankruptcy only one day later, as a judge approved their restructuring plan.

TNT Crane & Rigging

With a history that started in 1985 in Texas with only one crane, TNT is one of the leading crane providers in North America. In time, they grew to almost 40 branches, servicing clients all over the U.S.

Since a major part of their clients were companies in the oil and gas industry that were going through a tough time, TNT also received a serious hit from the COVID-19. They had to file for bankruptcy on August 23, 2020 and created a plan to trade debt for equity.

Brooks Brothers

As the oldest seller of men’s clothes in the U.S., Brooks Brothers was founded in 1818. They specialized in expensive and top-quality clothes, particularly in timeless classic designs. With 500 stores worldwide, the company had to decide to close over 50 locations and file for bankruptcy in July 2020.

The retailer that proudly advertised having dressed 40 presidents of the United States registered a significant drop in sales, and rent became overwhelming. They are currently looking for buyers that can help the company’s tradition carry on.

American Addiction Centers

The healthcare system is also seriously affected by the current crisis. American Addiction Centers, a company from Tennessee that provides assistance to people battling addiction, has accumulated a massive debt for a few years, and the pandemic only made matters worse.

They had to file for bankruptcy on June 20, 2020, but they hope to exit after 125 days, due to their recapitalization plan. They also managed to keep their treatment operations active during this challenging period.

New York & Company, Inc.

It is a massive retailer that sells apparel and accessories for women, especially work-appropriate outfits. They went through a rebranding process in 2018, but things didn’t improve very much.

When the COVID-19 added an extra burden, the company was forced to file for bankruptcy on July 13, 2020. They also began the process of closing most or possibly all of their stores. In August, they sold their online business to Sunrise Brands LLC for $20 million.

Vivus

This pharmaceutical company from California, develops drugs for various health problems, like obesity, sexual and sleep disorders, and other life-limiting conditions.

But the pandemic context has affected them to no small extent, and they filed for bankruptcy on July 7, 2020. The reorganization plan presented to the Court consisted of handing over the ownership to IEH Biopharma LLC, a subsidiary of Icahn Enterprises.

California Pizza Kitchen

California Pizza Kitchen has been serving California-style pizza since 1985. It’s a chain of casual restaurants with over 14,000 employees. The impact of the Coronavirus on restaurants was huge in the U.S., and the company was forced to file for bankruptcy on July 29, 2020.

They had been accumulating debt for a long time, and in the current context, the burden became too heavy. They made a restructuring plan and are hoping to exit bankruptcy this fall.

Lord & Taylor

The oldest department store in the U.S., Lord & Taylor, sells clothing, shoes, and accessories in 39 locations. They made a strategic move in 2019 and sold the chain to Le Tote.

However, the pandemic in 2020 affected the company to a great extent, as not only were their stores closed, but some of them were also ransacked during protests. They filed for bankruptcy on August 2, 2020, and decided to permanently close all their stores while searching for alternatives for their brands.

Century 21 Department Stores LLC

This American retailer that took a severe hit from the pandemic. Selling men’s and women’s apparel in 13 department stores, the New York-based company has been on the market since 1961.

On September 10, 2020, the iconic retailer filed for bankruptcy, planning to shut down all their locations. The company had hoped to use the insurance money to bounce back, as they had done in the past, after 9/11, but when that didn’t happen, they had no other alternative than bankruptcy.

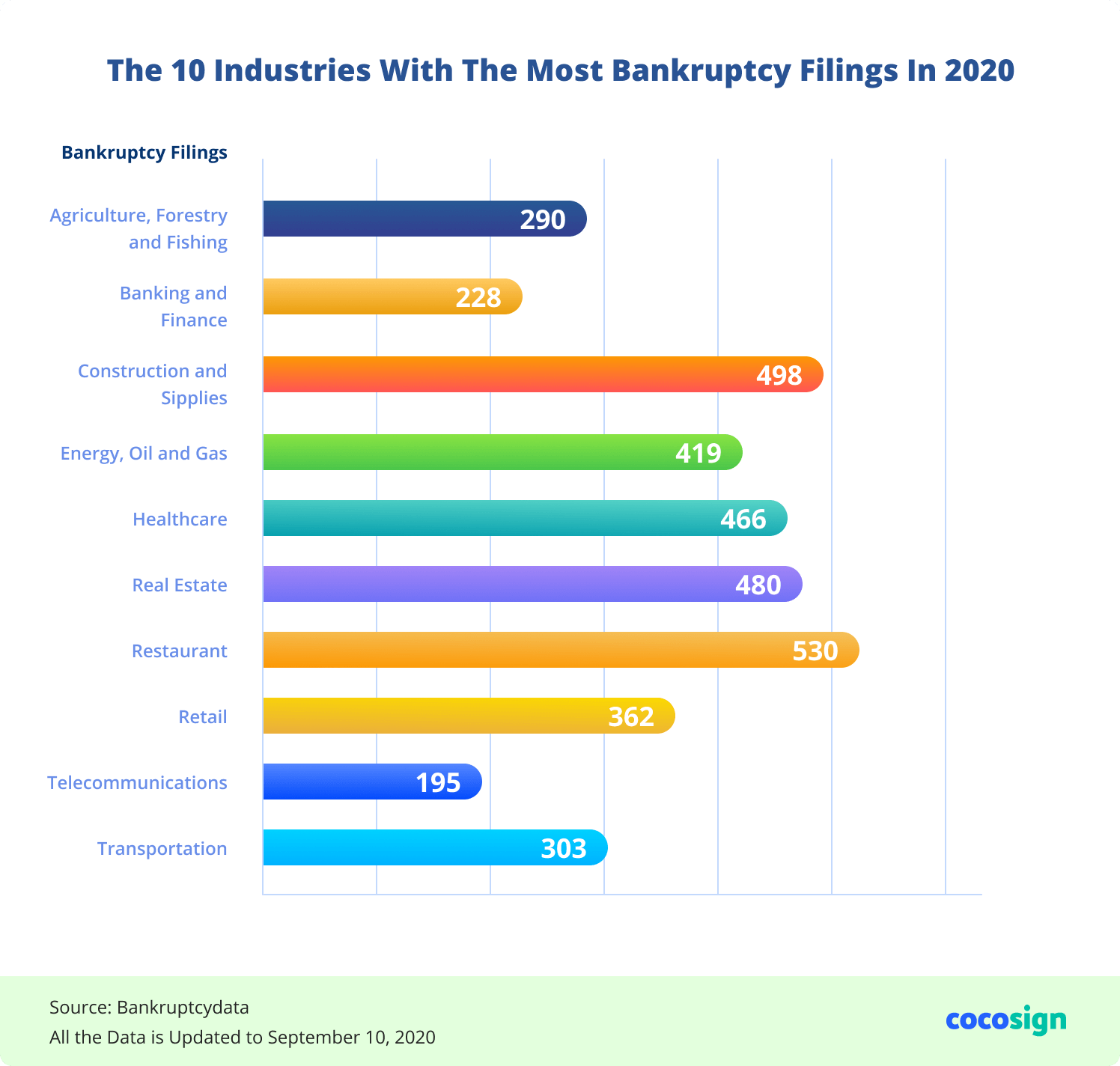

10 Industries That Have Been Hit Hardest by COVID-19

The measure to keep non-essential businesses closed in a general effort to keep the virus from spreading was necessary. Still, it also had a substantial negative impact on the economy.

Debts kept accumulating, and small businesses weren’t the only ones severely affected by the pandemic. Many giants ended up filing for bankruptcy, especially in those domains where the lockdown and safety measures did the most damage.

These are the industries that suffered the most from the crisis:

Restaurants

The restaurant industry registered the most bankruptcy filings. The reason is this field of activity was at the convergence of a few crucial aspects.

First of all, the market was overpopulated with restaurants before the crisis, meaning many of them were already having a hard time measuring up to the competition.

Secondly, the lockdown and the crisis came during the time of the year when people usually spend more time outdoors, travel, and explore more than in other seasons, and the restaurants were counting on the earnings that these warm months were supposed to bring.

Now that the cold season is approaching, moving the dining experience outside the restaurant will no longer be an option. On top of all that, apart from the businesses that can handle deliveries, the rest is entirely dependent on the close relation to their customers.

Therefore, surviving has become extremely difficult in the current context. There were 530 filings for bankruptcy so far, including quite a few from major chains, and the list is about to get much longer.

Construction and Supplies

Many construction projects were canceled by their beneficiaries, which in many cases, were governments or major companies. The funding necessary to complete those projects suddenly became unavailable, and contractors and subcontractors took a severe hit.

In a context where financial survival became an issue, such significant investments had to be postponed. On the other hand, many supplies for the construction sector came from outside the U.S., like steel and glass imported from Asia.

The pandemic has broken supply chains and everything that depended on them got postponed or canceled. So far, 498 companies in the construction and supplies sector have filed for bankruptcy, and the crisis isn’t over yet.

Real Estate

The real estate field was also severely hit by the current economic situation. Not only have people stopped buying properties, but the status of countless tenants has become critical. The sudden drop in income has already sent 480 real estate companies into bankruptcy.

With so many people losing their jobs, paying the mortgage has become an impossibility in many cases. Individuals cannot pay their mortgages, businesses that must remain closed cannot afford rent anymore, and the downward spiral is continuing.

Healthcare

The Coronavirus is, before anything else, an acute health crisis. Many hospitals all over the U.S. need to file for bankruptcy, which can lead to an even more severe crash in healthcare.

So far, 466 companies in this sector have filed for bankruptcy, and many others are just around the corner. The number of patients is skyrocketing, and the reimbursements are increasingly difficult, so the system is in real danger of being blocked.

Energy, Oil, and Gas

Most companies in this field of activity started having problems in the last years. The pandemic came as the final blow. 419 have already filed for bankruptcy and are struggling to find a way to get back on track by reducing the massive debts they have accumulated.

The oil and gas industry was drastically disrupted, and many giants have fallen. The problem is 2022 is unlikely to be a better year for this sector, as the economy is still on the rocks, and investors demand efficiency even in this impossible situation, so many others are likely to fall.

Retail

The retail market has seen 362 companies filing for bankruptcy this year, and there are many others very close to this step.

As we have shown above, many iconic retailers that have been on the market for over 100 years are now forced to sell or permanently close their stores. A combination of pandemic and unhelpful insurance companies is forcing many retailers to enter bankruptcy.

Transportation

Transports are also on a downward path in 2020, as 303 companies have already filed for bankruptcy. Tourism-related transportation was almost eliminated, business travels have been reduced to the maximum. And even trucking companies are in trouble, as transporting goods also met severe problems this year.

Agriculture, Forestry, and Fishing

Despite the federal aid being at a high level, the agriculture sector is facing an extremely tough period. In the sector of agriculture, forestry, and fishing, there are 290 bankruptcies so far. As far as small farms are concerned, one third are probably going to file for bankruptcy this year. And major companies are not safe either.

Banking and Finance

Banks and other financial institutions are taking serious hits from the Coronavirus, as it was expected. With most people suffering income drops, deposits are no longer made, installments aren’t paid, and getting a loan has become almost impossible. So it’s no wonder that 228 companies, including major ones, have entered bankruptcy.

Telecommunications

Communicating from a distance has become extremely important in the context of the pandemic. But while a few lucky companies are doing exceptionally well, many telecommunication businesses are falling, as 195 have already filed for bankruptcy.

Accumulated debts have added to the current expenses, and for many, it has been too much to handle.

Conclusion

Apart from the health crisis and the countless tragedies that happen every day because of the pandemic, the economic repercussions are also dramatic. The United States is faced with a general crisis that will be extremely hard to end.

We have taken a closer look at 50 companies that entered bankruptcy this year, but the list is much longer. As the above has shown, the current situation is bringing down even the giants that have been on the market for decades.

In many cases, the struggle had begun a few years before, and with no reserves to fall back on, the crisis has taken an incredibly high toll. While some may manage to restructure and get back on the right track, others will have to shut down their operations altogether.

Reference:

- “Paycheck Protection Program." Web. 24 Sept. 2020.

- “Racing Roundup: Penske Feeling Financial Pressure?"News Break. Wheels.ca, 10 Aug. 2020. Web. 24 Sept. 2020.

- Kelly, Jack. “Hertz Files For Bankruptcy After 16,000 Employees Were Let Go And CEO Made Over $9 Million." Forbes. Forbes Magazine, 23 May 2020. Web. 24 Sept. 2020.

- “McDermott International Inc - Company Profile and News." Bloomberg. Web. 24 Sept. 2020.

- Isidore, Chris, and Nathaniel Meyersohn. “JCPenney Files for Bankruptcy." CNN. Cable News Network, 16 May 2020. Web. 24 Sept. 2020.

- Kumar, Uday Sampath. “Neiman Marcus Expects to Emerge from Bankruptcy by End-September." Reuters. Thomson Reuters, 04 Sept. 2020. Web. 24 Sept. 2020.

- Friedman, Gillian. “Men's Wearhouse Owner Files for Bankruptcy." The New York Times, 03 Aug. 2020. Web. 24 Sept. 2020.

- “Centric Brands Inc - Company Profile and News." Bloomberg. Web. 24 Sept. 2020.

- Green, Rick, and Allison McNeely. “Briggs & Stratton, Stalwart of Suburban Lawn Culture, Goes Bust." Bloomberg, 20 July 2020. Web. 24 Sept. 2020.

- “NPC International." Wikipedia. Wikimedia Foundation, 22 Aug. 2020. Web. 24 Sept. 2020.

- “Hi-Crush Inc - Company Profile and News." Bloomberg. Web. 24 Sept. 2020.

- “GNC (store)." Wikipedia. Wikimedia Foundation, 13 Sept. 2020. Web. 24 Sept. 2020.

- “Global Eagle Entertainment Inc - Company Profile and News." Bloomberg. Web. 24 Sept. 2020.